Answered step by step

Verified Expert Solution

Question

1 Approved Answer

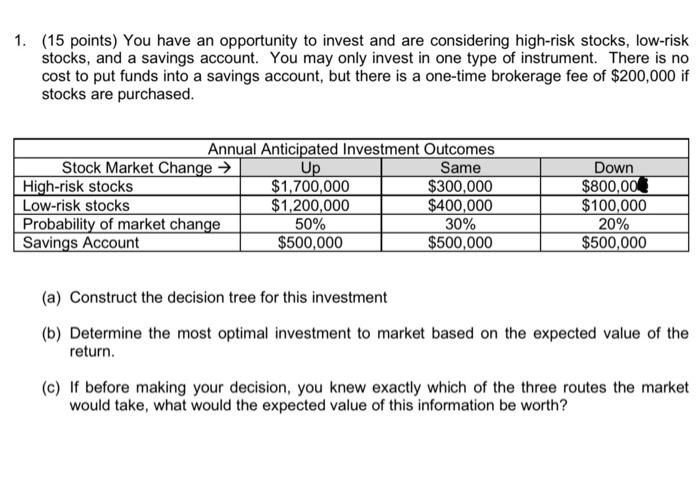

1. (15 points) You have an opportunity to invest and are considering high-risk stocks, low-risk stocks, and a savings account. You may only invest

1. (15 points) You have an opportunity to invest and are considering high-risk stocks, low-risk stocks, and a savings account. You may only invest in one type of instrument. There is no cost to put funds into a savings account, but there is a one-time brokerage fee of $200,000 if stocks are purchased. Stock Market Change High-risk stocks Low-risk stocks Annual Anticipated Investment Outcomes Up $1,700,000 $1,200,000 Probability of market change Savings Account 50% $500,000 Same $300,000 $400,000 Down $800,00 $100,000 30% 20% $500,000 $500,000 (a) Construct the decision tree for this investment (b) Determine the most optimal investment to market based on the expected value of the return. (c) If before making your decision, you knew exactly which of the three routes the market would take, what would the expected value of this information be worth?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started