Question

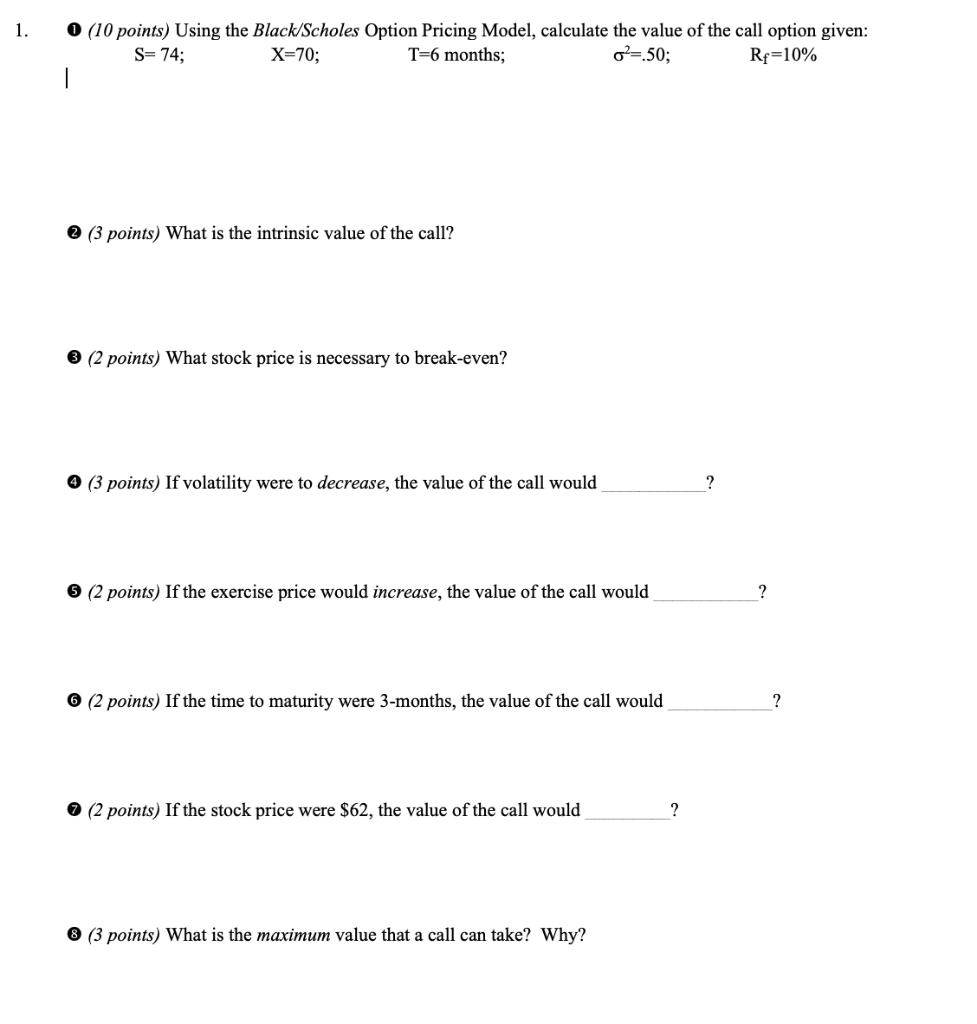

1. 0 (10 points) Using the Black/Scholes Option Pricing Model, calculate the value of the call option given: o=.50; S=74; X=70; T=6 months; Rf=10%

1. 0 (10 points) Using the Black/Scholes Option Pricing Model, calculate the value of the call option given: o=.50; S=74; X=70; T=6 months; Rf=10% 1 (3 points) What is the intrinsic value of the call? 3 (2 points) What stock price is necessary to break-even? (3 points) If volatility were to decrease, the value of the call would (2 points) If the exercise price would increase, the value of the call would 6 (2 points) If the time to maturity were 3-months, the value of the call would (2 points) If the stock price were $62, the value of the call would 8 (3 points) What is the maximum value that a call can take? Why? ? ? ? ?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Call Option Value Given the information you provided the call option value using the BlackScholes ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting And Analysis

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer

8th Edition

1260247848, 978-1260247848

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App