Explain.

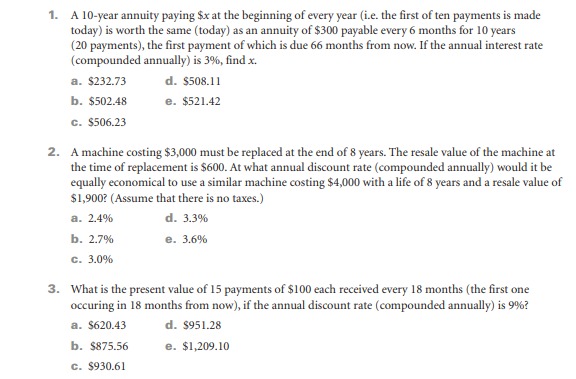

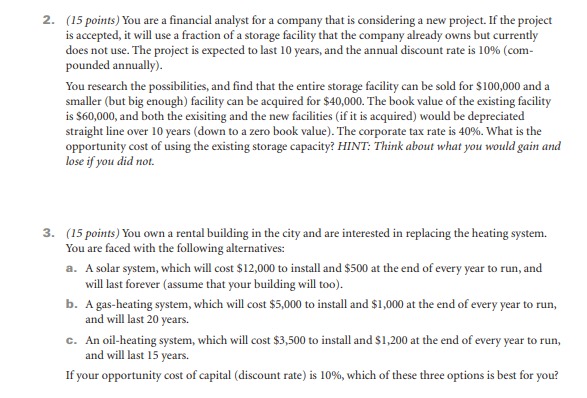

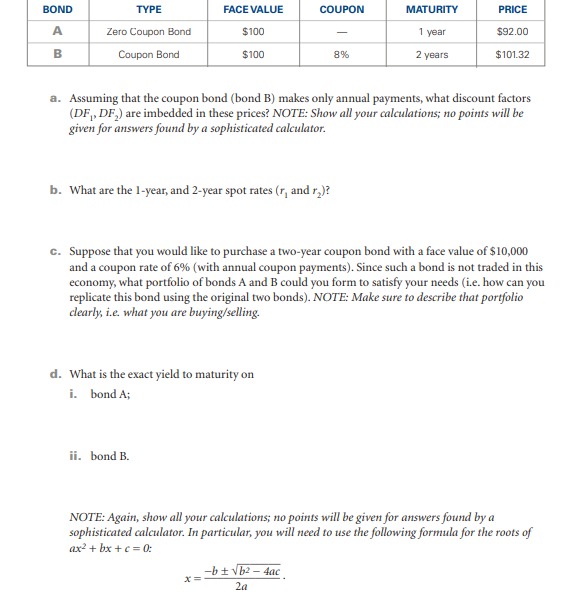

1. A 10-year annuity paying $x at the beginning of every year (i.e. the first of ten payments is made today) is worth the same (today) as an annuity of $300 payable every 6 months for 10 years (20 payments), the first payment of which is due 66 months from now. If the annual interest rate (compounded annually) is 3%, find x. a. $232.73 d. $508.11 b. $502.48 e. $521.42 c. $506.23 2. A machine costing $3,000 must be replaced at the end of 8 years. The resale value of the machine at the time of replacement is $600. At what annual discount rate (compounded annually) would it be equally economical to use a similar machine costing $4,000 with a life of 8 years and a resale value of $1,900? (Assume that there is no taxes.) a. 2.4% d. 3.3% b. 2.7% e. 3.6% C. 3.0% 3. What is the present value of 15 payments of $100 each received every 18 months (the first one occuring in 18 months from now), if the annual discount rate (compounded annually) is 9%? a. $620.43 d. $951.28 b. $875.56 e. $1,209.10 C. $930.612. (15 points) You are a financial analyst for a company that is considering a new project. If the project is accepted, it will use a fraction of a storage facility that the company already owns but currently does not use. The project is expected to last 10 years, and the annual discount rate is 10% (com- pounded annually). You research the possibilities, and find that the entire storage facility can be sold for $100,000 and a smaller (but big enough) facility can be acquired for $40,000. The book value of the existing facility is $60,000, and both the exisiting and the new facilities (if it is acquired) would be depreciated straight line over 10 years (down to a zero book value). The corporate tax rate is 40%. What is the opportunity cost of using the existing storage capacity? HINT: Think about what you would gain and lose if you did not. 3. (15 points) You own a rental building in the city and are interested in replacing the heating system. You are faced with the following alternatives: a. A solar system, which will cost $12,000 to install and $500 at the end of every year to run, and will last forever (assume that your building will too). b. A gas-heating system, which will cost $5,000 to install and $1,000 at the end of every year to run, and will last 20 years. C. An oil-heating system, which will cost $3,500 to install and $1,200 at the end of every year to run, and will last 15 years. If your opportunity cost of capital (discount rate) is 10%, which of these three options is best for you?BOND TYPE FACE VALUE COUPON MATURITY PRICE A Zero Coupon Bond $100 1 year $92.00 B Coupon Bond $100 8% 2 years $101.32 a. Assuming that the coupon bond (bond B) makes only annual payments, what discount factors (DF , DF,) are imbedded in these prices? NOTE: Show all your calculations; no points will be given for answers found by a sophisticated calculator. b. What are the I-year, and 2-year spot rates (r, and r,)? c. Suppose that you would like to purchase a two-year coupon bond with a face value of $10,000 and a coupon rate of 6% (with annual coupon payments). Since such a bond is not traded in this economy, what portfolio of bonds A and B could you form to satisfy your needs (i.e. how can you replicate this bond using the original two bonds). NOTE: Make sure to describe that portfolio clearly, i.e. what you are buying/selling. d. What is the exact yield to maturity on i. bond A; ii. bond B. NOTE: Again, show all your calculations; no points will be given for answers found by a sophisticated calculator. In particular, you will need to use the following formula for the roots of ax' + bx + c = 0: -b tvb2 - 4ac 2a1. (5 points) Suppose that the price of the stock is 5,, and its annual volatility is G. Suppose also that the annual riskfree rate is r . According to Black-Scholes, what is the price of a European put option with a strike price of X maturing in T years? NOTE: In the answers below, we use log x/ (1+r/) + GVT. GVT X A. 1 - N(x - OVT) - So 1 - N(2) X b. So N(x) - (1 + rat N(x - GVT) C. So N(x - GVT) - X (1 + rot N(x) d. So 1 - N(x) - X (1 + rat [1 - N(x - avT)] e. So 1 - N(x - OVT) - X (1 + ry)T 1 - N(x) 2. (5 points) Which of the following statements are true? I. In a perfect capital market, it is advantageous for the firm to issue debt (vs. equity) to finance a project, because the cost of debt (r, ) is always smaller than the cost of equity ( ). II. The reason that Modigliani and Miller's Proposition I does not hold in the presence of corporate taxes is because levered firms pay less taxes than identical unlevered firms. III. Equity financing is always better than debt financing when the personal tax rate on equity income (t ) is smaller than the personal tax rate on interest income (fp). a. I and II d. I, II and III b. I and III e. fewer than two statements are true. C. II and