Answered step by step

Verified Expert Solution

Question

1 Approved Answer

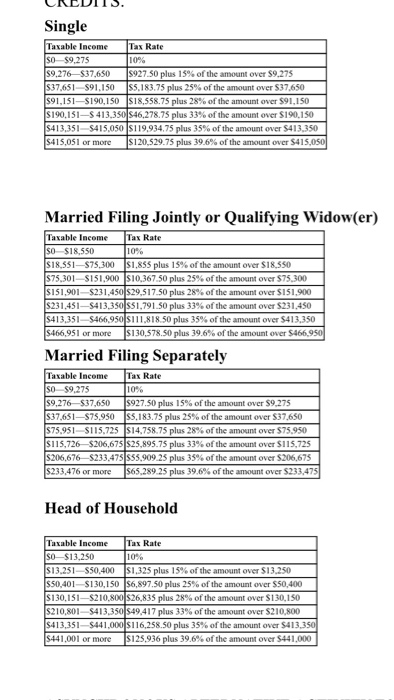

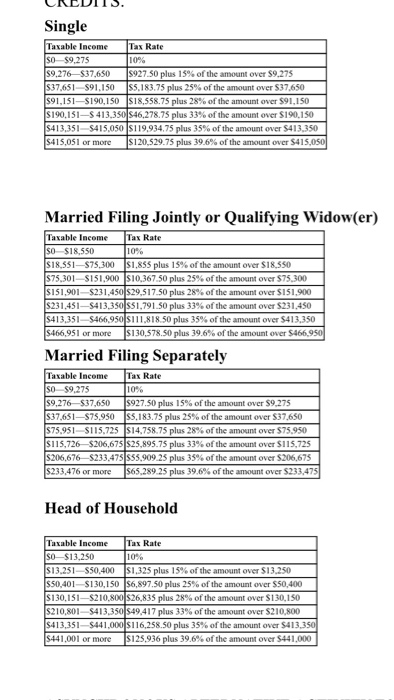

1. (10 Points) Based on the Federal Income Tax Bracket table provided at the end of this assignment, calculate the total income taxes due (before

1. (10 Points) Based on the Federal Income Tax Bracket table provided at the end of this assignment, calculate the total income taxes due (before deductions, exemptions, and credits) for the following three individuals: (i) Larry Little: Annual Income $25,025 (Larry is a married and filing jointly); (ii) Mary Median: Annual Income $56,516 (Mary is a Head of Household); (iii) Franklin Fatstacks: Annual Income $34,125,000 + $62,420,000 in Capital Gains (Franklin is single). use the tax image below

Single Taxable Income $9,275 Tax Rate 10% $9,276-$37,650 |S927 50 plus 15% of the amount over S9.275 $37,651 S91.150 $5.183.75 plus 25% ofthe amount over $37,650 s9 1,1 51--S 190.150 SIS,558.75 plus 28% ofthe amount over S91,150 $ 190. I 5 1-S 4 1 3.350 S46.278 75 plus 33% of the amount over $ 190.1 50 13,351.. S4 15.050|$119,934.75 plus 35% ofthe amount over $413,350 S4 15,051 or more $120.529.75 plus 39.6% of the amount over S415.050 Married Filing Jointly or Qualifying Widow(er) Taxable Income a Rate $18,550 10% S18.551-$75.300 $1,855 plus 15% of the amount over $18.550 151,900 367 50 plus 25% of the amount over $75,300 SI 5 1 .901-S231 ,450 $29,51 7.50 plus 28% of the amount over $ 1 5 1 .900 31 .45 1-S4 13.3 IS 791 50 plus 33% of the amount over S231 .450 S4 I 3,351 S466.950[S 111 .81 8 50 plus 35% ofthe amount over $413,350 951 or more $ 0,578.50 plus 39.6% of the amount over S466.95 Married Filing Separately Taxable Income Tax Rate S0 $9,275 S9,276-537,650 S92750 plus 15% of the amount over S9275 $37.651-$75.950 SSI 83.75 plus 25% of the amount over $37,650 $75,951- $115,7 $1 15,726--$206,675|625.895. 75 plus 33% of the amount over $ 1 15,725 $206,676-S23 3.475|$ ,909 25 plus 35% of the amount over $206,675 $233,476 or more $65,289.25 39.6% of the amount over $233,47 0% 14,758 75 plus 28% of the amount over $75.950 Head of Household Tax Rate 10% Taxable Incom $13,250 $13.251 $50.400 $ 325 plus 15% of the amount over $13,250 s50,401 $130, l 50 56.897.50 plus 25% of the amount over S50.400 $130,151-S210.N |$26.835 plus 28% of the amount over S 130,150 $2 10,801 S41 3,350 $49,41 7 plus 33% of the amount over $210,800 13,351 S441.000 $116,258.50 plus 35% ofthe amount over S413.35( $44 1,001 or more S1 25.936 plus 39.6% of the amount over S441 ,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started