Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. 1(a). Suppose you are evaluating a project that involves manufacturing solar-powered electric hand tools for the Asian market. You have decided to use

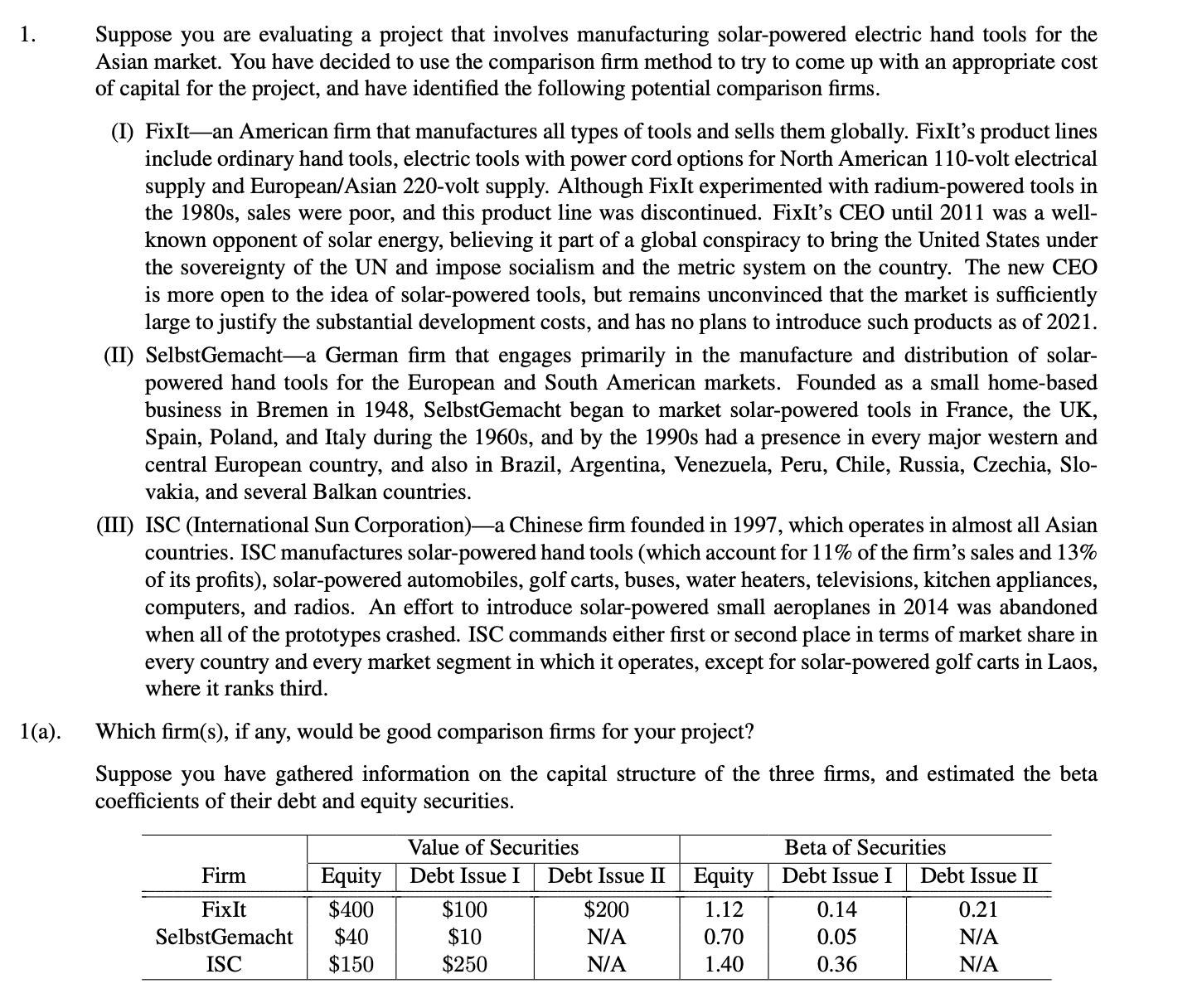

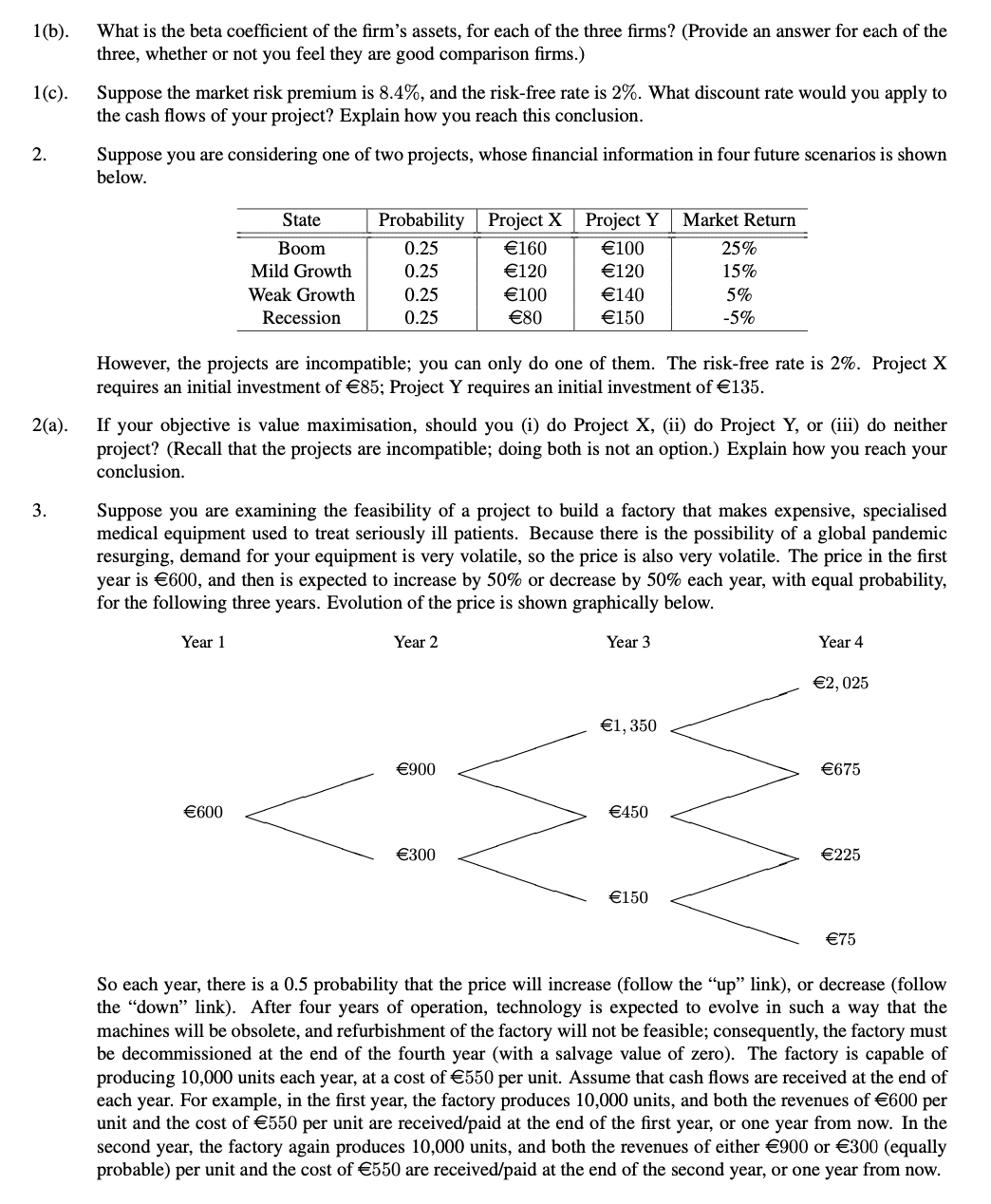

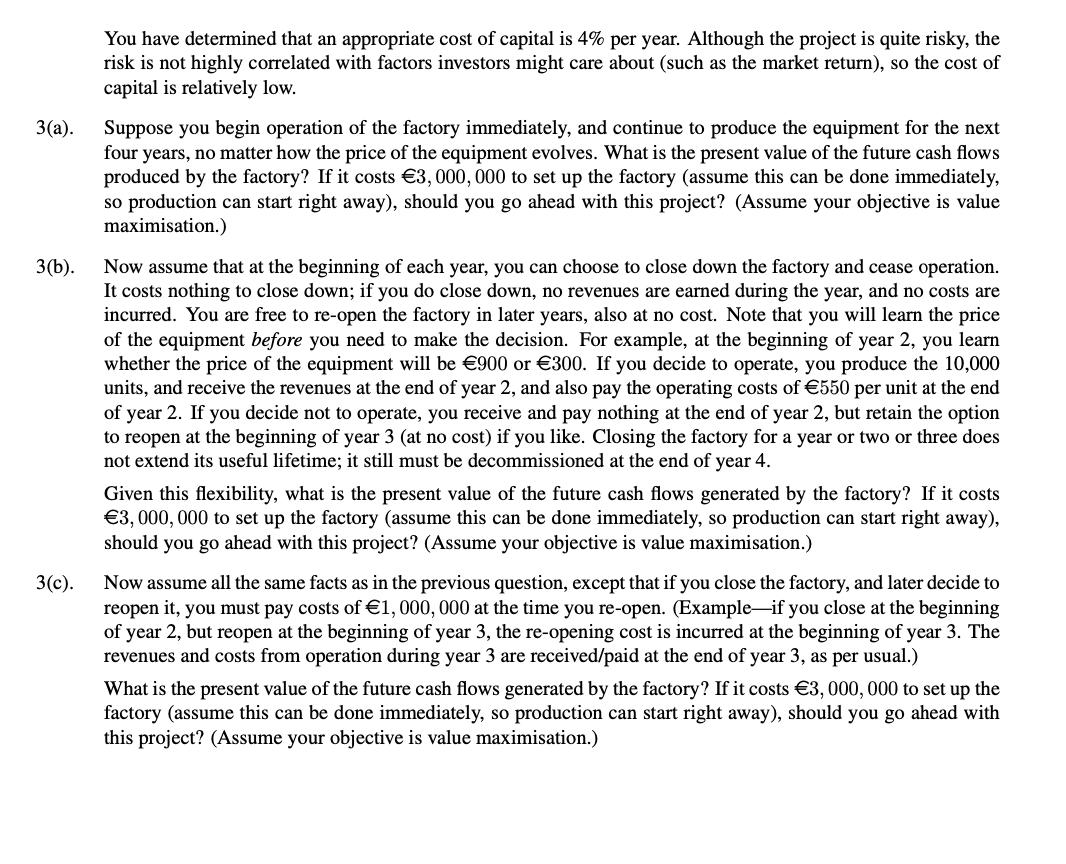

1. 1(a). Suppose you are evaluating a project that involves manufacturing solar-powered electric hand tools for the Asian market. You have decided to use the comparison firm method to try to come up with an appropriate cost of capital for the project, and have identified the following potential comparison firms. (I) FixIt-an American firm that manufactures all types of tools and sells them globally. FixIt's product lines include ordinary hand tools, electric tools with power cord options for North American 110-volt electrical supply and European/Asian 220-volt supply. Although FixIt experimented with radium-powered tools in the 1980s, sales were poor, and this product line was discontinued. FixIt's CEO until 2011 was a well- known opponent of solar energy, believing it part of a global conspiracy to bring the United States under the sovereignty of the UN and impose socialism and the metric system on the country. The new CEO is more open to the idea of solar-powered tools, but remains unconvinced that the market is sufficiently large to justify the substantial development costs, and has no plans to introduce such products as of 2021. (II) Selbstgemacht-a German firm that engages primarily in the manufacture and distribution of solar- powered hand tools for the European and South American markets. Founded as a small home-based business in Bremen in 1948, SelbstGemacht began to market solar-powered tools in France, the UK, Spain, Poland, and Italy during the 1960s, and by the 1990s had a presence in every major western and central European country, and also in Brazil, Argentina, Venezuela, Peru, Chile, Russia, Czechia, Slo- vakia, and several Balkan countries. (III) ISC (International Sun Corporation)a Chinese firm founded in 1997, which operates in almost all Asian countries. ISC manufactures solar-powered hand tools (which