Answered step by step

Verified Expert Solution

Question

1 Approved Answer

0.39% 1.56% 0.49% 1.3% 2.32% 0.83% 0.72% James has recently been hired as the chief investment officer for a wealth management company. He wants to

0.39%

0.39%

1.56%

0.49%

1.3%

2.32%

0.83%

0.72%

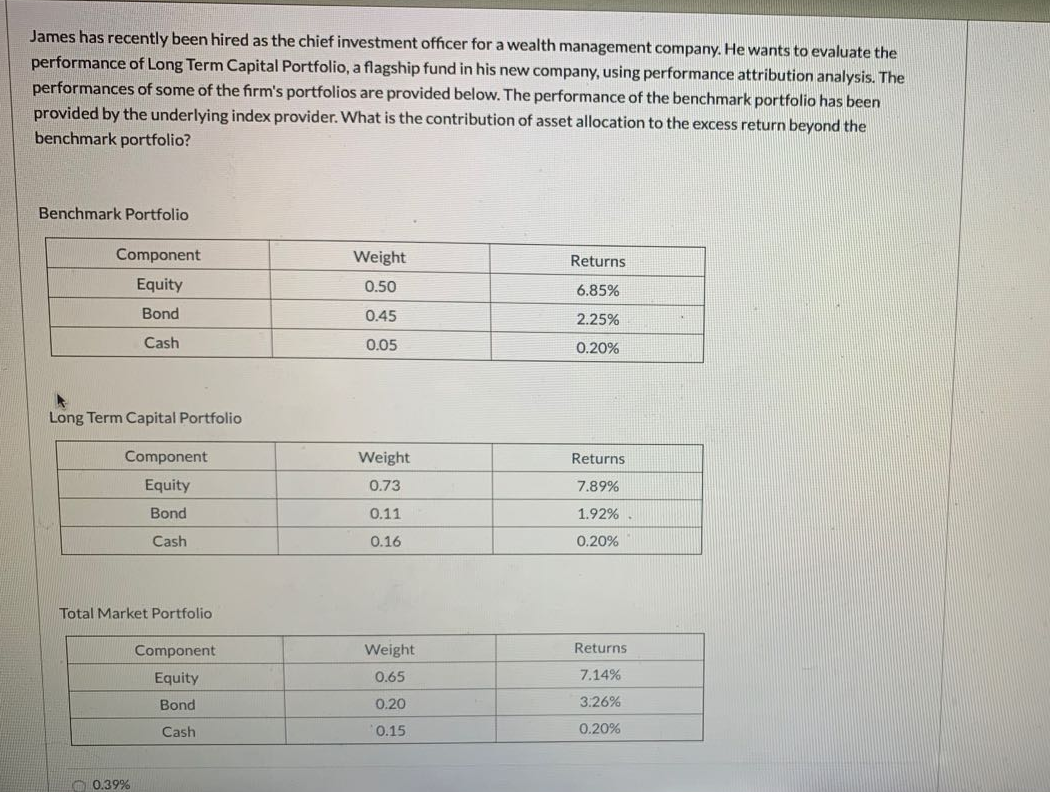

James has recently been hired as the chief investment officer for a wealth management company. He wants to evaluate the performance of Long Term Capital Portfolio, a flagship fund in his new company, using performance attribution analysis. The performances of some of the firm's portfolios are provided below. The performance of the benchmark portfolio has been provided by the underlying index provider. What is the contribution of asset allocation to the excess return beyond the benchmark portfolio? Benchmark Portfolio Returns 6.85% Component Equity Bond Cash Weight 0.50 0.45 0.05 2.25% 0.20% Long Term Capital Portfolio Component Equity Bond Cash Weight 0.73 0.11 0.16 Returns 7.89% 1.92% 0.20% Total Market Portfolio Weight 0.65 Returns 7.14% Component Equity Bond Cash 0.20 3.26% 0.20% 0.15Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started