Answered step by step

Verified Expert Solution

Question

1 Approved Answer

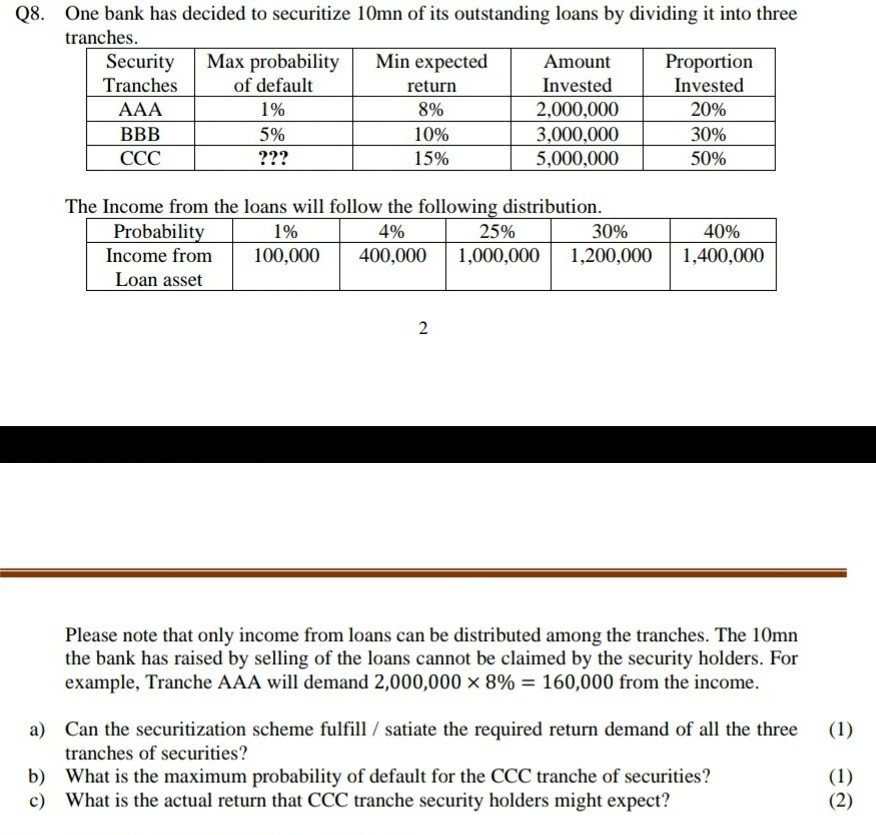

08. One bank has decided to securitize 10mn of its outstanding loans by dividing it into three tranches. Security Max probability Min expected Amount Proportion

08. One bank has decided to securitize 10mn of its outstanding loans by dividing it into three tranches. Security Max probability Min expected Amount Proportion Tranches of default return Invested Invested AAA 1% 8% 2,000,000 20% BBB 5% 10% 3,000,000 30% ??? 15% 5,000,000 50% The Income from the loans will follow the following distribution. Probability 1% 4% 25% 30% Income from 100,000 400,000 1,000,000 1,200,000 Loan asset 40% 1,400,000 2. Please note that only income from loans can be distributed among the tranches. The 10mn the bank has raised by selling of the loans cannot be claimed by the security holders. For example, Tranche AAA will demand 2,000,000 8% = 160,000 from the income. (1) a) Can the securitization scheme fulfill / satiate the required return demand of all the three tranches of securities? b) What is the maximum probability of default for the CCC tranche of securities? c) What is the actual return that CCC tranche security holders might expect? (1) (2)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started