account for 11% of the firm's sales and 13% of its profits), solar-powered automobiles, golf carts, buses, water heaters, televisions, kitchen appliances, computers, and radios. An effort to introduce solar-powered small aeroplanes in 2014 was abandoned when all of the prototypes crashed. ISC commands either first or second place in terms of market share in every country and every market segment in which it operates, except for solar-powered golf carts in Laos, where it ranks third. Which firm(s), if any, would be good comparison firms for your project? Suppose you have gathered information on the capital structure of the three firms, and estimated the beta coefficients of their debt and equity securities. Firm Equity FixIt $400 SelbstGemacht $40 ISC $150 Value of Securities Debt Issue I Debt Issue II Equity 1.12 0.70 1.40 $100 $10 $250 $200 N/A N/A Beta of Securities Debt Issue I 0.14 0.05 0.36 Debt Issue II 0.21 N/A N/A 1(b). 1(c). 2. 2(a). 3. What is the beta coefficient of the firm's assets, for each of the three firms? (Provide an answer for each of the three, whether or not you feel they are good comparison firms.) Suppose the market risk premium is 8.4%, and the risk-free rate is 2%. What discount rate would you apply to the cash flows of your project? Explain how you reach this conclusion. Suppose you are considering one of two projects, whose financial information in four future scenarios is shown below. State Boom Mild Growth Weak Growth Recession Probability Project X 0.25 160 0.25 120 0.25 100 0.25 80 600 Project Y 100 120 140 150 However, the projects are incompatible; you can only do one of them. The risk-free rate is 2%. Project X requires an initial investment of 85; Project Y requires an initial investment of 135. 900 If your objective is value maximisation, should you (i) do Project X, (ii) do Project Y, or (iii) do neither project? (Recall that the projects are incompatible; doing both is not an option.) Explain how you reach your conclusion. 