Answered step by step

Verified Expert Solution

Question

1 Approved Answer

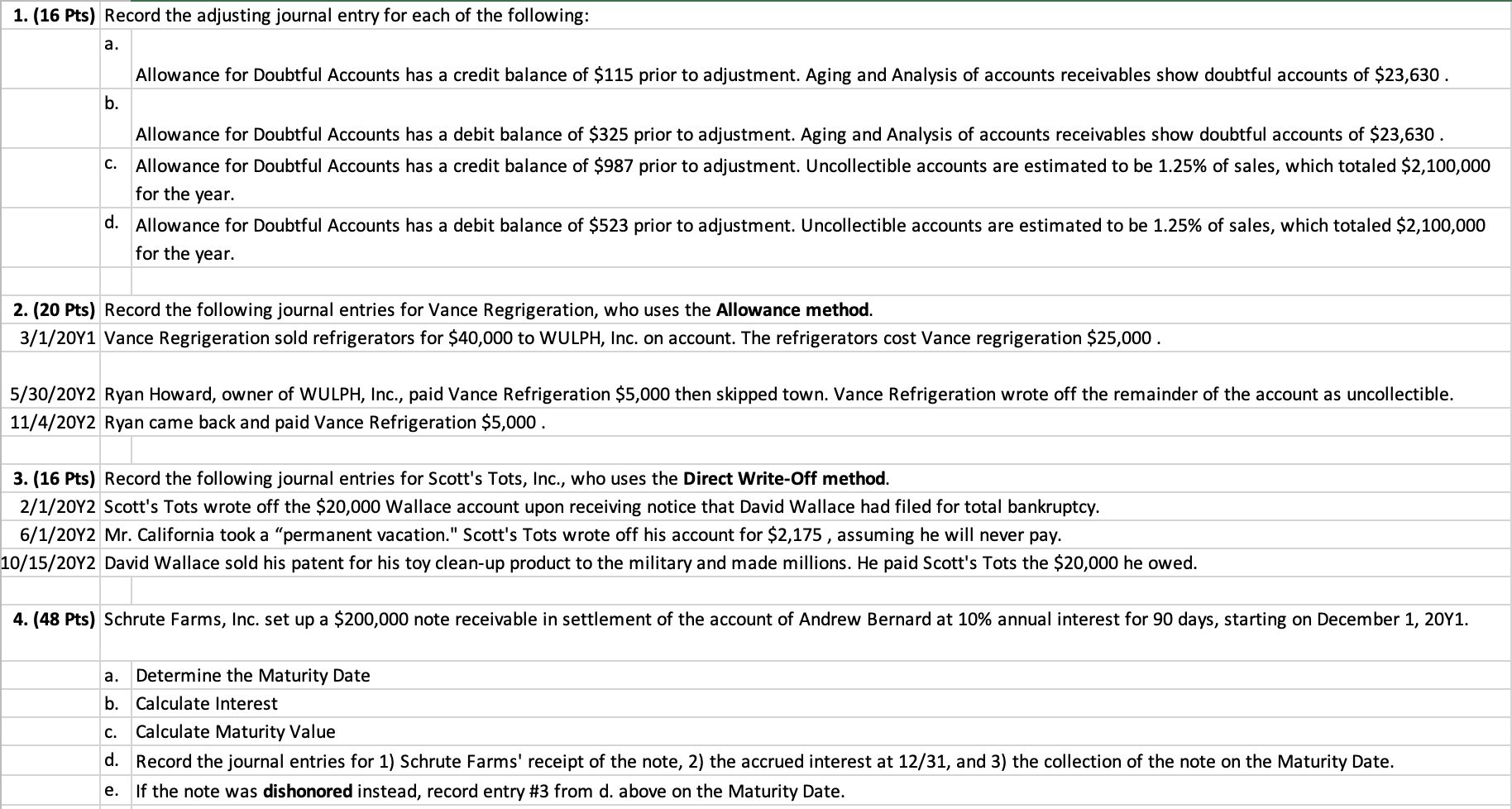

1. (16 Pts) Record the adjusting journal entry for each of the following: a. b. C. Allowance for Doubtful Accounts has a credit balance

1. (16 Pts) Record the adjusting journal entry for each of the following: a. b. C. Allowance for Doubtful Accounts has a credit balance of $115 prior to adjustment. Aging and Analysis of accounts receivables show doubtful accounts of $23,630. Allowance for Doubtful Accounts has a debit balance of $325 prior to adjustment. Aging and Analysis of accounts receivables show doubtful accounts of $23,630. Allowance for Doubtful Accounts has a credit balance of $987 prior to adjustment. Uncollectible accounts are estimated to be 1.25% of sales, which totaled $2,100,000 for the year. d. Allowance for Doubtful Accounts has a debit balance of $523 prior to adjustment. Uncollectible accounts are estimated to be 1.25% of sales, which totaled $2,100,000 for the year. 2. (20 Pts) Record the following journal entries for Vance Regrigeration, who uses the Allowance method. 3/1/20Y1 Vance Regrigeration sold refrigerators for $40,000 to WULPH, Inc. on account. The refrigerators cost Vance regrigeration $25,000. 5/30/20Y2 Ryan Howard, owner of WULPH, Inc., paid Vance Refrigeration $5,000 then skipped town. Vance Refrigeration wrote off the remainder of the account as uncollectible. 11/4/2012 Ryan came back and paid Vance Refrigeration $5,000. 3. (16 Pts) Record the following journal entries for Scott's Tots, Inc., who uses the Direct Write-Off method. 2/1/2012 Scott's Tots wrote off the $20,000 Wallace account upon receiving notice that David Wallace had filed for total bankruptcy. 6/1/2012 Mr. California took a "permanent vacation." Scott's Tots wrote off his account for $2,175, assuming he will never pay. 10/15/20Y2 David Wallace sold his patent for his toy clean-up product to the military and made millions. He paid Scott's Tots the $20,000 he owed. 4. (48 Pts) Schrute Farms, Inc. set up a $200,000 note receivable in settlement of the account of Andrew Bernard at 10% annual interest for 90 days, starting on December 1, 20Y1. a. Determine the Maturity Date b. Calculate Interest C. Calculate Maturity Value d. Record the journal entries for 1) Schrute Farms' receipt of the note, 2) the accrued interest at 12/31, and 3) the collection of the note on the Maturity Date. e. If the note was dishonored instead, record entry #3 from d. above on the Maturity Date.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started