Question

1 18. X, Y and Z are partners with capital of $11,000, $12,000 and $4,500. X has a loan due from the partnership to

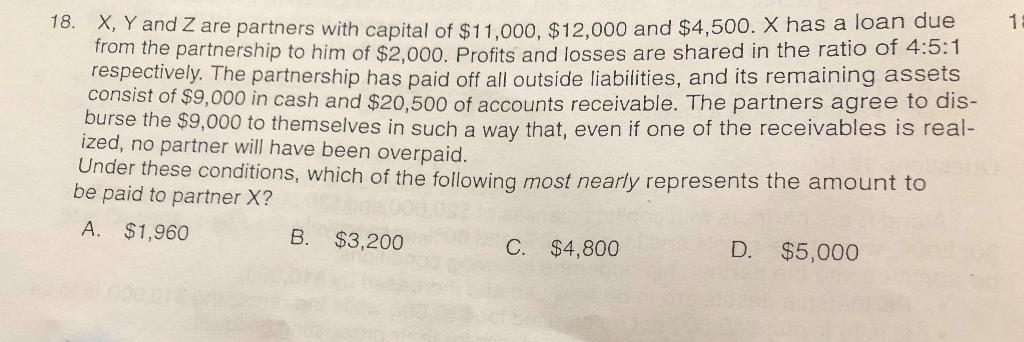

1 18. X, Y and Z are partners with capital of $11,000, $12,000 and $4,500. X has a loan due from the partnership to him of $2,000. Profits and losses are shared in the ratio of 4:5:1 respectively. The partnership has paid off all outside liabilities, and its remaining assets consist of $9,000 in cash and $20,500 of accounts receivable. The partners agree to dis- burse the $9,000 to themselves in such a way that, even if one of the receivables is real- ized, no partner will have been overpaid. Under these conditions, which of the following most nearly represents the amount to be paid to partner X? A. $1,960 B. $3,200 C. $4,800 D. $5,000

Step by Step Solution

3.29 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

C 4800 is the correct option Calculated as X Y Z Capital ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Financial Accounting

Authors: Theodore E. Christensen, David M. Cottrell, Richard E. Baker

10th edition

78025621, 978-0078025624

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App