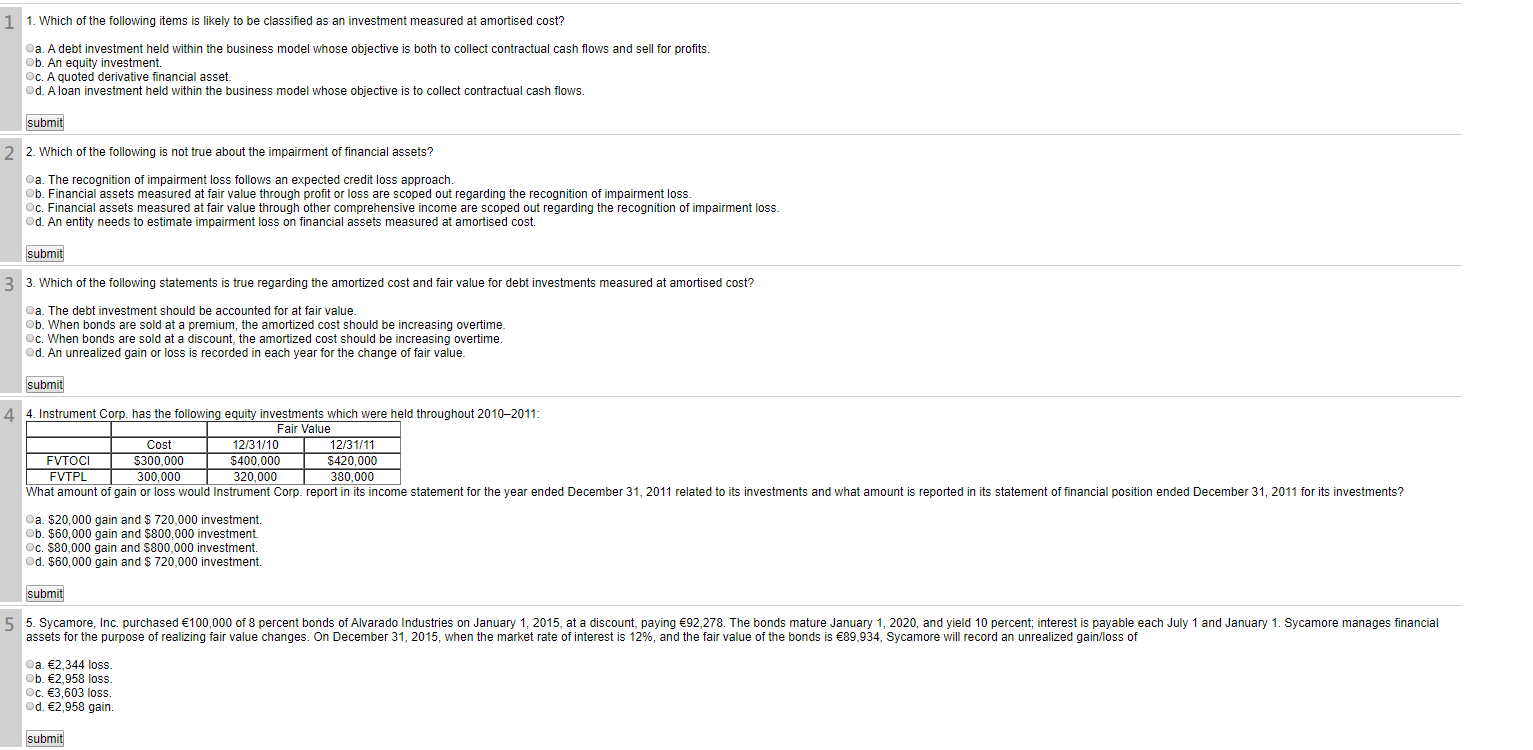

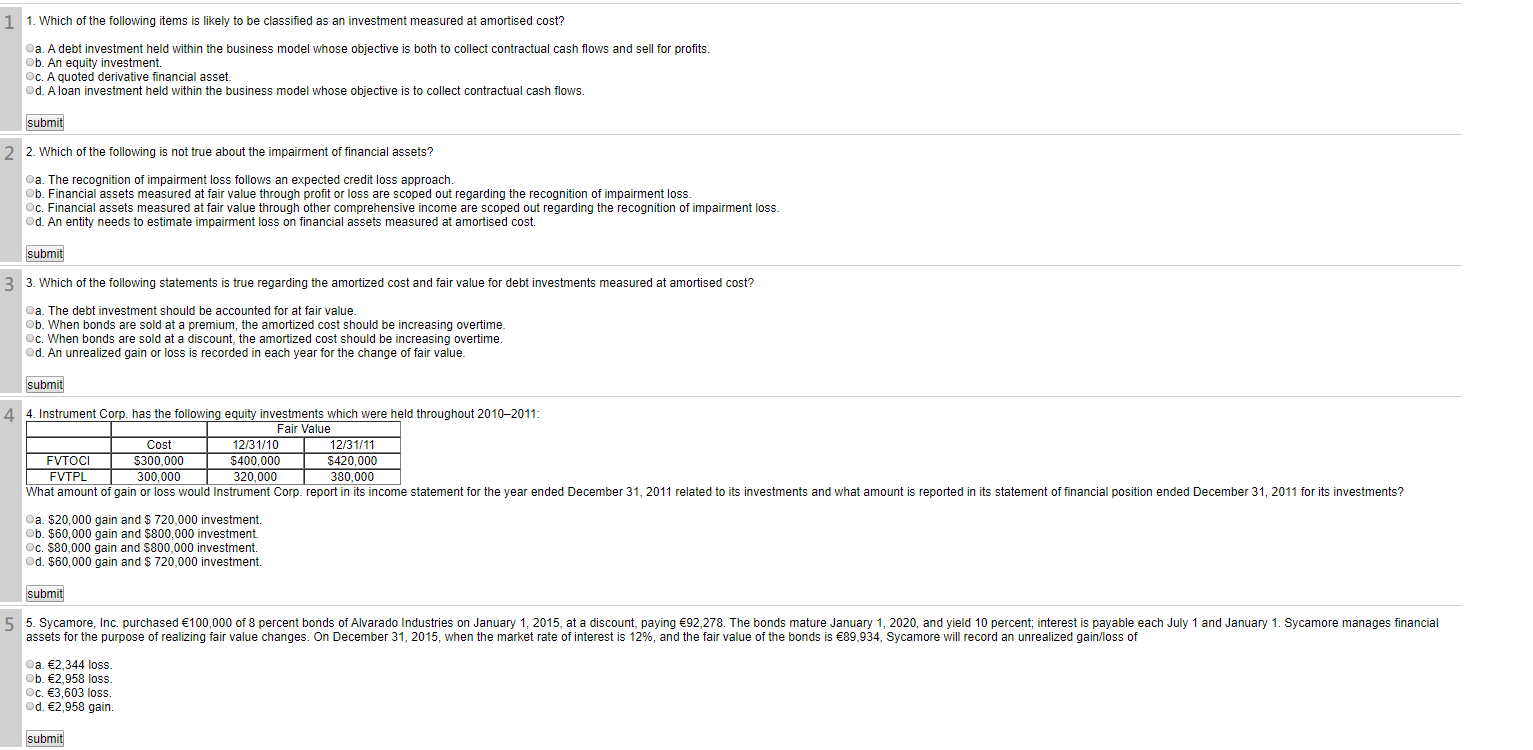

1 1. Which of the following items is likely to be classified as an investment measured at amortised cost? a. A debt investment held within the business model whose objective is both to collect contractual cash flows and sell for profits. Ob. An equity investment. OC. A quoted derivative financial asset. Od. A loan investment held within the business model whose objective is to collect contractual cash flows. submit 2 2. Which of the following is not true about the impairment of financial assets? a. The recognition of impairment loss follows an expected credit loss approach. Ob. Financial assets measured at fair value through profit or loss are scoped out regarding the recognition of impairment loss. c. Financial assets measured at fair value through other comprehensive income are scoped out regarding the recognition of impairment loss. od. An entity needs to estimate impairment loss on financial assets measured at amortised cost. submit 3 3. Which of the following statements is true regarding the amortized cost and fair value for debt investments measured at amortised cost? a. The debt investment should be accounted for at fair value. Ob. When bonds are sold at a premium, the amortized cost should be increasing overtime. Oc. When bonds are sold at a discount, the amortized cost should be increasing overtime. d. An unrealized gain or loss is recorded in each year for the change of fair value. submit 4. Instrument Corp. has the following equity investments which were held throughout 2010-2011: Fair Value Cost 12/31/10 12/31/11 FVTOCI $300,000 $400,000 $420,000 FVTPL 300,000 320,000 380,000 What amount of gain or loss would Instrument Corp. report