Answered step by step

Verified Expert Solution

Question

1 Approved Answer

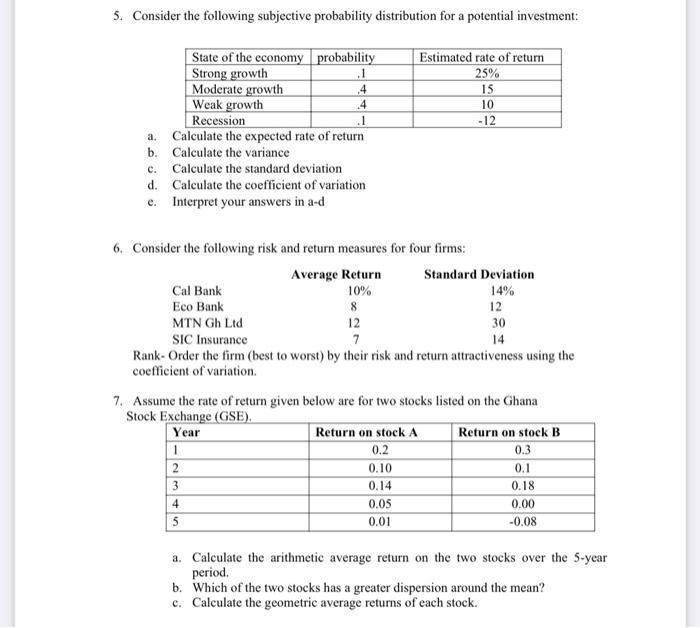

5. Consider the following subjective probability distribution for a potential investment: a. b. c. d. State of the economy probability Strong growth Moderate growth

5. Consider the following subjective probability distribution for a potential investment: a. b. c. d. State of the economy probability Strong growth Moderate growth Weak growth Recession Calculate the expected rate of return Calculate the variance e. Interpret your answers in a-d Calculate the standard deviation Calculate the coefficient of variation .1 Cal Bank Eco Bank MTN Gh Ltd 4 4 .1 6. Consider the following risk and return measures for four firms: Average Return 10% 8 12 1 2 3 4 5 Estimated rate of return 25% 15 10 -12 SIC Insurance 7 Rank- Order the firm (best to worst) by their risk and return attractiveness using the coefficient of variation. Standard Deviation 14% 12 7. Assume the rate of return given below are for two stocks listed on the Ghana Stock Exchange (GSE). Year Return on stock A 0.2 0.10 0.14 0.05 0.01 30 14 Return on stock B 0.3 0.1 0.18 0.00 -0.08 a. Calculate the arithmetic average return on the two stocks over the 5-year period. b. Which of the two stocks has a greater dispersion around the mean? c. Calculate the geometric average returns of each stock.

Step by Step Solution

★★★★★

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

10573 answers 5a Expected rate of return SumProbabilty Estimated rate of return ans5d ie 0125041504100112 1130 The most expected return from the poten...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started