300 Suppose you are examining the feasibility of a project to build a factory that makes expensive, specialised medical equipment used to treat seriously ill patients. Because there is the possibility of a global pandemic resurging, demand for your equipment is very volatile, so the price is also very volatile. The price in the first year is 600, and then is expected to increase by 50% or decrease by 50% each year, with equal probability, for the following three years. Evolution of the price is shown graphically below. Year 1 Year 2 Year 3 Market Return 1,350 25% 15% 5% -5% 450 150 Year 4 2, 025 675 225 75 So each year, there is a 0.5 probability that the price will increase (follow the up link), or decrease (follow the "down" link). After four years of operation, technology is expected to evolve in such a way that the machines will be obsolete, and refurbishment of the factory will not be feasible; consequently, the factory must be decommissioned at the end of the fourth year (with a salvage value of zero). The factory is capable of producing 10,000 units each year, at a cost of 550 per unit. Assume that cash flows are received at the end of each year. For example, in the first year, the factory produces 10,000 units, and both the revenues of 600 per unit and the cost of 550 per unit are received/paid at the end of the first year, or one year from now. In the second year, the factory again produces 10,000 units, and both the revenues of either 900 or 300 (equally probable) per unit and the cost of 550 are received/paid at the end of the second year, or one year from now. 3(a). 3(b). 3(c). You have determined that an appropriate cost of capital is 4% per year. Although the project is quite risky, the risk is not highly correlated with factors investors might care about (such as the market return), so the cost of capital is relatively low. Suppose you begin operation of the factory immediately, and continue to produce the equipment for the next four years, no matter how the price of the equipment evolves. What is the present value of the future cash flows produced by the factory? If it costs 3,000,000 to set up the factory (assume this can be done immediately, so production can start right away), should you go ahead with this project? (Assume your objective is value maximisation.) Now assume that at the beginning of each year, you can