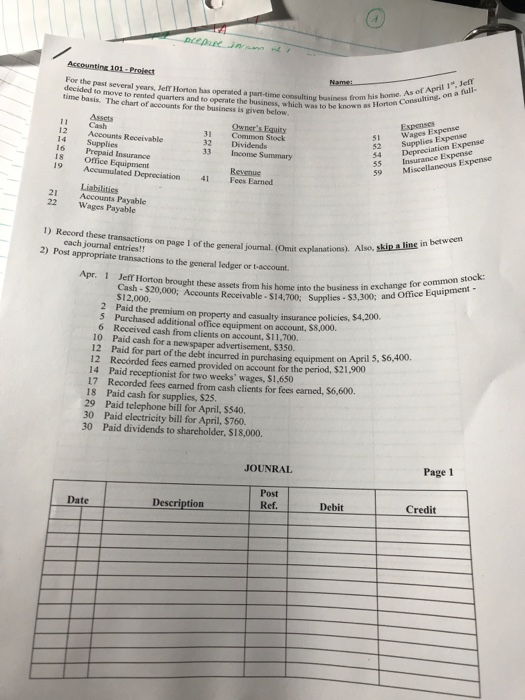

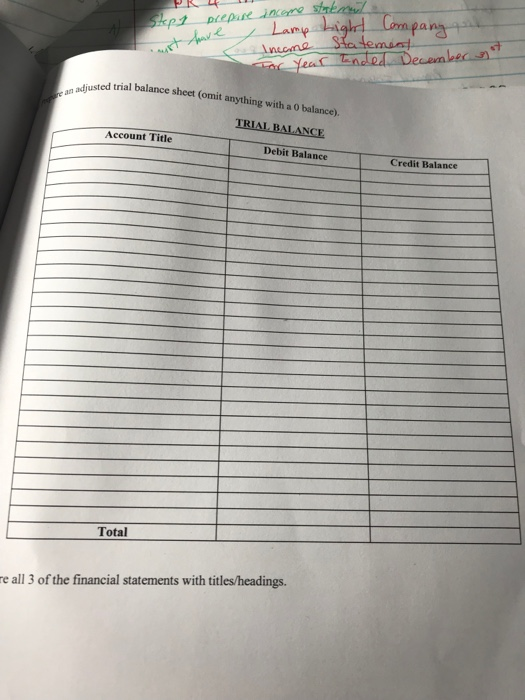

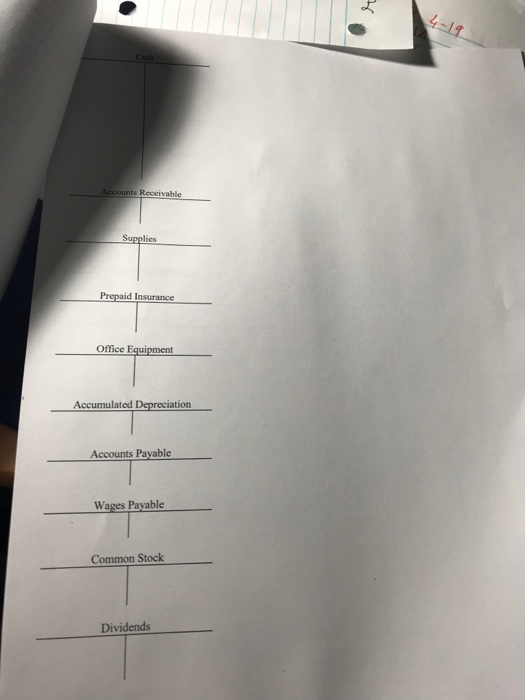

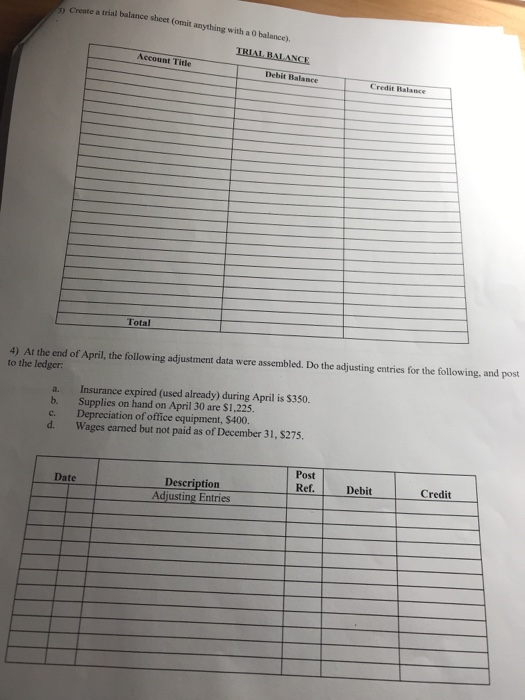

1 1" Jeff past several years, Jeff Horton has operatod a part-tine consulting business from his hom Consulting. move to rented quarters and to operate the business, which was to be known as h Consulting on a full Horton time basis. The chart of accounts for the business is given below Assets Cash ants Recet 5 Wages Expense 34 De 59 Expenscs Owner's.Equity 31 Common Stock 32 Dividends 33 Income Summary 12 Accounts Receivable 14 Supplies 16 Prepaid Insurance IS Office Equipment 19Acumulated Depreciation 41 Fees Earmed Miscellaneous Expense Revsnue Liabilities 21 Accounts Payable 2 Wages Payable 1) Record these transactions on page 1 of the gemeral journal. (Omit explanations) 2) Post appropriate transactions to the general ledger or t-account. each journal entries!! I. (Omit explanations). Also, skip a lias in between Apr. JefT Horton brought these assets from his home into the business in eschang foce Equipment Cash- $20,000; Accounts Receivable $14.700; Supplies- $3,300; an $12,000. 2 Paid the premium on property and casualty insurance policies, $4,200. 5 Purchased additional office equipment on account, $8,000 6 Received cash from clients on account, $11,700. 12 Paid for pat of the Je nured s purchasing eqipment on Apri 5, 56,400 12 Recrded fees eaned provided on account for the period, $21,900 14 Paid receptionist for two wecks' wages, S1,650 17 Recorded fees earned from cash clients for fees earned, $6,600. 18 Paid cash for supplies, $25 29 Paid telephone bill for April, $540. 30 Paid electricity bill for April, $760. 30 Paid dividends to shareholder, $18,000. JOUNRAL Page 1 Post Ref Date Description Debit Credit Con pa ayn diusted trial balance sheet (omit anything with a 0 balance TRIAL BALANCE Debit Balance . Account Title Credit Balance Total re all 3 of the financial statements with titles/headings. Office E on ble Wages Payable Common Stock Dividends 3) Create a trial balance sheet (omit anything with a 0 balance). TRIAL BALANCE Account Title Debit Balance Credit Balance Total 4) At the end of April, the following adjustment data were assembled. Do the adjusting entries for the following, and post to the ledger a. Insurance expired (used already) during April is $350. b. Supplies on hand on April 30 are $1,225. c. Depreciation of office equipment, $400. d. Wages earned but not paid as of December 31, $275 Post Ref. Debit Credit Date Description balance sheet (omit anything with a 0 balance). Prepare an adjusted trial Account Title Debit Balance Credit Balance Total 6) Prepare all 3 of the financial statements with titles/headings. and post the closing entries. Date Descriptiorn Clos Post Ref. Debit Credit ntries 8) Prepare the post-closing trial balance (omit anything with a 0 balance). TRIAL BALANCE Debit Balance Credit Balance Account Title