in its income statement for the year ended December 31, 2011 related to its investments and what amount is reported in its statement of financial position ended December 31, 2011 for its investments? Ca. $20,000 gain and $ 720,000 investment. Ob. $60,000 gain and $800,000 investment. OC. $80,000 gain and $800,000 investment. d. $60,000 gain and $ 720,000 investment. submit 5 5. Sycamore, Inc. purchased 100,000 of 8 percent bonds of Alvarado Industries on January 1, 2015, at a discount, paying 92,278. The bonds mature January 1, 2020, and yield 10 percent; interest is payable each July 1 and January 1. Sycamore manages financial assets for the purpose of realizing fair value changes. On December 31, 2015, when the market rate of interest is 12%, and the fair value of the bonds is 89,934, Sycamore will record an unrealized gain/loss of ca. 2,344 loss. Ob. 2.958 loss. c. 3,603 loss. d. 2,958 gain. submit 1 1. Which of the following items is likely to be classified as an investment measured at amortised cost? a. A debt investment held within the business model whose objective is both to collect contractual cash flows and sell for profits. Ob. An equity investment. OC. A quoted derivative financial asset. Od. A loan investment held within the business model whose objective is to collect contractual cash flows. submit 2 2. Which of the following is not true about the impairment of financial assets? a. The recognition of impairment loss follows an expected credit loss approach. Ob. Financial assets measured at fair value through profit or loss are scoped out regarding the recognition of impairment loss. c. Financial assets measured at fair value through other comprehensive income are scoped out regarding the recognition of