Answered step by step

Verified Expert Solution

Question

1 Approved Answer

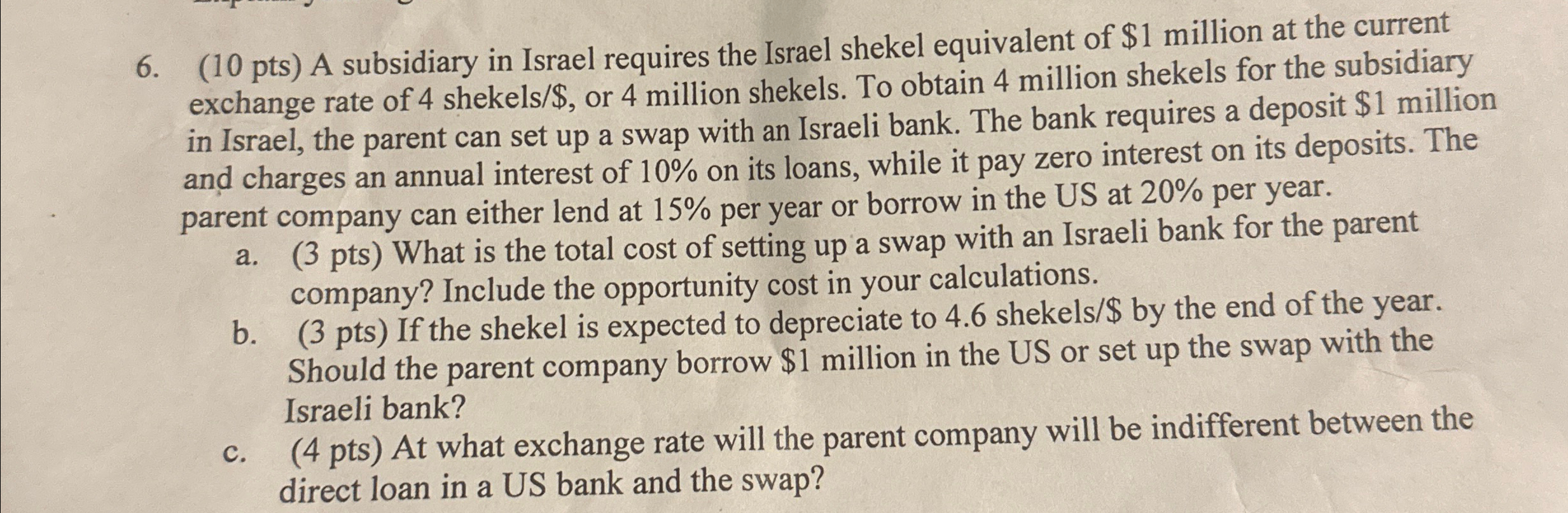

( 1 0 pts ) A subsidiary in Israel requires the Israel shekel equivalent of $ 1 million at the current exchange rate of 4

pts A subsidiary in Israel requires the Israel shekel equivalent of $ million at the current exchange rate of shekels $ or million shekels. To obtain million shekels for the subsidiary in Israel, the parent can set up a swap with an Israeli bank. The bank requires a deposit $ million and charges an annual interest of on its loans, while it pay zero interest on its deposits. The parent company can either lend at per year or borrow in the US at per year.

a pts What is the total cost of setting up a swap with an Israeli bank for the parent company? Include the opportunity cost in your calculations.

b pts If the shekel is expected to depreciate to shekels$ by the end of the year. Should the parent company borrow $ million in the US or set up the swap with the Israeli bank?

c pts At what exchange rate will the parent company will be indifferent between the direct loan in a US bank and the swap?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started