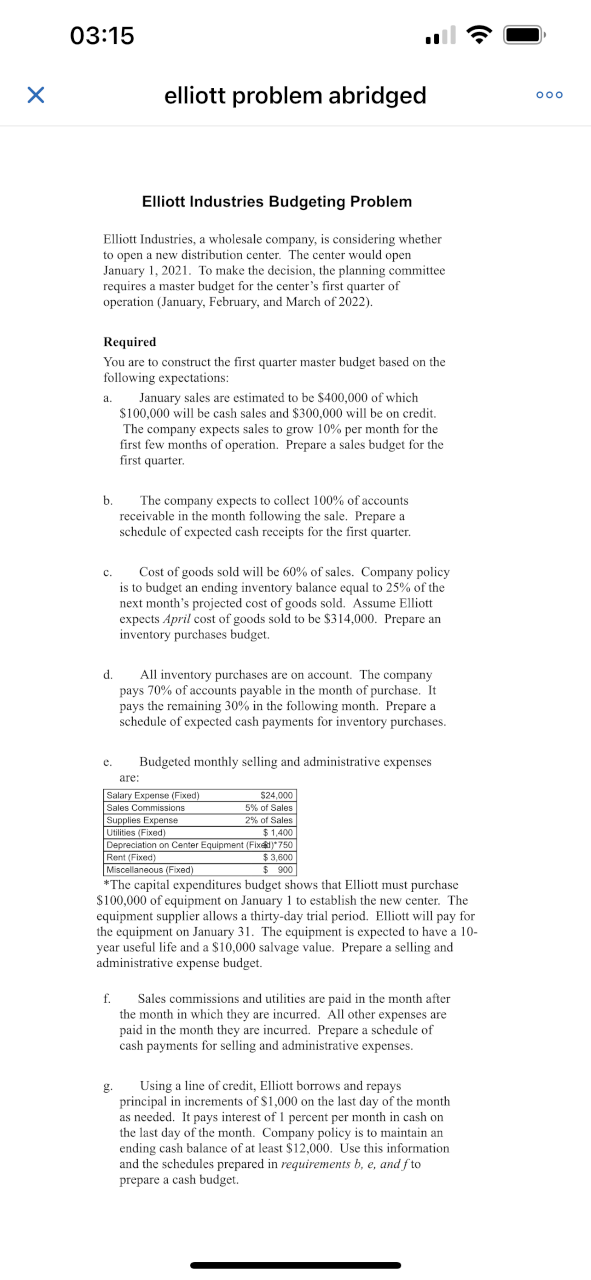

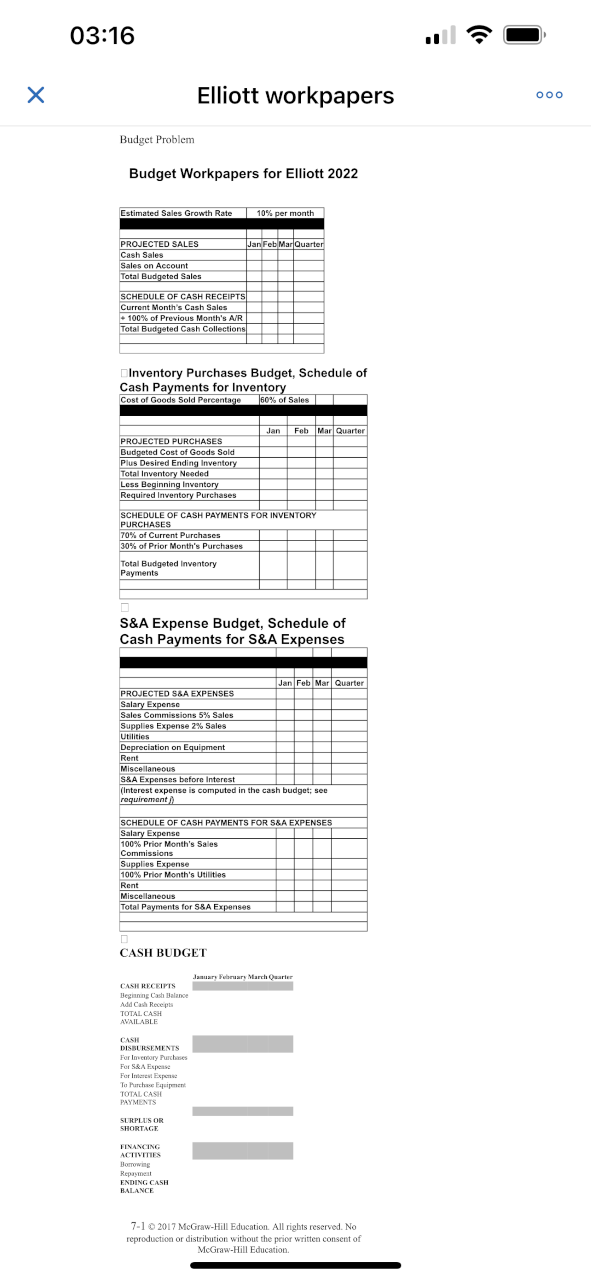

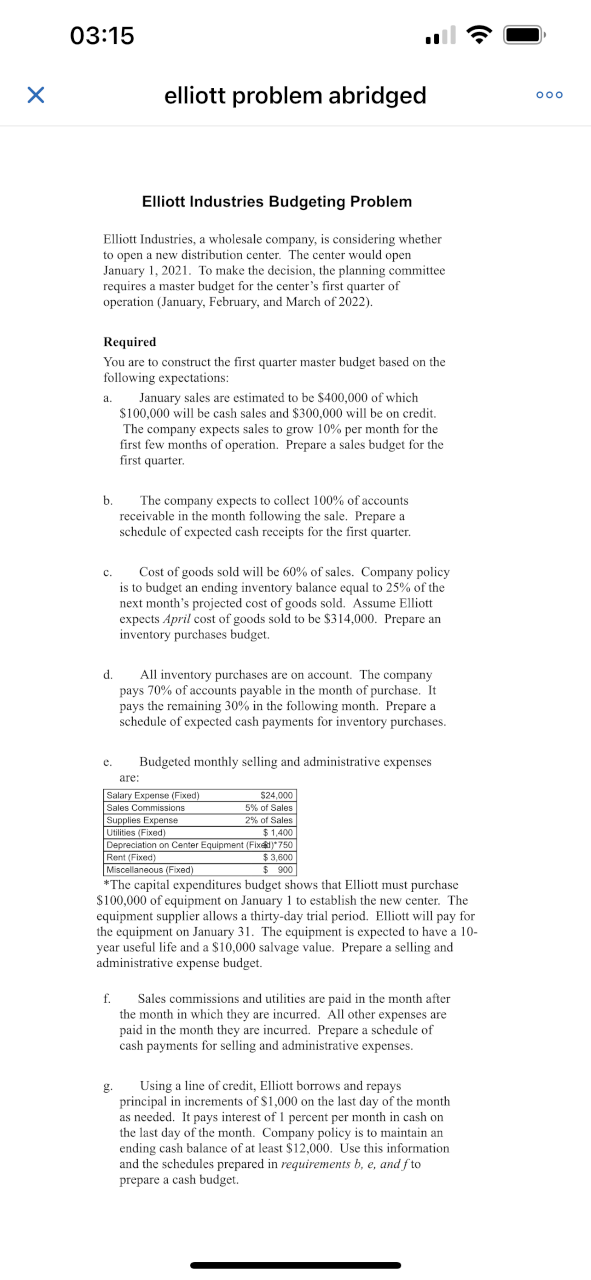

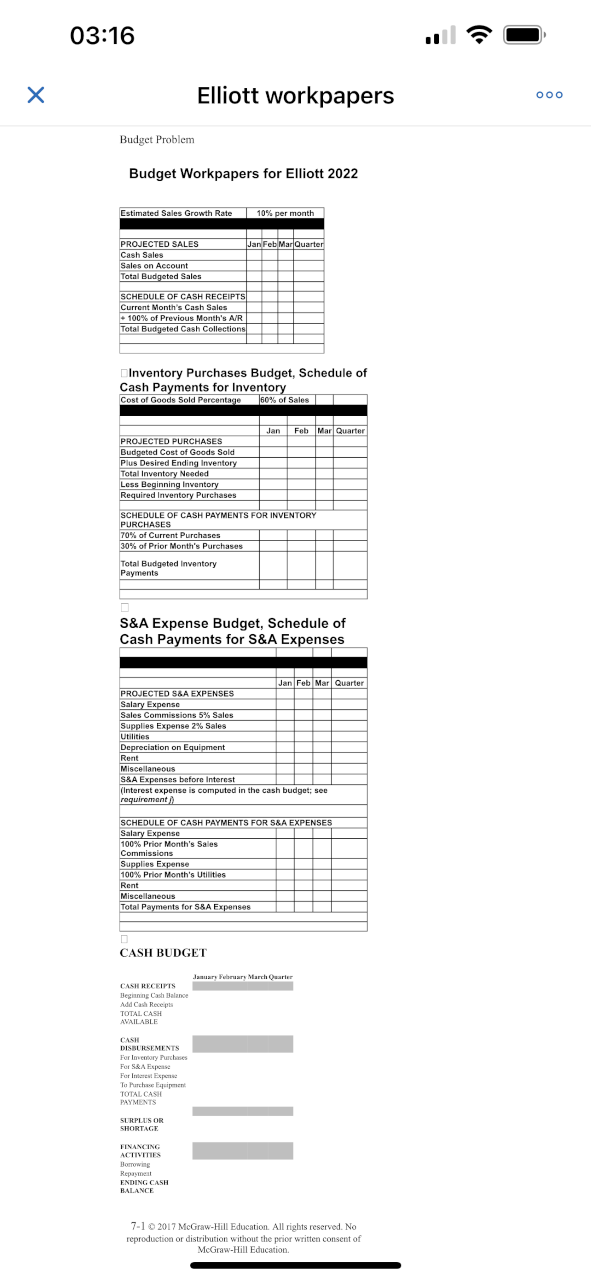

03:15 elliott problem abridged Elliott Industries Budgeting Problem Elliott Industries, a wholesale company, is considering whether to open a new distribution center. The center would open January 1, 2021. To make the decision, the planning committee requires a master budget for the center's first quarter of operation (January, February, and March of 2022). Required You are to construct the first quarter master budget based on the following expectations: a. January sales are estimated to be $400,000 of which $100,000 will be cash sales and $300,000 will be on credit. The company expects sales to grow 10% per month for the first few months of operation. Prepare a sales budget for the first quarter. a. b. b. The company expects to collect 100% of accounts receivable in the month following the sale. Prepare a schedule of expected cash receipts for the first quarter. Cost of goods sold will be 60% of sales. Company policy is to budget an ending inventory balance equal to 25% of the next month's projected cost of goods sold. Assume Elliott expects April cost of goods sold to be $314,000. Prepare an inventory purchases budget. d. All inventory purchases are on account. The company pays 70% of accounts payable in the month of purchase. It pays the remaining 30% in the following month. Prepare