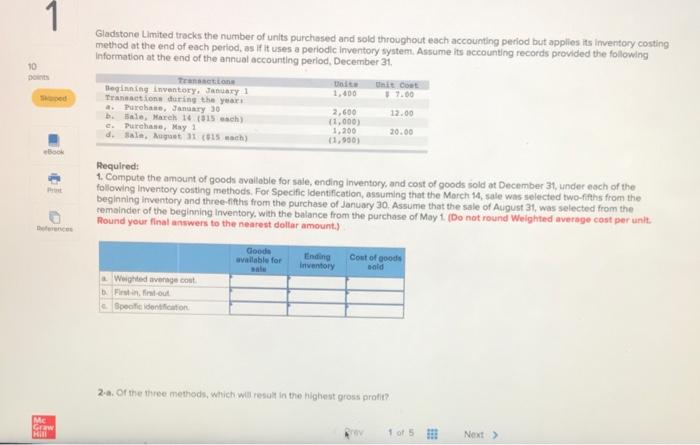

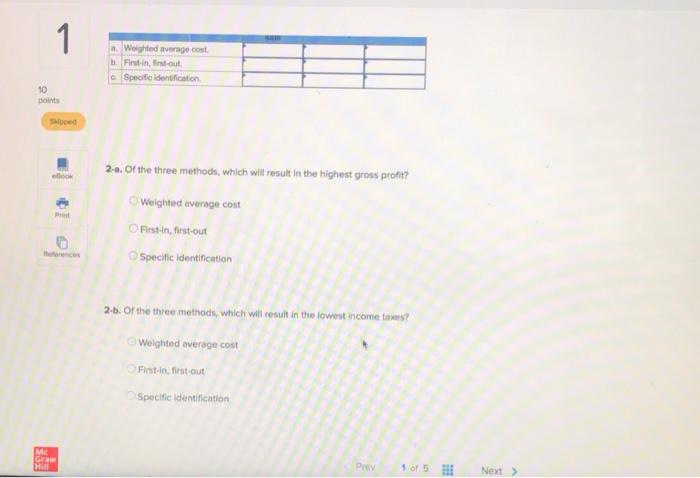

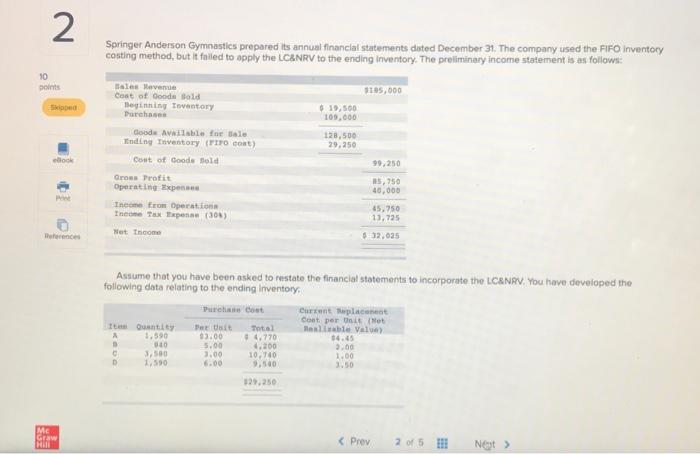

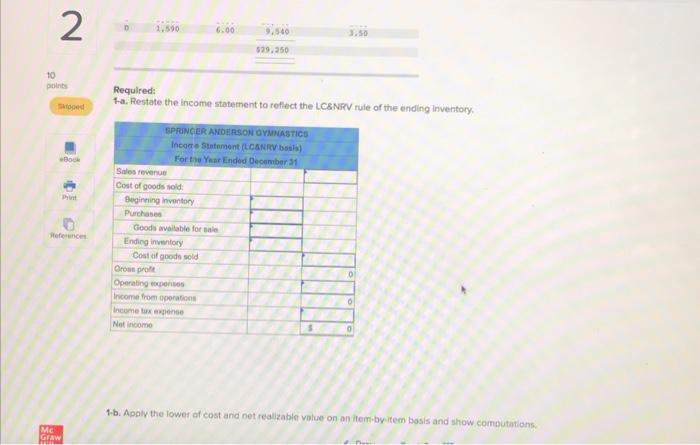

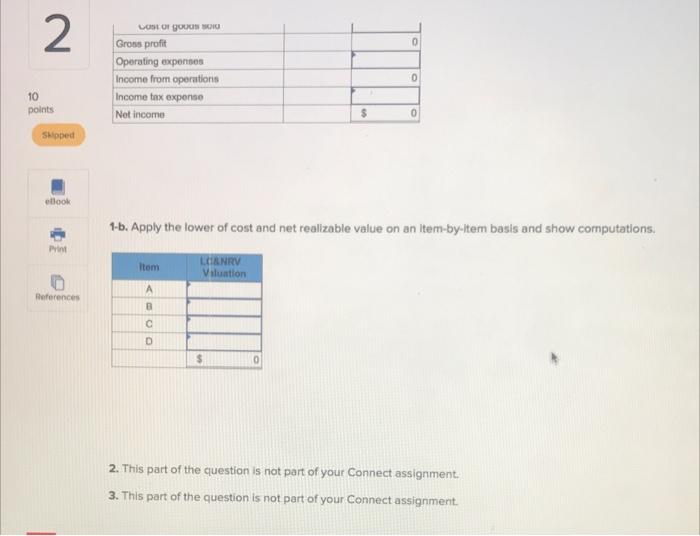

1 10 Gladstone Limited tracks the number of units purchased and sold throughout each accounting perlod but applies its inventory costing method at the end of each perlod, as if it uses a periodic inventory system. Assume its accounting records provided the following Information at the end of the annual accounting period, December 31, Transmeton D Unitat Beginning inventory, January 1 1,400 Traction during the years 4 Purchase, January 30 2,600 b. , March 16 015 sach) 12.00 (1,000) c. Purchase, May 1 1,200 20.00 dSale. Aut 11 (115 ch 11.900) Required: 1. Compute the amount of goods available for sale, ending inventory, and cost of goods sold at December 31, under each of the following Inventory costing methods. For Specific identification, assuming that the March 14 sale was selected two-fifths from the beginning inventory and three-fifths from the purchase of January 30. Assume that the sale of August 31, was selected from the remainder of the beginning inventory with the balance from the purchase of May 1 (Do not round Weighted average cost per unit Round your final answers to the nearest dollar amount.) Goode available for Ending Inventory Cost of goods sold Weighted average cout out Specific identification 2.a. Of the three methods, which will result in the highest gross profit? ME GEW Hill of 5 Next > 1 Weighted average cost Fistin, Ertout Specific identification 10 points saipoel 2-a. Of the three methods, which will result in the highest gross profit? Weighted average cost Fistin, first-out fo Specific identification 2-b. Of the three methods, which will result in the lowest income taxes? Weighted average cost First in first-out Specific Identification Mc GES Hill Prey 1 of 5 Next > 2 Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company used the FIFO inventory costing method, but it failed to apply the LCANRV to the ending inventory. The preliminary income statement is as follows: 10 points 1165,000 Bippud. $ 19,500 109,000 128,500 29.250 Sales Revenue Cost of Good Bold Beginning Tventory Purchase Goode Available for sale Hinding Teventory (FIFO COR) Cut of Goode sold Gross Profit Operating Expenses Income from Operation Income Tax tepenne (30) 99,250 5,750 40,000 45.750 13.725 $32025 Not