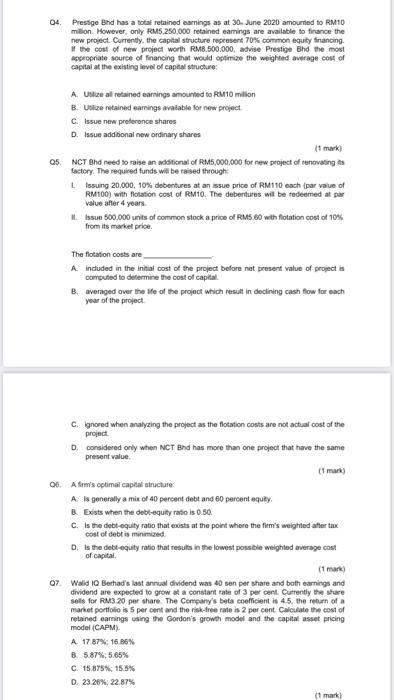

04 Prestige Bhd has a total retained earnings as at 30. June 2020 amounted to RM10 milion However, only RM5,250,000 retained earings are available to finance the new project. Currently, the capital structure represent 70% common equity financing If the cost of new project worth RM8.500.000, advise Prestige Bhd the most appropriate source of financing that would optimize the weighted average cost of capital at the existing level of capital structure: Alize al retained earnings amounted to RM10 millon B. Utilize retained eamings available for new project c.Issue new preference shares D. Issue additional new ordinary shares 05. NCT Bhd need to raise an additional of RM5,000,000 for new project of renovating factory. The required funds will be raised through Lissuing 20.000, 10% debentures at an issue price of RM110 each par value of RM100) with flotation cost of RM10. The debentures will be redeemed at pa value after 4 years Issue 500.000 units of common stock a price of RM5.60 with flotation cost of 10% from its market price The flotation costs are Aindluded in the initial cost of the project before net present value of project is computed to determine the cost of capital B. averaged over the life of the project which result in declining cash flow for each year of the project c.gnored when analyzing the project as the flotation costs are not actual cost of the project D. considered only when NCT Bhd has more than one project that have the same present value 06. Afirm's optimal capital structure Als generally a mix of 40 percent debt and 60 percent equly B. Exists when the debl-equity ratio is 0.50 C. Is the debt-equity ratio that exists at the point where the firm's weighted after tax cost of debt is minimized D. is the debt equity ratio that results in the lowest possible weighted average cost of capital (1 mark) 07. Walid 10 Berhad's last annual dividend was 40 sen per share and both earnings and Gividend are expected to grow a constant rate of 3 per cent Currently the sure sells for RM3 20 per share. The Company's beta coefficient is 45, the return of a market portfolio is 5 per cent and the risk-free rate is 2 per cent Calculate the cost of retained earnings using the Gordon's growth model and the capital asset pricing model (CAPM) A 17 87%: 16.86% 8. 5.87% 5,65% C 15.875% 15.5% D. 23.26%: 22.87% (1 mark)