a schedule of expected cash payments for inventory purchases. e. Budgeted monthly selling and administrative expenses are: Salary Expense (Fixed) $24,000 Sales Commissions 5% of Sales Supplies Expense 2% of Sales Utilities (Fixed) $ 1,400 $ Depreciation on Center Equipment (Fixed)*750 Rent (Fixed) $3,600 Miscellaneous (Fixed) $ $ 900 *The capital expenditures budget shows that Elliott must purchase $100,000 of equipment on January 1 to establish the new center. The equipment supplier allows a thirty-day trial period. Elliott will pay for the equipment on January 31. The equipment is expected to have a 10- year useful life and a $10,000 salvage value. Prepare a selling and administrative expense budget. f. Sales commissions and utilities are paid in the month after the month in which they are incurred. All other expenses are paid in the month they are incurred. Prepare a schedule of cash payments for selling and administrative expenses. Using a line of credit, Elliott borrows and repays principal in increments of $1,000 on the last day of the month as needed. It pays interest of 1 percent per month in cash on the last day of the month. Company policy is to maintain an ending cash balance of at least $12,000. Use this information and the schedules prepared in requirements b, e, and f to prepare a cash budget. 03:16 Elliott workpapers Budget Problem Budget Workpapers for Elliott 2022 Estimated Sales Growth Rate 10% per month I_ Llan Feb Mar Quarter PROJECTED SALES Cash Sales Sales on Account Total Budgeted Sales SCHEDULE OF CASH RECEIPTS Current Month's Cash Sales + 100% of Previous Month's AR Total Budgeted Cash Collections Inventory Purchases Budget, Schedule of Cash Payments for Inventory Cost of Goods Sold Percentage 60% of Sales % Jan Feb Mar Quarter PROJECTED PURCHASES Budgeted Cost of Goods Sold Plus Desired Ending Inventory Total Inventory Needed Less Beginning Inventory Required Inventory Purchases SCHEDULE OF CASH PAYMENTS FOR INVENTORY PURCHASES 70% of Current Purchases 30% of Prior Month's Purchases Total Budgeted Inventory Payments S&A Expense Budget, Schedule of Cash Payments for S&A Expenses Jan Feb Mar Quarter PROJECTED S&A EXPENSES Salary Expense Sales Commissions 5% Sales Supplies Expense 2% Sales Utilities Depreciation on Equipment Rent Miscellaneous S&A Expenses before interest (Interest expense is computed in the cash budget; see requirement SCHEDULE OF CASH PAYMENTS FOR S&A EXPENSES Salary Expense 100% Prior Month's Sales Commissions Supplies Expense 100% Prior Month's Utilities Rent Miscellaneous Total Payments for S&A Expenses CASH BUDGET January February March Quarter CASH RECEIPTS Beginning Cash Balance Add Cash Recept TOTAL CASH AVAILABLE CASH DISBURSEMENTS For cory Purchases For SAAB For Expo To Purchase TOTALCAS PAYMENTS SURPLUS OR SHORTAGE FINANCING ACTIVITIES Borrowing Repayment ENDING CASH BALANCE 7-10 2017 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education