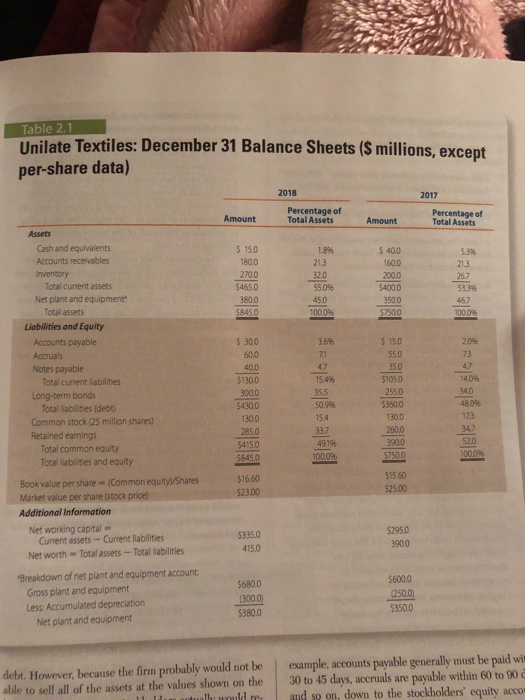

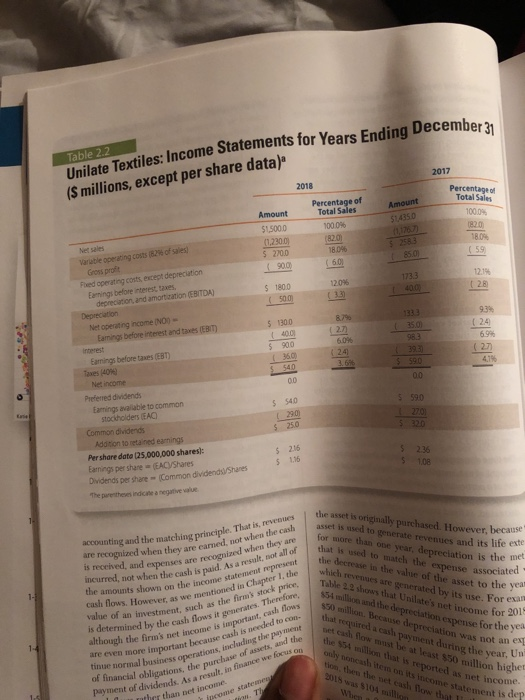

0.5 pts Question 5 What is Net Income for the later year (ending year) on the financial statement: none of the choices are correct 0 50 40 54 O Question 6 0.5 pts What is EBITDA for the later year (ending year): 140 104 none of the choices are correct 54 180 Table 2.1 Unilate Textiles: December 31 Balance Sheets ($ millions, except per-share data) 2018 2017 Amount Percentage of Total Assets Amount Percentage of Total Assets $ 15.0 1800 270.0 $465.0 380.0 58450 1.8% 21.3 32.0 55.0% 45.0 100046 5 400 1600 2000 540000 350.0 $750.0 5.3% 213 26.7 53.346 467 100.00 3.6% Assets Cash and equivalents Accounts receivables Inventory Total current assets Net plant and equipment Total assets Liabilities and Equity Accounts payable Accruals Notes payable Total current abilities Long-term bonds Total liabilities (debt) Common stock (25 million shares) Retained earnings Total common equity Total liabilities and equity $ 150 55.0 2.046 73 350 $ 30,0 60.0 40.0 $130,0 300.0 $430.0 1300 285.0 $4150 $845.0 15.4% 35.5 50.99 154 33.7 49.1% 100.00 $105.0 255.0 $360.0 1300 2600 3900 $750.0 14.04 34.0 48.09 173 347 520 100.0% $16.60 $23.00 $15.60 $25.00 Book value per share (Common equity/Shares Market value per share (stock price) Additional Information Net working capital Current assets - Current liabilities Net worth Total assets - Total abilities $335.0 415.0 $295.0 390.0 Breakdown of net plant and equipment account: Gross plant and equipment Less: Accumulated depreciation Net plant and equipment $680.0 3000) $380.0 $600.0 (2500) $350.0 debt. However, because the firm probably would not be able to sell all of the assets at the values shown on the sulle would re- example, accounts payable generally must be paid will 30 to 45 days, accruals are payable within 60 to 90 and so on, down to the stockholders' equity acco Unilate Textiles: Income Statements for Years Ending December 31 asset is used to treate revenues and its life exte accounting and the matching principle. That is revenue are recognized when they are eamed, not when the cash is recehed, and expenses are recognized when they are which revenues are generated by its use. For ex incurred, not when the cash is paid. As a result of all of the amounts shown on the income statement represent Table 22 shows that Unilate's net income for 2014 $54 won and the depreciation expense for the ye cash flows. However, as we mentioned in Chapter I, the $56) mo. Because depreciation was not an el value of an investment, such as the firm stock price that required a cal payment during the year, Un is determined by the cash flows it generates. Therefore, bet cash flow must be at least 550 million highet although the firm's net income is limportant cash flows the 554 that is reported as net income. are even more important because cash is needed to co omni hones en come statement is dep tinue normal business operations, including the peut of financial obligations, the purchase of assets and the that is used to match the expense associated Payment of dividends. As a result. in finance we focus on Table 22 2017 2018 (5 millions, except per share data) Percentage of Total Sales 100.0% Amount 514350 Percentage of Total Sales 100.0% 1820 18.09 Amount 515000 (1.230,00 $ 2700 (900 (82.01 1804 850 (59 Gross proft Ped operating costs, except depreciation 1733 $1800 120N (33 depreciation and amortization (EBITDA) 934 ( 24 Net operating income NOO- Caming before interest and taxes (EBIT) $ 1300 400 $900 (2.7 60% 6.94 983 39. $S90 (27 00 00 $ 540 $59.0 27.01 5320 Earnings before taxes (ET) Taxes 40 Net income Preferred dividends Earnings able to common stod holders EAG Common dividends Adation to retained earnings Pershare dato 125,000,000 shares): Earnings per share (EAC) Shares Dividends per share - Common dividends/Shares The present indicate a negative e $250 $ 2.16 $ 155 2.36 $10 1 the asset is originally purchased. However, because for more than one year, depreciation is the me the decrease in the value of the asset to the year thon, then the net cash now that I 3015 was $104 other than net income come statem tom. To