Answered step by step

Verified Expert Solution

Question

1 Approved Answer

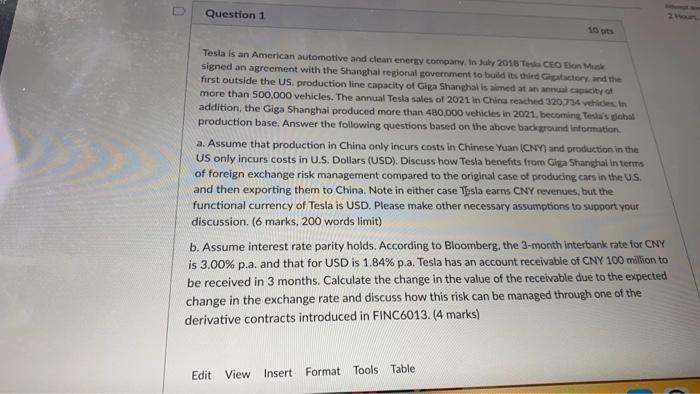

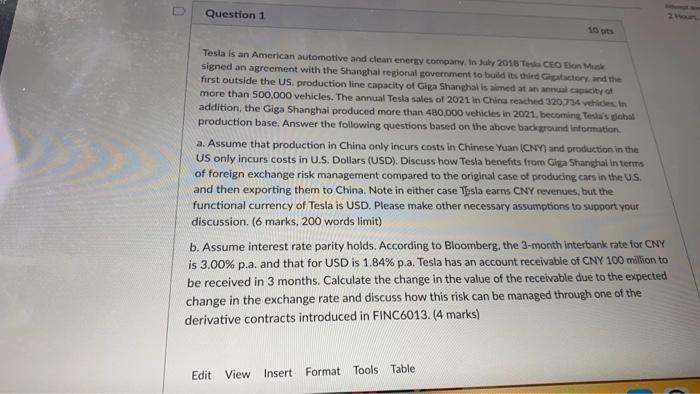

1 0 Question 1 10 pits Tesla is an American automotive and clean energy company. In July 2018 Tesla CEO Elon Musk signed an agreement

1

0 Question 1 10 pits Tesla is an American automotive and clean energy company. In July 2018 Tesla CEO Elon Musk signed an agreement with the Shanghal regional government to build its third Gigafactory, and the first outside the US. production line capacity of Giga Shanghal is aimed at an annual capacity of more than 500,000 vehicles. The annual Tesla sales of 2021 in China reached 320,734 vehicles, In addition, the Giga Shanghai produced more than 480,000 vehicles in 2021, becoming Tesla's global production base. Answer the following questions based on the above background information. a. Assume that production in China only incurs costs in Chinese Yuan (CNY) and production in the US only incurs costs in U.S. Dollars (USD). Discuss how Tesla benefits from Giga Shanghai in terms of foreign exchange risk management compared to the original case of producing cars in the US. and then exporting them to China. Note in either case Tesla earns CNY revenues, but the functional currency of Tesla is USD. Please make other necessary assumptions to support your discussion. (6 marks, 200 words limit) b. Assume interest rate parity holds. According to Bloomberg, the 3-month interbank rate for CNY is 3.00% p.a. and that for USD is 1.84% p.a. Tesla has an account receivable of CNY 100 million to be received in 3 months. Calculate the change in the value of the receivable due to the expected change in the exchange rate and discuss how this risk can be managed through one of the derivative contracts introduced in FINC6013. (4 marks) Edit View Insert Format Tools Table 0 Question 1 10 pits Tesla is an American automotive and clean energy company. In July 2018 Tesla CEO Elon Musk signed an agreement with the Shanghal regional government to build its third Gigafactory, and the first outside the US. production line capacity of Giga Shanghal is aimed at an annual capacity of more than 500,000 vehicles. The annual Tesla sales of 2021 in China reached 320,734 vehicles, In addition, the Giga Shanghai produced more than 480,000 vehicles in 2021, becoming Tesla's global production base. Answer the following questions based on the above background information. a. Assume that production in China only incurs costs in Chinese Yuan (CNY) and production in the US only incurs costs in U.S. Dollars (USD). Discuss how Tesla benefits from Giga Shanghai in terms of foreign exchange risk management compared to the original case of producing cars in the US. and then exporting them to China. Note in either case Tesla earns CNY revenues, but the functional currency of Tesla is USD. Please make other necessary assumptions to support your discussion. (6 marks, 200 words limit) b. Assume interest rate parity holds. According to Bloomberg, the 3-month interbank rate for CNY is 3.00% p.a. and that for USD is 1.84% p.a. Tesla has an account receivable of CNY 100 million to be received in 3 months. Calculate the change in the value of the receivable due to the expected change in the exchange rate and discuss how this risk can be managed through one of the derivative contracts introduced in FINC6013. (4 marks) Edit View Insert Format Tools Table

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started