Income Assume that you have been asked to restate the financial statements to incorporate the LC NRV. You have developed the following data relating to the ending Inventory Post Curent placement Coat per tot It Quantity Test Total Malable Value 1.590 13.00 + 4,770 14.45 360 5.00 9.00 3.500 10,740 1.00 D 1,500 6.00 9,500 3.50 129,250 4.200 c Me Graw 2 1.590 6:00 9.540 3.50 29,250 10 point Required: 1-a. Restate the income statement to reflect the LC&NRV rule of the ending Inventory Sood B SPRINGER ANDERSON GYMNASTICS Income Statement (LCANRV bols) For the Year Ended December 31 Sales revenue Cost of goods sold Beginning inventory Purchase Goods available for sale Ending inventory Cost of goods sold Gross prolet Operating con Income from operations neomexpense Net Income Wences 0 0 $ 0 1-b. Apply the lower of cost and not realizable value on an item-by-item bosis and show computations ME GEAW 2 0 LOOF GOD Gross profit Operating expenses Income from operations Income tax expense Net income 0 10 points $ 0 Shipped look 1-5. Apply the lower of cost and net realizable value on an Item-by-item basis and show computations, Print Item NRV Valuation References B D 0 2. This part of the question is not part of your Connect assignment. 3. This part of the question is not part of your Connect assignment 1 10 Gladstone Limited tracks the number of units purchased and sold throughout each accounting perlod but applies its inventory costing method at the end of each perlod, as if it uses a periodic inventory system. Assume its accounting records provided the following Information at the end of the annual accounting period, December 31, Transmeton D Unitat Beginning inventory, January 1 1,400 Traction during the years 4 Purchase, January 30 2,600 b. , March 16 015 sach) 12.00 (1,000) c. Purchase, May 1 1,200 20.00 dSale. Aut 11 (115 ch 11.900) Required: 1. Compute the amount of goods available for sale, ending inventory, and cost of goods sold at December 31, under each of the following Inventory costing methods. For Specific identification, assuming that the March 14 sale was selected two-fifths from the beginning inventory and three-fifths from the purchase of January 30. Assume that the sale of August 31, was selected from the remainder of the beginning inventory with the balance from the purchase of May 1 (Do not round Weighted average cost per unit Round your final answers to the nearest dollar amount.) Goode available