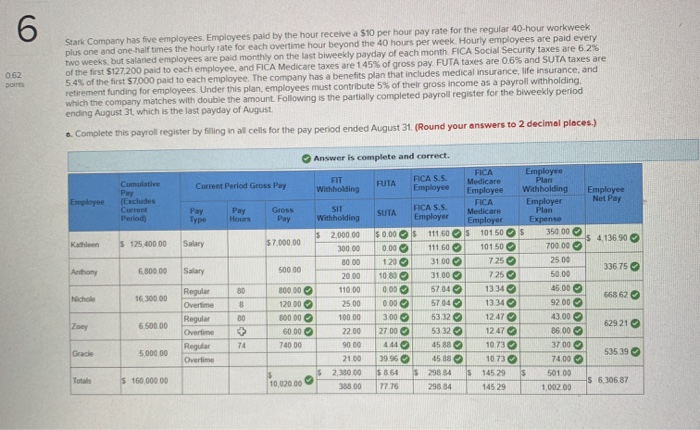

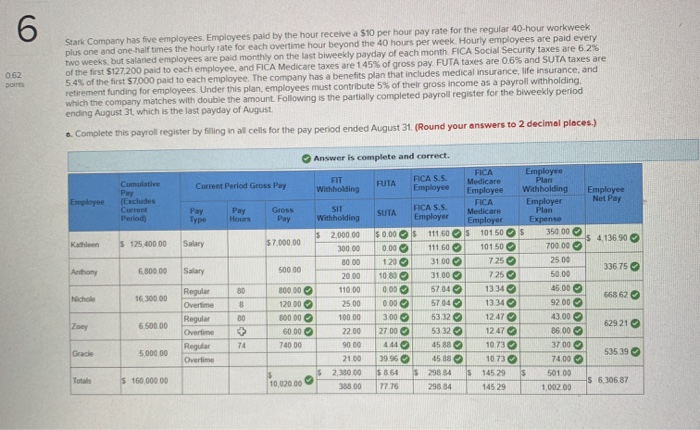

062 Stark Company has five employees. Employees paid by the hour receive a $10 per hour pay rate for the regular 40-hour workweek plus one and one-half times the hourly rate for each overtime hour beyond the 40 hours per week. Hourly employees are paid every two weeks, but saaned employees are paid monthly on the last biweekly payday of each month. FICA Social Security taxes are 62% of the first $127.200 paid to each employee, and FICA Medicare taxes are 145% of gross pay FUTA taxes are 06% and SUTA taxes are 5.4% of the first $7,000 paid to each employee. The company has a benefits plan that includes medical insurance life insurance, and retirement funding for employees. Under this plan, employees must contribute 5% of their gross income as a payroll withholding. which the company matches with double the amount. Following is the partially completed payroll register for the biweekly period ending August 31, which is the last payday of August a. Complete this payrol register by Siling in al cells for the pay period ended August 31 (Round your answers to 2 decimal places.) Answer is complete and correct. Current Period Gross Pay FIT Withholding PICASS Employee Employee Excludes C Period Empoyee Net Pay Pay Type Pay Hours Gross Pay SUTA Withholding FICA 5.5. Employer FCA care Employee FICA Medicare Employer S101 505 101 50 725 Employee Plan witholeng Employer Plan Expense 35000 70000 $200000 5000 $ 111 K S 125.00000 Swary 57 000.00 $ 4,136 90 30000 8000 Anthony 6,800.00 Salary 500.00 336 75 725 20.00 110.00 | Regular Niche 1630000 Overtime 668 62 25.00 30000 120.00 500.00 60.00 740 00 10000 1267 6.500.00 5312 300 2700 Overtime 22.00 629 21 5312 Regular 90 00 85.00 3700 Grade 5.000.00 53539 $ 150,000.00 50100 10 000 $ 6,306 87 1.002.00 062 Stark Company has five employees. Employees paid by the hour receive a $10 per hour pay rate for the regular 40-hour workweek plus one and one-half times the hourly rate for each overtime hour beyond the 40 hours per week. Hourly employees are paid every two weeks, but saaned employees are paid monthly on the last biweekly payday of each month. FICA Social Security taxes are 62% of the first $127.200 paid to each employee, and FICA Medicare taxes are 145% of gross pay FUTA taxes are 06% and SUTA taxes are 5.4% of the first $7,000 paid to each employee. The company has a benefits plan that includes medical insurance life insurance, and retirement funding for employees. Under this plan, employees must contribute 5% of their gross income as a payroll withholding. which the company matches with double the amount. Following is the partially completed payroll register for the biweekly period ending August 31, which is the last payday of August a. Complete this payrol register by Siling in al cells for the pay period ended August 31 (Round your answers to 2 decimal places.) Answer is complete and correct. Current Period Gross Pay FIT Withholding PICASS Employee Employee Excludes C Period Empoyee Net Pay Pay Type Pay Hours Gross Pay SUTA Withholding FICA 5.5. Employer FCA care Employee FICA Medicare Employer S101 505 101 50 725 Employee Plan witholeng Employer Plan Expense 35000 70000 $200000 5000 $ 111 K S 125.00000 Swary 57 000.00 $ 4,136 90 30000 8000 Anthony 6,800.00 Salary 500.00 336 75 725 20.00 110.00 | Regular Niche 1630000 Overtime 668 62 25.00 30000 120.00 500.00 60.00 740 00 10000 1267 6.500.00 5312 300 2700 Overtime 22.00 629 21 5312 Regular 90 00 85.00 3700 Grade 5.000.00 53539 $ 150,000.00 50100 10 000 $ 6,306 87 1.002.00