Answered step by step

Verified Expert Solution

Question

1 Approved Answer

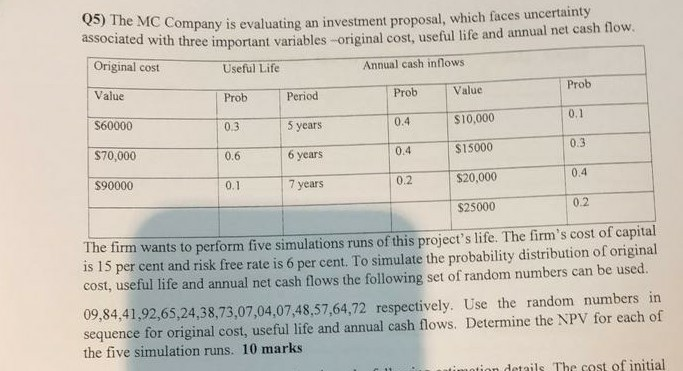

05) The MC C ompany is evaluating an investment proposal, which faces uncertainty ree important variables -original cost, useful life and annual net cash flow

05) The MC C ompany is evaluating an investment proposal, which faces uncertainty ree important variables -original cost, useful life and annual net cash flow Original cost Value S60000 S70,000 90000 Useful Life Prob 0.3 Annual cash inflows Prob 0.1 0.3 0.4 0.2 Value Period 5 years 0.66 years 7 years Prob 0.4 0.4 0.2 10,000 $15000 $20,000 $25000 0.1 e firm wants to perform five simulations runs of this project's life. The firm's cost of capital is 15 per cent and risk free rate is 6 per cent. To simulate the probability distribution of original cost, useful life and annual net cash flows the following set of random numbers can be used. 09,84,41,92,65,24,38,73,07,04,07,48,57,64,72 respectively. Use the random numbers in sequence for original cost, useful life and annual cash flows. Determine the NPV for each of the five simulation runs. 10 marks tiondetails The cost of initial

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started