1)

2)

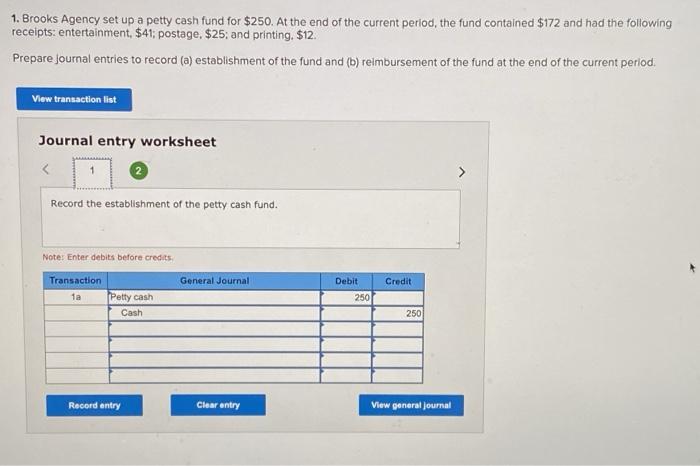

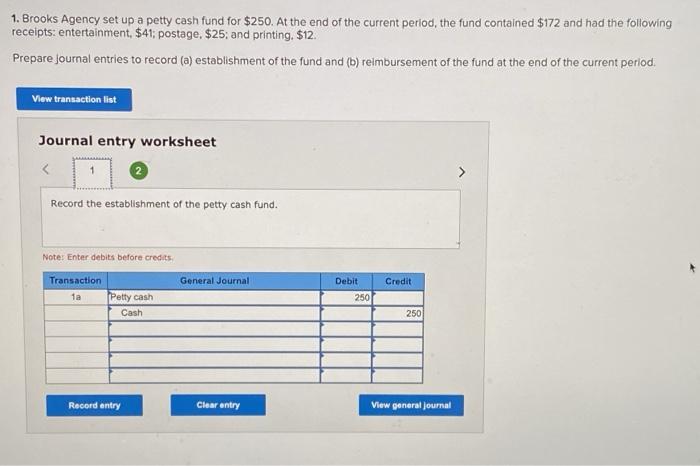

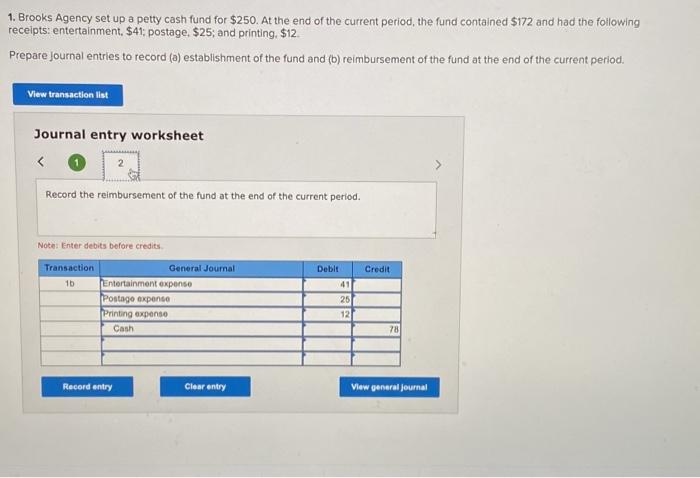

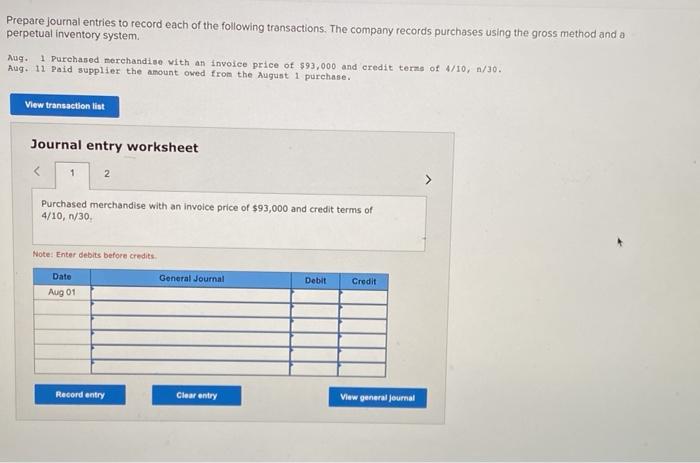

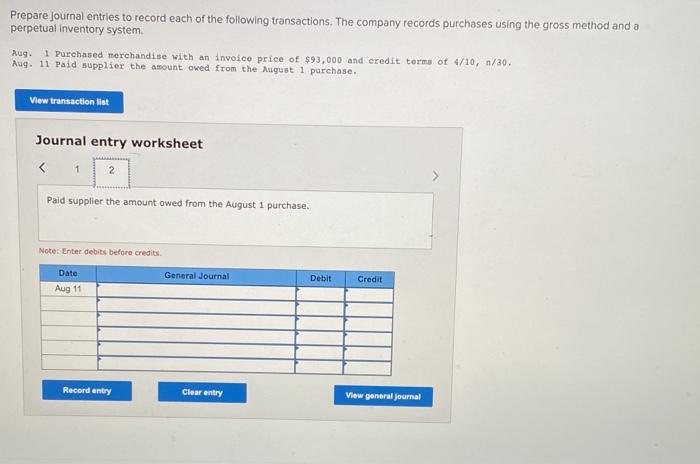

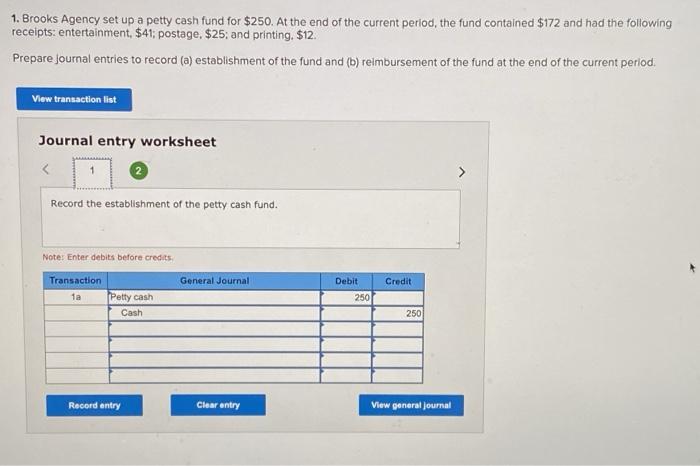

1. Brooks Agency set up a petty cash fund for $250. At the end of the current period, the fund contained $172 and had the following receipts: entertainment, $41; postage, $25; and printing. $12. Prepare Journal entries to record (a) establishment of the fund and (b) reimbursement of the fund at the end of the current period, View transaction list Journal entry worksheet Record the establishment of the petty cash fund. Note: Enter debits before credits General Journal Credit Transaction ta Petty cash Cash Debit 250 250 Record entry Clear entry View general Journal 1. Brooks Agency set up a petty cash fund for $250. At the end of the current period, the fund contained $172 and had the following receipts: entertainment. $41: postage. $25; and printing. $12. Prepare Journal entries to record (a) establishment of the fund and (b) reimbursement of the fund at the end of the current period. View transaction list Journal entry worksheet Record the reimbursement of the fund at the end of the current period. Note: Enter debits before credits Credit Debit 41 Transaction General Journal 1b Entertainment expenso Postage expense Printing expenso Cash 25 12 78 Record entry Clear entry View general Journal Prepare journal entries to record each of the following transactions. The company records purchases using the gross method and a perpetual inventory system Aug. 1 Purchased merchandise with an invoice price of $93,000 and credit terns of 4/10, 1/30. Aug. 11 Paid supplier the amount owed from the August 1 purchase. View transaction list Journal entry worksheet 2 Purchased merchandise with an invoice price of $93,000 and credit terms of 4/10, 1/30 Note: Enter debits before credits Date General Journal Debit Credit Aug 01 Record entry Clear entry View general Journal Prepare journal entries to record each of the following transactions. The company records purchases using the gross method and a perpetual Inventory system Aug. 1 Purchased merchandise with an invoice price of $93,000 and credit terms of 4/10, n/30. Aug. 11 Paid supplier the amount owed from the August 1 purchase View transaction list Journal entry worksheet 2 Paid supplier the amount owed from the August 1 purchase. Note: Enter debits before credits General Journal Date Aug 11 Debit Credit Record entry Clear entry View general Journal