Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. 16.4, 17.38, 21.31, 17.66 2. 374.50m, 83.19m, 86.54m, 77.58m 3. 57.03m, 71.29m, 92.68m, 85.55m Western Gas & Electric Co. (WG&E) is considering an acquisition

1. 16.4, 17.38, 21.31, 17.66 2. 374.50m, 83.19m, 86.54m, 77.58m 3. 57.03m, 71.29m, 92.68m, 85.55m

1. 16.4, 17.38, 21.31, 17.66 2. 374.50m, 83.19m, 86.54m, 77.58m 3. 57.03m, 71.29m, 92.68m, 85.55m

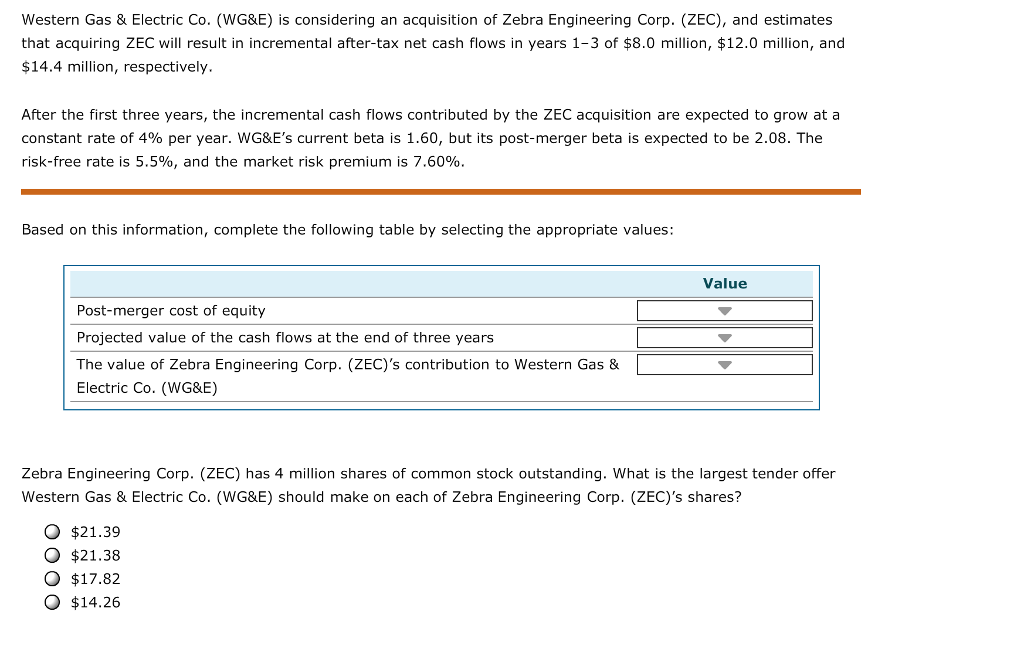

Western Gas & Electric Co. (WG&E) is considering an acquisition of Zebra Engineering Corp. (ZEC), and estimates that acquiring ZEC will result in incremental after-tax net cash flows in years 1-3 of $8.0 million, $12.0 million, and $14.4 million, respectively. After the first three years, the incremental cash flows contributed by the ZEC acquisition are expected to grow at a constant rate of 4% per year. WG&E's current beta is 1.60, but its post-merger beta is expected to be 2.08. The risk-free rate is 5.5%, and the market risk premium is 7.60%. Based on this information, complete the following table by selecting the appropriate values Value Post-merger cost of equity Projected value of the cash flows at the end of three years The value of Zebra Engineering Corp. (ZEC)'s contribution to Western Gas & Electric Co. (WG&E) Zebra Engineering Corp. (ZEC) has 4 million shares of common stock outstanding. What is the largest tender offer Western Gas & Electric Co. (WG&E) should make on each of Zebra Engineering Corp. (ZEC)'s shares? O $21.39 O $21.38 O $17.82 O $14.26

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started