Answered step by step

Verified Expert Solution

Question

1 Approved Answer

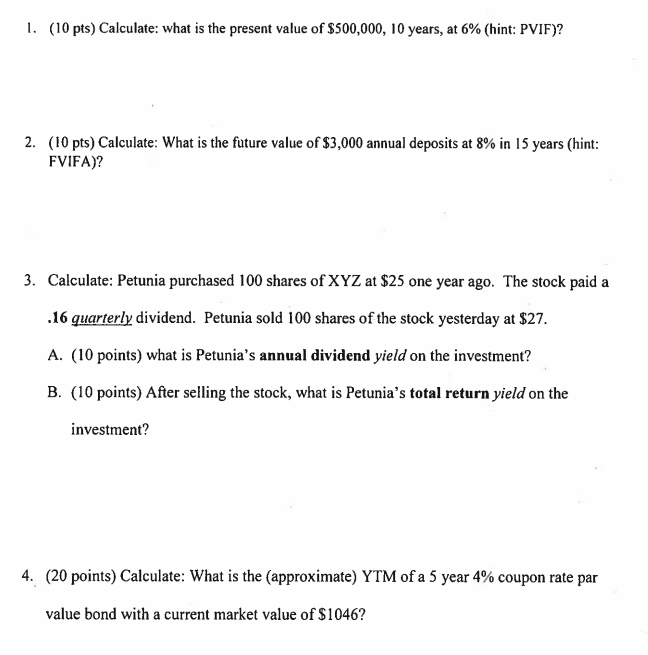

1. (10 pts) Calculate: what is the present value of $500,000,10 years, at 6% (hint: PVIF)? 2. (10 pts) Calculate: What is the future value

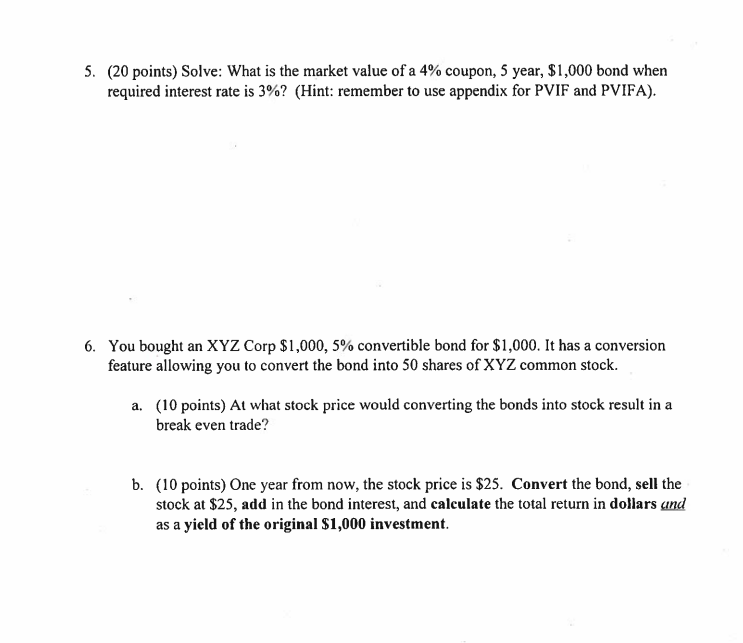

1. (10 pts) Calculate: what is the present value of $500,000,10 years, at 6% (hint: PVIF)? 2. (10 pts) Calculate: What is the future value of $3,000 annual deposits at 8% in 15 years (hint: FVIFA)? 3. Calculate: Petunia purchased 100 shares of XYZ at $25 one year ago. The stock paid a .16 quarterly dividend. Petunia sold 100 shares of the stock yesterday at $27. A. (10 points) what is Petunia's annual dividend yield on the investment? B. (10 points) After selling the stock, what is Petunia's total return yield on the investment? 4. (20 points) Calculate: What is the (approximate) YTM of a 5 year 4% coupon rate par value bond with a current market value of $1046 ? 5. (20 points) Solve: What is the market value of a 4% coupon, 5 year, $1,000 bond when required interest rate is 3% ? (Hint: remember to use appendix for PVIF and PVIFA). 6. You bought an XYZ Corp $1,000,5% convertible bond for $1,000. It has a conversion feature allowing you to convert the bond into 50 shares of XYZ common stock. a. (10 points) At what stock price would converting the bonds into stock result in a break even trade? b. (10 points) One year from now, the stock price is $25. Convert the bond, sell the stock at $25, add in the bond interest, and calculate the total return in dollars and as a yield of the original $1,000 investment

1. (10 pts) Calculate: what is the present value of $500,000,10 years, at 6% (hint: PVIF)? 2. (10 pts) Calculate: What is the future value of $3,000 annual deposits at 8% in 15 years (hint: FVIFA)? 3. Calculate: Petunia purchased 100 shares of XYZ at $25 one year ago. The stock paid a .16 quarterly dividend. Petunia sold 100 shares of the stock yesterday at $27. A. (10 points) what is Petunia's annual dividend yield on the investment? B. (10 points) After selling the stock, what is Petunia's total return yield on the investment? 4. (20 points) Calculate: What is the (approximate) YTM of a 5 year 4% coupon rate par value bond with a current market value of $1046 ? 5. (20 points) Solve: What is the market value of a 4% coupon, 5 year, $1,000 bond when required interest rate is 3% ? (Hint: remember to use appendix for PVIF and PVIFA). 6. You bought an XYZ Corp $1,000,5% convertible bond for $1,000. It has a conversion feature allowing you to convert the bond into 50 shares of XYZ common stock. a. (10 points) At what stock price would converting the bonds into stock result in a break even trade? b. (10 points) One year from now, the stock price is $25. Convert the bond, sell the stock at $25, add in the bond interest, and calculate the total return in dollars and as a yield of the original $1,000 investment Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started