choose to close down the factory and cease operation. It costs nothing to close down; if you do close down, no revenues are earned during the year, and no costs are incurred. You are free to re-open the factory in later years, also at no cost. Note that you will learn the price of the equipment before you need to make the decision. For example, at the beginning of year 2, you learn whether the price of the equipment will be 900 or 300. If you decide to operate, you produce the 10,000 units, and receive the revenues at the end of year 2, and also pay the operating costs of 550 per unit at the end of year 2. If you decide not to operate, you receive and pay nothing at the end of year 2, but retain the option to reopen at the beginning of year 3 (at no cost) if you like. Closing the factory for a year or two or three does not extend its useful lifetime; it still must be decommissioned at the end of year 4. Given this flexibility, what is the present value of the future cash flows generated by the factory? If it costs 3,000,000 to set up the factory (assume this can be done immediately, so production can start right away), should you go ahead with this project? (Assume your objective is value maximisation.) Now assume all the same facts as in the previous question, except that if you close the factory, and later decide to reopen it, you must pay costs of 1,000,000 at the time you re-open. (Example-if you close at the beginning of year 2, but reopen at the beginning of year 3, the re-opening cost is incurred at the beginning of year 3. The revenues and costs from operation during year 3 are received/paid at the end of year 3, as per usual.) What is the present value of the future cash flows generated by the factory? If it costs 3,000,000 to set up the factory (assume this can be done immediately, so production can start right away), should you go ahead with this project? (Assume your objective is value maximisation.)

Step by Step Solution

★★★★★

3.49 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

Sure lets break it down 1 SelbstGemacht This German firm closely resembles your project as it ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started