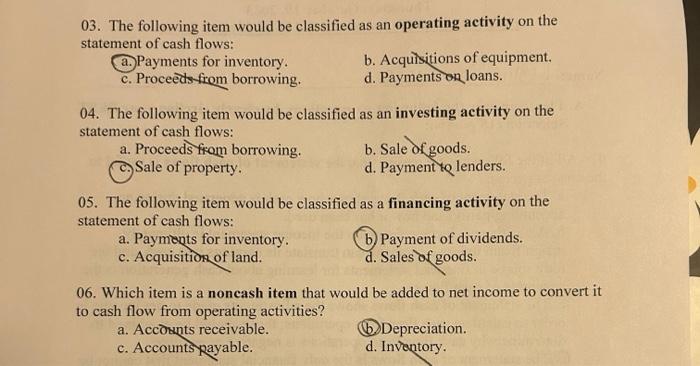

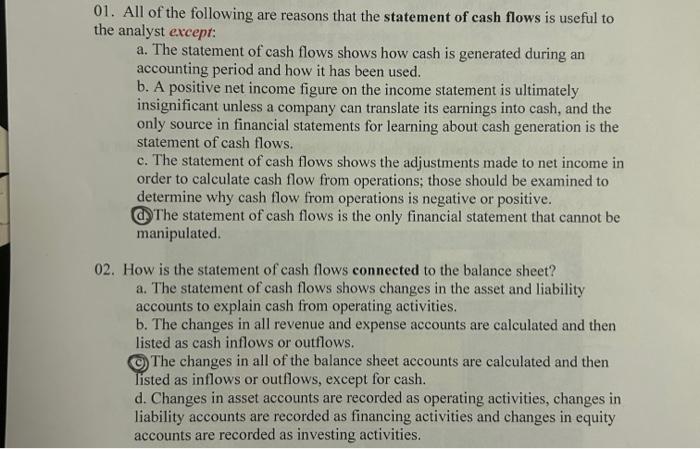

03. The following item would be classified as an operating activity on the statement of cash flows: (a.) Payments for inventory. b. Acquisitions of equipment. c. Proceeds-from borrowing. d. Payments on loans. 04. The following item would be classified as an investing activity on the statement of cash flows: a. Proceeds from borrowing. b. Sale of goods. c. Sale of property. d. Payment te lenders. 05. The following item would be classified as a financing activity on the statement of cash flows: a. Payments for inventory. (b) Payment of dividends. c. Acquisition of land. d. Sales of goods. 06. Which item is a noncash item that would be added to net income to convert it to cash flow from operating activities? a. Accounts receivable. (b) Depreciation. c. Accounts yayable. d. Inventory. 01. All of the following are reasons that the statement of cash flows is useful to the analyst except: a. The statement of cash flows shows how cash is generated during an accounting period and how it has been used. b. A positive net income figure on the income statement is ultimately insignificant unless a company can translate its earnings into cash, and the only source in financial statements for learning about cash generation is the statement of cash flows. c. The statement of cash flows shows the adjustments made to net income in order to calculate cash flow from operations; those should be examined to determine why cash flow from operations is negative or positive. (d) The statement of cash flows is the only financial statement that cannot be manipulated. 02. How is the statement of cash flows connected to the balance sheet? a. The statement of cash flows shows changes in the asset and liability accounts to explain cash from operating activities. b. The changes in all revenue and expense accounts are calculated and then listed as cash inflows or outflows. (C) The changes in all of the balance sheet accounts are calculated and then listed as inflows or outflows, except for cash. d. Changes in asset accounts are recorded as operating activities, changes in liability accounts are recorded as financing activities and changes in equity accounts are recorded as investing activities