impairment loss. od. An entity needs to estimate impairment loss on financial assets measured at amortised cost. submit 3 3. Which of the following statements is true regarding the amortized cost and fair value for debt investments measured at amortised cost? a. The debt investment should be accounted for at fair value. Ob. When bonds are sold at a premium, the amortized cost should be increasing overtime. Oc. When bonds are sold at a discount, the amortized cost should be increasing overtime. d. An unrealized gain or loss is recorded in each year for the change of fair value. submit 4. Instrument Corp. has the following equity investments which were held throughout 2010-2011: Fair Value Cost 12/31/10 12/31/11 FVTOCI $300,000 $400,000 $420,000 FVTPL 300,000 320,000 380,000 What amount of gain or loss would Instrument Corp. report in its income statement for the year ended December 31, 2011 related to its investments and what amount is reported in its statement of financial position ended December 31, 2011 for its investments? Ca. $20,000 gain and $ 720,000 investment. Ob. $60,000 gain and $800,000 investment. OC. $80,000 gain and $800,000 investment. d. $60,000 gain and $ 720,000 investment. submit 5 5. Sycamore, Inc. purchased 100,000 of 8 percent bonds of Alvarado Industries on January 1, 2015, at a discount, paying 92,278. The bonds mature January 1, 2020, and yield 10 percent; interest is payable each July 1 and January 1. Sycamore manages financial assets for the purpose of realizing fair value changes. On December 31, 2015, when the market rate of interest is 12%, and the fair value of the bonds is 89,934, Sycamore will record an unrealized gain/loss of ca. 2,344 loss. Ob. 2.958 loss. c. 3,603 loss. d. 2,958 gain. submit