Answered step by step

Verified Expert Solution

Question

1 Approved Answer

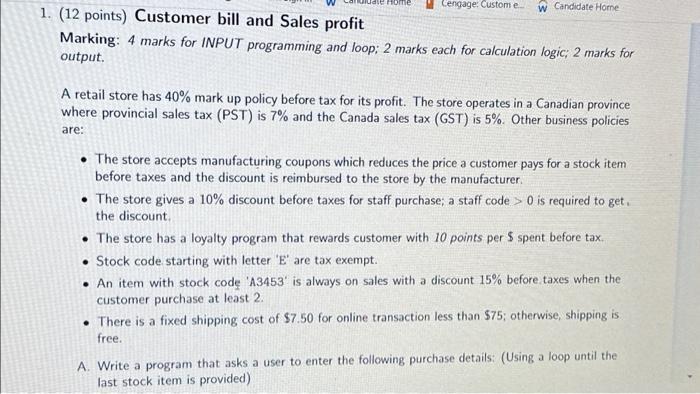

1. (12 points) Customer bill and Sales profit Cengage: Custom e... Candidate Home Marking: 4 marks for INPUT programming and loop; 2 marks each

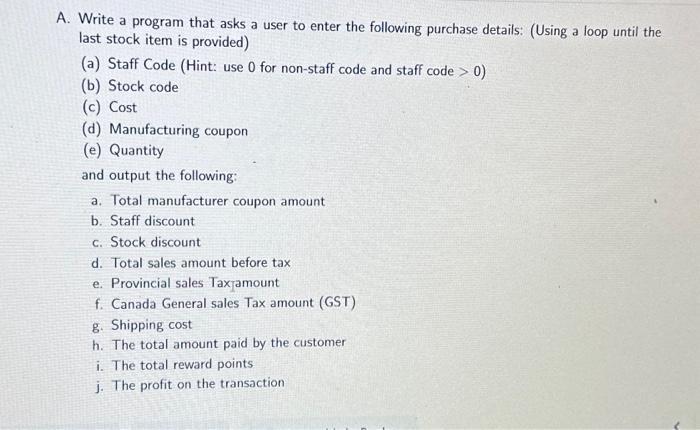

1. (12 points) Customer bill and Sales profit Cengage: Custom e... Candidate Home Marking: 4 marks for INPUT programming and loop; 2 marks each for calculation logic; 2 marks for output. A retail store has 40% mark up policy before tax for its profit. The store operates in a Canadian province where provincial sales tax (PST) is 7% and the Canada sales tax (GST) is 5%. Other business policies are: The store accepts manufacturing coupons which reduces the price a customer pays for a stock item before taxes and the discount is reimbursed to the store by the manufacturer. The store gives a 10% discount before taxes for staff purchase; a staff code > 0 is required to get. the discount. The store has a loyalty program that rewards customer with 10 points per $ spent before tax. Stock code starting with letter 'E' are tax exempt. An item with stock code 'A3453' is always on sales with a discount 15% before taxes when the customer purchase at least 2. There is a fixed shipping cost of $7.50 for online transaction less than $75; otherwise, shipping is. free. A. Write a program that asks a user to enter the following purchase details: (Using a loop until the last stock item is provided) A. Write a program that asks a user to enter the following purchase details: (Using a loop until the last stock item is provided) (a) Staff Code (Hint: use 0 for non-staff code and staff code > 0) (b) Stock code (c) Cost (d) Manufacturing coupon (e) Quantity and output the following: a. Total manufacturer coupon amount b. Staff discount c. Stock discount d. Total sales amount before tax e. Provincial sales Tax amount f. Canada General sales Tax amount (GST) g. Shipping cost h. The total amount paid by the customer i. The total reward points j. The profit on the transaction

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started