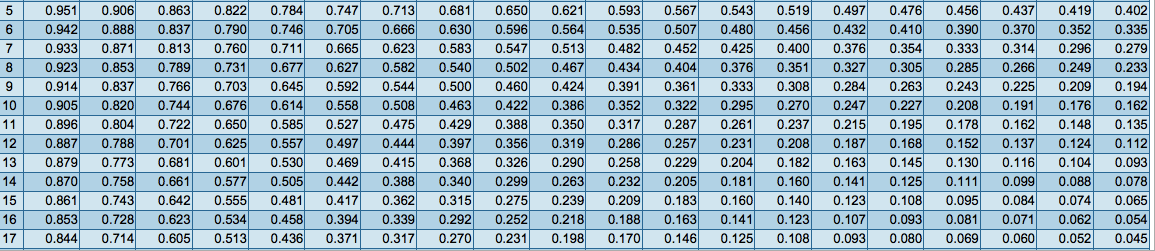

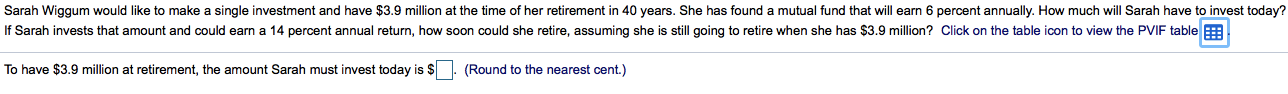

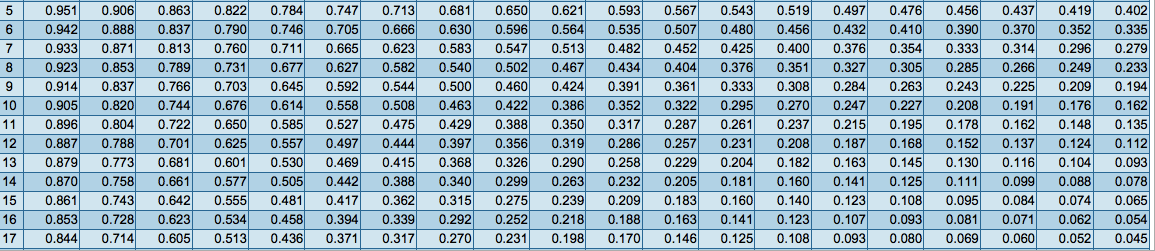

0.713 0.822 0.790 0.760 0.784 0.746 0.711 0.677 0.747 0.705 0.665 0.650 0.567 0.543 0.497 0.432 0.376 0.476 0.456 0.437 5 0.951 0.906 0.863 0.681 0.621 0.593 0.519 0.419 0.402 0.888 0.564 0.513 0.352 0.942 0.933 0.837 0.666 0.630 0.596 0.535 0.507 0.480 0.456 0.410 0.390 0.370 0.335 0.871 0.547 0.482 0.354 0.333 0.285 0.314 0.813 0.452 0.425 0.400 0.279 0.623 0.583 0.296 0.540 0.500 0.327 0.923 0.853 0.789 0.731 0.627 0.582 0.502 0.467 0.434 0.404 0.376 0.351 0.305 0.266 0.249 0.233 0.703 0.676 0.650 0.424 0.263 0.914 0.837 0.766 0.645 0.592 0.544 0.460 0.391 0.361 0.333 0.308 0.284 0.243 0.225 0.209 0.194 0.905 0.820 0.804 0.614 0.508 0.475 0.422 0.386 10 0.744 0.558 0.463 0.352 0.322 0.295 0.270 0.247 0.227 0.208 0.191 0.176 0.162 0.350 0.319 0.215 0.195 0.168 0.178 0.388 0.237 0.208 11 0.896 0.722 0.585 0.527 0.429 0.317 0.287 0.261 0.162 0.148 0.135 0.887 0.397 0.286 0.788 0.773 0.758 0.743 12 13 0.701 0.625 0.557 0.497 0.444 0.356 0.257 0.231 0.187 0.152 0.137 0.124 0.112 0.469 0.290 0.263 0.368 0.879 0.681 0.601 0.530 0.415 0.326 0.258 0.229 0.204 0.182 0.163 0.145 0.130 0.116 0.104 0.093 0.577 0.299 0.275 0.252 0.340 0.315 0.125 0.099 14 0.870 0.661 0.505 0.442 0.388 0.232 0.205 0.181 0.160 0.141 0.111 0.088 0.078 0.555 0.534 0.362 0.183 0.160 0.140 0.095 0.065 15 16 0.861 0.642 0.481 0.417 0.108 0.239 0.209 0.123 0.084 0.074 0.218 0.093 0.080 0.853 0.728 0.623 0.458 0.394 0.339 0.292 0.188 0.163 0.141 0.123 0.107 0.081 0.071 0.062 0.054 0.844 0.714 0.605 0.436 0.270 0.198 0.170 0.146 0.108 0.060 0.052 17 0.125 0.093 0.045 0.513 0.371 0.317 0.231 0.069 Sarah Wiggum would like to make a single investment and have $3.9 million at the time of her retirement in 40 years. She has found a mutual fund that will earn 6 percent annually. How much will Sarah have to invest today? If Sarah invests that amount and could earn a 14 percent annual return, how soon could she retire, assuming she is still going to retire when she has 3.9 million? Click on the table icon to view the PVIF table To have $3.9 million at retirement, the amount Sarah must invest today is $ (Round to the nearest cent.)