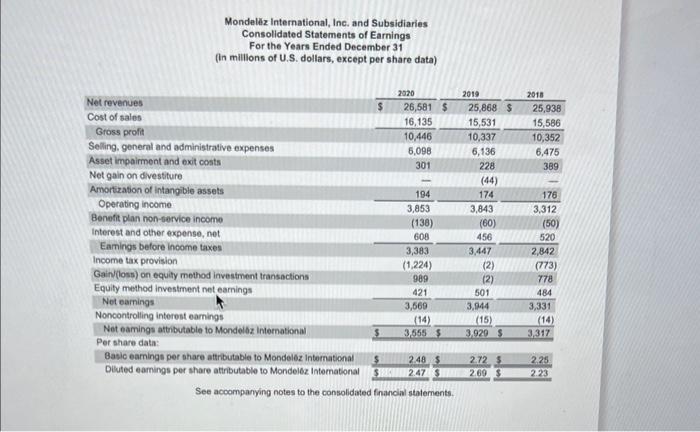

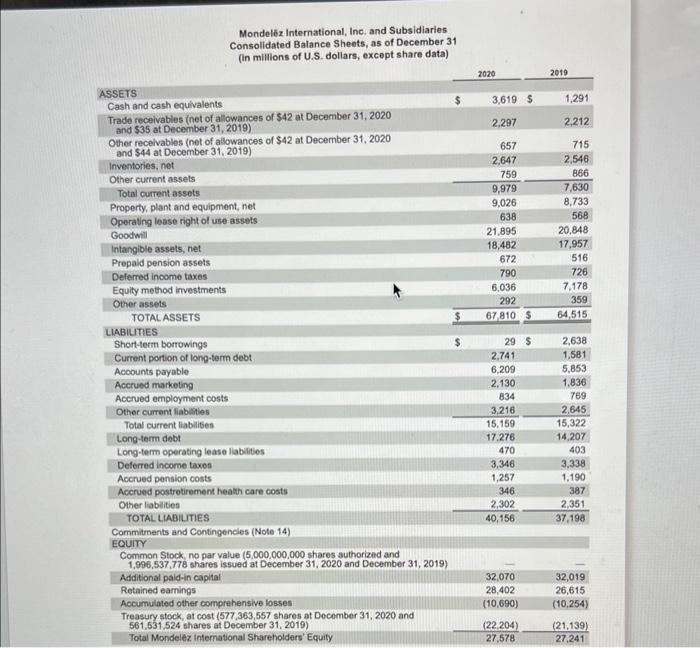

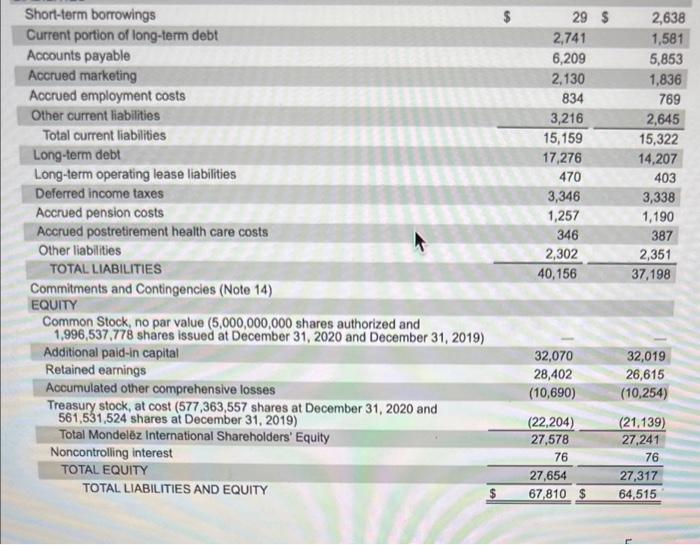

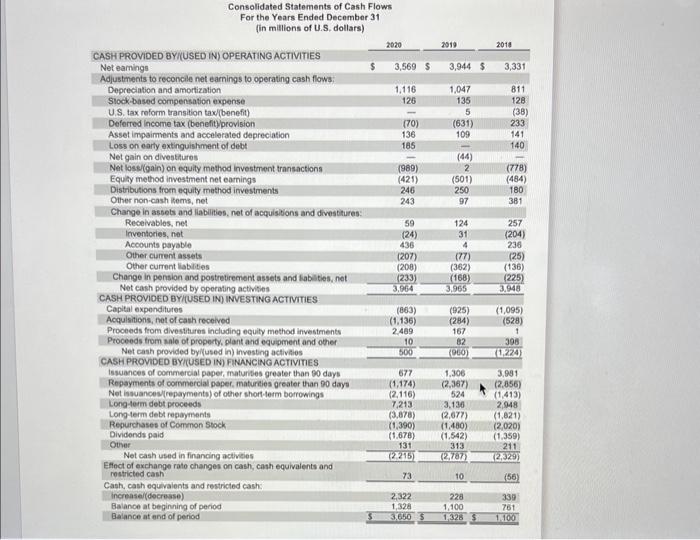

1. (100%) Use the financial statements below to answer the following questions for fiscal 2020, unless overwise specified. Support your answers and conclusions. a. (5%) Calculate the firm's gross profit margin. b. (5%) Calculate the average collection period for the firm. c. (5%) Calculate the fixed asset turnover ratio. d. (5%) Calculate the change in working capital. e. (35%) Calculate the firm's free cash flow. How did they spend it? f. (10%) Calculate the Return on Equity (ROE) and Return on Assets (ROA). What accounts for the discrepancy between the two figures? g. (20%) Assess the leverage of the company, Can they handle their debt load? Why or why not? h. (15\%) Identify two strengths and two weaknesses (or concerns) from the financial statements. Support your answers. Mondelz International, Ine. and Subsidiaries Consolidated Statements of Earnings For the Years Ended December 31 (in millions of U.S. dollars, except per share data) Mondelz International, Inc, and Subsidiaries Consolidated Balance Sheets, as of December 31 (in millions of U.S. dollars, except share data) Short-term borrowings Consolidated Statements of Cash Flows For the Years Ended December 31 (in millions of U.S, dollars) 1. (100%) Use the financial statements below to answer the following questions for fiscal 2020, unless overwise specified. Support your answers and conclusions. a. (5%) Calculate the firm's gross profit margin. b. (5%) Calculate the average collection period for the firm. c. (5%) Calculate the fixed asset turnover ratio. d. (5%) Calculate the change in working capital. e. (35%) Calculate the firm's free cash flow. How did they spend it? f. (10%) Calculate the Return on Equity (ROE) and Return on Assets (ROA). What accounts for the discrepancy between the two figures? g. (20%) Assess the leverage of the company, Can they handle their debt load? Why or why not? h. (15\%) Identify two strengths and two weaknesses (or concerns) from the financial statements. Support your answers. Mondelz International, Ine. and Subsidiaries Consolidated Statements of Earnings For the Years Ended December 31 (in millions of U.S. dollars, except per share data) Mondelz International, Inc, and Subsidiaries Consolidated Balance Sheets, as of December 31 (in millions of U.S. dollars, except share data) Short-term borrowings Consolidated Statements of Cash Flows For the Years Ended December 31 (in millions of U.S, dollars)