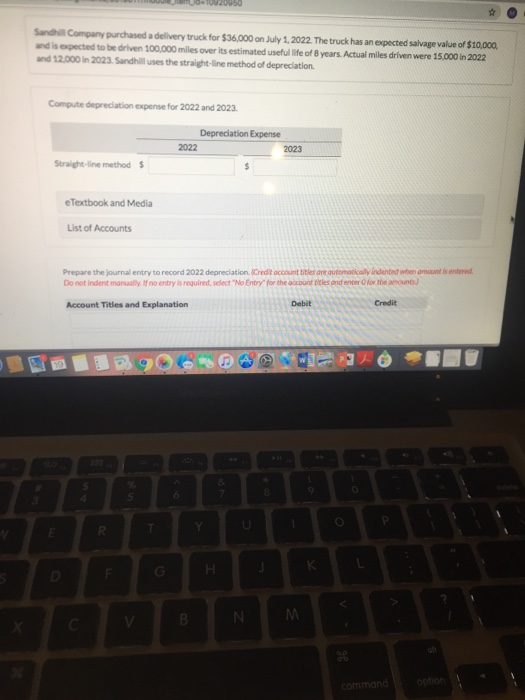

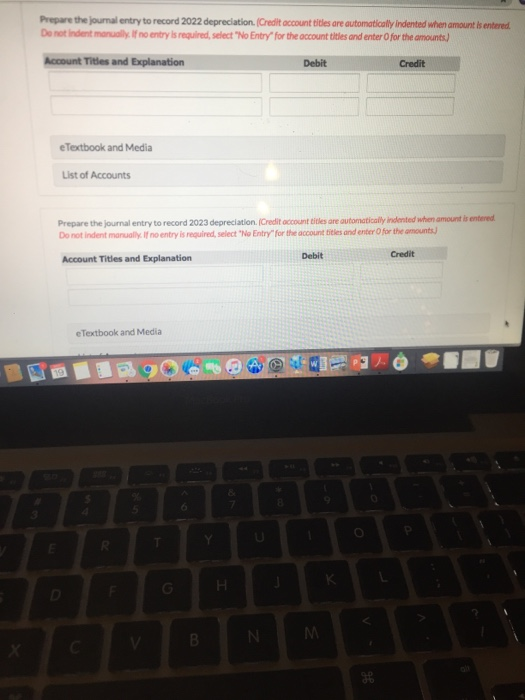

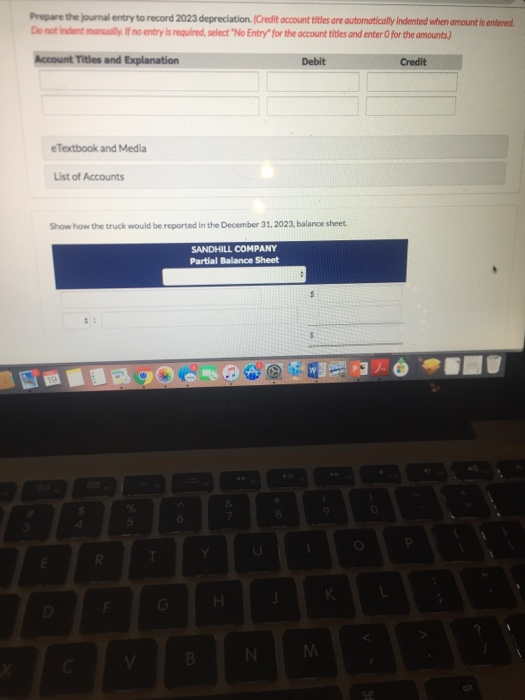

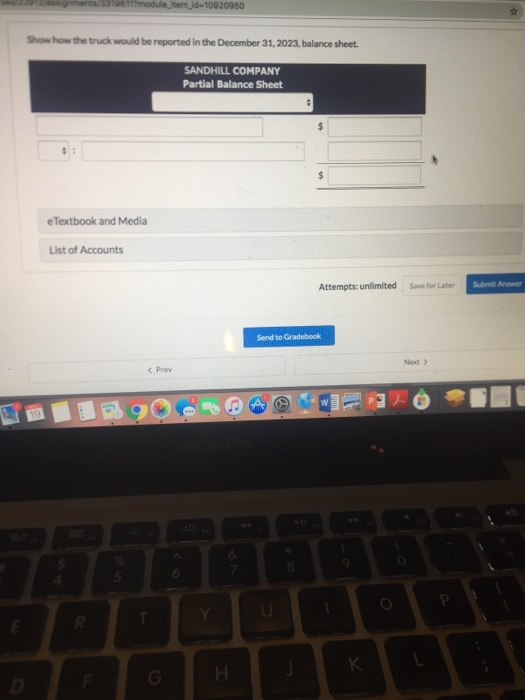

0950 Sandhill Company purchased a delivery truck for $36,000 on July 1, 2022. The truck has an expected salvage value of $10,000 and is opected to be driven 100,000 miles over its estimated useful life of 8 years. Actual miles driven were 15,000 in 2022 and 12.000 in 2023. Sandhill uses the straight-line method of depreclation Compute depreciation expense for 2022 and 2023 Depreciation Expense 2022 2023 Straight-line method $ eTextbook and Media List of Accounts Prepare the journal entry to record 2022 depreciation. (Credit account titles are automaticaly indenteed when amaunt is entered Do not indent manually If no entry is required, select "No Entry for the account bitles and enter Ofor the anounts Credit Account Titles and Explanation Debit % 5 4 P N V option command Prepare the journal entry to record 2022 depreciation. (Credit account titles are automatically Indented when amount is entered De not indent manually If no entry is required, select "No Entry"for the account titles and enter 0 for the amounts) Account Titles and Explanation Debit Credit eTextbook and Media List of Accounts Prepare the journal entry to record 2023 depreciation. (Credit occount titles are automatically indented when amount is entered Do not indent manually If no entry is required, select "No Entry for the account titles and enter O for the amounts) Credit Debit Account Titles and Explanation eTextbook and Media 6 3 P G N Prepare the journal entry to record 2023 depreciation. (Credit account titles are automatically indented when amount is entered De not Indent manually If no entry is required, select "No Entry' for the account titles and enter O for the amounts) Account Titles and Explanation Debit Credit eTextbook and Media List of Accounts Show how the truck would be reported in the December 31, 2023, balance sheet SANDHILL COMPANY Partial Balance Sheet 6 5 4 N ighments/3396117module jtem id-10920950 Show how the truck would be reported in the December 31, 2023, balance sheet. SANDHILL COMPANY Partial Balance Sheet $ $ eTextbook and Media List of Accounts Submit Answer Save for Later Attempts: unlimited Send to Gradebook Next