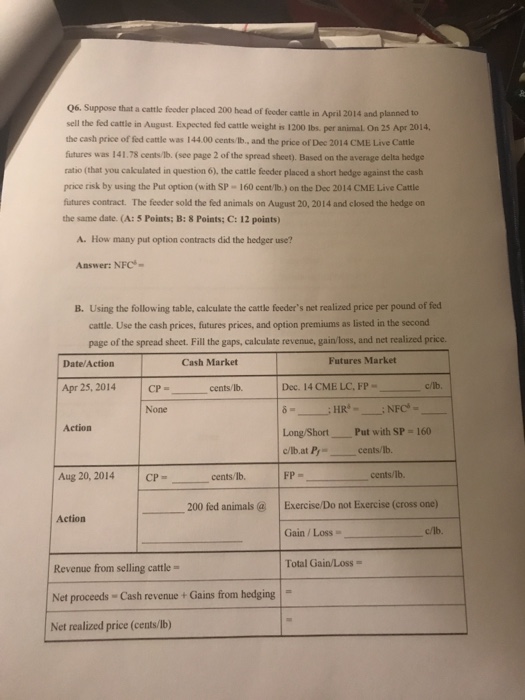

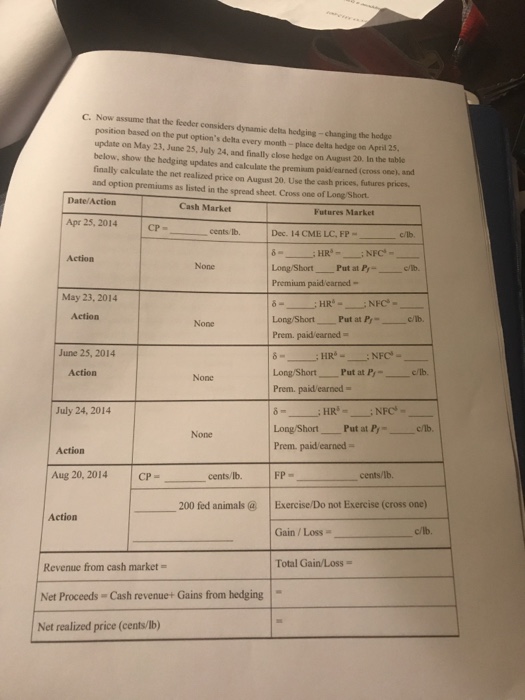

06. Suppose that a cattlc fooder placed 200 bead of fooder catle in April 2014 and planned to sell the fed cattle in August. Expected fed cattle weight is 1200 Ibs. per animal On 25 Apr 2014, the cash price of fed cattle was 144.00 cents/lb., and the price of Dec 2014 CME Live Cattle futures was 141.78 cents/1b. (see page 2 of the spread sheet). Based on the average delta hedge ratio (that you cakculated in question 6), the cattle feeder placed a short hedge against the cash price risk by using the Put option (with SP 160 cent/lb.) on the Dec 2014 CME Live Cattle futures contract. The feeder sold the fed animals on August 20, 2014 and closed the hedge on the same date. (A: 5 Points; B: 8 Points; C: 12 points) A. How many put option contracts did the hedger use? Answer: NFC B. Using the following table, calculate the cattle feeder's net realized price per pound of fed cattle. Use the cash prices, futures prices, and option premiums as listed in the second page of the spread sheet. Fill the gaps, calculate revenue, gain/loss, and net realized price. Date/Action Cash Market Futures Market Apr 25, 2014 CP cents/lb. Dec. 14 CME LC, FP None HR-NFC Action LongShort--Put with SP = 160 c/lb.at Pr cents/lb. FP = Aug 20, 2014 CP cents/lb. cents/lb. 200 fed animals@ Exercise/Do not Exercise (cross one) Action Gain /Loss Total Gain/Loss = Revenue from selling cattle- Net proceeds Cash revenue+Gains from hedging Net realized price (cents/lb) 06. Suppose that a cattlc fooder placed 200 bead of fooder catle in April 2014 and planned to sell the fed cattle in August. Expected fed cattle weight is 1200 Ibs. per animal On 25 Apr 2014, the cash price of fed cattle was 144.00 cents/lb., and the price of Dec 2014 CME Live Cattle futures was 141.78 cents/1b. (see page 2 of the spread sheet). Based on the average delta hedge ratio (that you cakculated in question 6), the cattle feeder placed a short hedge against the cash price risk by using the Put option (with SP 160 cent/lb.) on the Dec 2014 CME Live Cattle futures contract. The feeder sold the fed animals on August 20, 2014 and closed the hedge on the same date. (A: 5 Points; B: 8 Points; C: 12 points) A. How many put option contracts did the hedger use? Answer: NFC B. Using the following table, calculate the cattle feeder's net realized price per pound of fed cattle. Use the cash prices, futures prices, and option premiums as listed in the second page of the spread sheet. Fill the gaps, calculate revenue, gain/loss, and net realized price. Date/Action Cash Market Futures Market Apr 25, 2014 CP cents/lb. Dec. 14 CME LC, FP None HR-NFC Action LongShort--Put with SP = 160 c/lb.at Pr cents/lb. FP = Aug 20, 2014 CP cents/lb. cents/lb. 200 fed animals@ Exercise/Do not Exercise (cross one) Action Gain /Loss Total Gain/Loss = Revenue from selling cattle- Net proceeds Cash revenue+Gains from hedging Net realized price (cents/lb)