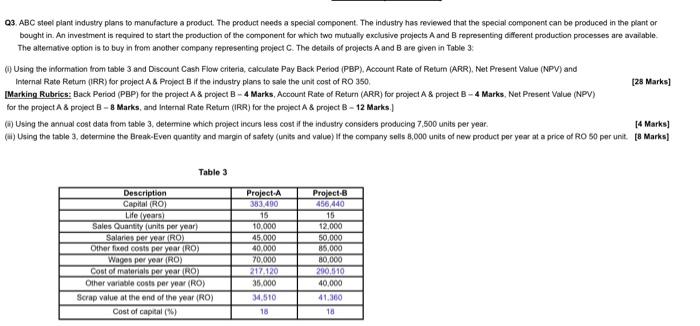

03 ABC steel plant industry plans to manufacture a product. The product needs a special component. The industry has reviewed that the special component can be produced in the plant or bought in. An investment is required to start the production of the component for which two mutually exclusive projects A and representing different production processes are available The alternative option is to buy in from another company representing project C. The details of projects A and B are given in Table 3 Using the information from table 3 and Discount Cash Flow criteria, caloutate Pay Back Period (PBP). Account Rate of Retum (ARR), Net Present Value (NPV) and Internal Rate Return (IRR) for project A & Project if the industry plans to sale the unit cost of RO 350 (28 Marks] Marking Rubrics: Back Period (PBP) for the project A& project B - 4 Marks, Account Rate of Return (ARR) for project A& project B-4 Marks, Net Present Value (NPV) for the project A & project B - 8 Marks and Internal Rate Return (IRR) for the project A & project B-12 Marks (a) Using the annual cost data from table 3, determine which project incurs less cost if the industry considers producing 7.500 units per year. [4 Marks) (ar) Using the table 3, determine the Break-Even quantity and margin of safety (unts and value) if the company sells 8,000 units of new product per year at a price of RO 50 per unit [8 Marks] Table 3 Description Capital (RO) Life years Sales Quantity (units per year) Salanes per year (RO) Other fixed costs per year (RO) Wagen per year (RO) Cost of materials per year RO) Other variable costs per year (RO) Scrap value at the end of the year (RO) Cost of capital (%) Project A 383.490 15 10.000 45.000 40.000 70.000 217.120 35.000 Project-B 456 440 15 12,000 50.000 85.000 80,000 200510 40.000 41.360 18 34,510 18 03 ABC steel plant industry plans to manufacture a product. The product needs a special component. The industry has reviewed that the special component can be produced in the plant or bought in. An investment is required to start the production of the component for which two mutually exclusive projects A and representing different production processes are available The alternative option is to buy in from another company representing project C. The details of projects A and B are given in Table 3 Using the information from table 3 and Discount Cash Flow criteria, caloutate Pay Back Period (PBP). Account Rate of Retum (ARR), Net Present Value (NPV) and Internal Rate Return (IRR) for project A & Project if the industry plans to sale the unit cost of RO 350 (28 Marks] Marking Rubrics: Back Period (PBP) for the project A& project B - 4 Marks, Account Rate of Return (ARR) for project A& project B-4 Marks, Net Present Value (NPV) for the project A & project B - 8 Marks and Internal Rate Return (IRR) for the project A & project B-12 Marks (a) Using the annual cost data from table 3, determine which project incurs less cost if the industry considers producing 7.500 units per year. [4 Marks) (ar) Using the table 3, determine the Break-Even quantity and margin of safety (unts and value) if the company sells 8,000 units of new product per year at a price of RO 50 per unit [8 Marks] Table 3 Description Capital (RO) Life years Sales Quantity (units per year) Salanes per year (RO) Other fixed costs per year (RO) Wagen per year (RO) Cost of materials per year RO) Other variable costs per year (RO) Scrap value at the end of the year (RO) Cost of capital (%) Project A 383.490 15 10.000 45.000 40.000 70.000 217.120 35.000 Project-B 456 440 15 12,000 50.000 85.000 80,000 200510 40.000 41.360 18 34,510 18