for Ending Inventory Cost of goods sold Weighted average cout out Specific identification 2.a. Of the three methods, which will result in the highest gross profit? ME GEW Hill of 5 Next > 1 Weighted average cost Fistin, Ertout Specific identification 10 points saipoel 2-a. Of the three methods, which will result in the highest gross profit? Weighted average cost Fistin, first-out fo Specific identification 2-b. Of the three methods, which will result in the lowest income taxes? Weighted average cost First in first-out Specific Identification Mc GES Hill Prey 1 of 5 Next > 2 Springer Anderson Gymnastics prepared its annual financial statements dated December 31. The company used the FIFO inventory costing method, but it failed to apply the LCANRV to the ending inventory. The preliminary income statement is as follows: 10 points 1165,000 Bippud. $ 19,500 109,000 128,500 29.250 Sales Revenue Cost of Good Bold Beginning Tventory Purchase Goode Available for sale Hinding Teventory (FIFO COR) Cut of Goode sold Gross Profit Operating Expenses Income from Operation Income Tax tepenne (30) 99,250 5,750 40,000 45.750 13.725 $32025 Not Income Assume that you have been asked to restate the financial statements to incorporate the LC NRV. You have developed the following data relating to the ending Inventory Post Curent placement Coat per tot It Quantity Test Total Malable Value 1.590 13.00 + 4,770 14.45 360 5.00 9.00 3.500 10,740 1.00 D 1,500 6.00 9,500 3.50 129,250 4.200 c Me Graw 2 1.590 6:00 9.540 3.50 29,250 10 point Required: 1-a. Restate the income statement to reflect the LC&NRV rule of the ending Inventory Sood B SPRINGER ANDERSON GYMNASTICS Income Statement (LCANRV bols) For the Year Ended December 31 Sales revenue Cost of goods sold Beginning inventory Purchase Goods available for sale Ending inventory Cost of goods sold Gross prolet Operating con Income from operations neomexpense Net Income Wences 0 0 $ 0 1-b. Apply the lower of cost and not realizable value on an item-by-item bosis and show computations ME GEAW 2 0 LOOF GOD Gross profit Operating expenses Income from operations Income tax expense Net income 0 10 points $ 0 Shipped look 1-5. Apply the lower of cost and net realizable value on an Item-by-item basis and show computations, Print Item NRV Valuation References B D 0 2. This part of the question is not part of your Connect assignment. 3. This part of the question is not part of your Connect assignment