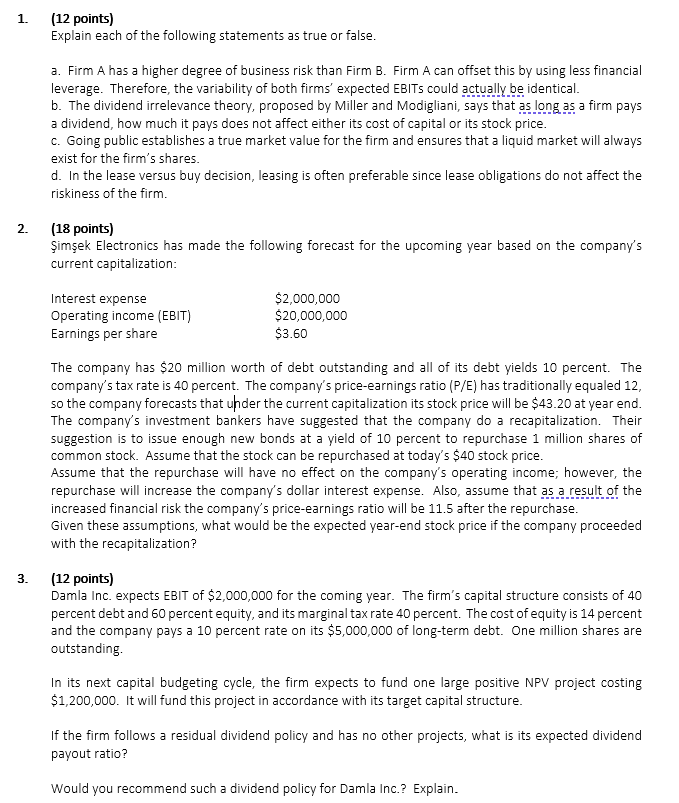

Question: 1 . ( 1 2 points ) Explain each of the following statements as true or false. a . Firm A has a higher degree

points

Explain each of the following statements as true or false.

a Firm A has a higher degree of business risk than Firm B Firm A can offset this by using less financial leverage. Therefore, the variability of both firms' expected EBITs could actually be identical.

b The dividend irrelevance theory, proposed by Miller and Modigliani, says that as long as a firm pays a dividend, how much it pays does not affect either its cost of capital or its stock price.

c Going public establishes a true market value for the firm and ensures that a liquid market will always exist for the firm's shares.

d In the lease versus buy decision, leasing is often preferable since lease obligations do not affect the riskiness of the firm.

points

imek Electronics has made the following forecast for the upcoming year based on the company's current capitalization:

The company has $ million worth of debt outstanding and all of its debt yields percent. The company's tax rate is percent. The company's priceearnings ratio mathrmPmathrmE has traditionally equaled so the company forecasts that uhder the current capitalization its stock price will be $ at year end. The company's investment bankers have suggested that the company do a recapitalization. Their suggestion is to issue enough new bonds at a yield of percent to repurchase million shares of common stock. Assume that the stock can be repurchased at today's $ stock price.

Assume that the repurchase will have no effect on the company's operating income; however, the repurchase will increase the company's dollar interest expense. Also, assume that as a result of the increased financial risk the company's priceearnings ratio will be after the repurchase. Given these assumptions, what would be the expected yearend stock price if the company proceeded with the recapitalization?

points

Damla Inc. expects EBIT of $ for the coming year. The firm's capital structure consists of percent debt and percent equity, and its marginal tax rate percent. The cost of equity is percent and the company pays a percent rate on its $ of longterm debt. One million shares are outstanding.

In its next capital budgeting cycle, the firm expects to fund one large positive NPV project costing $ It will fund this project in accordance with its target capital structure.

If the firm follows a residual dividend policy and has no other projects, what is its expected dividend payout ratio?

Would you recommend such a dividend policy for Damla Inc.? Explain.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock