Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 2 - 2 4 . Allowable Costs under Federal Grants. ( ? ? ? LO 1 2 - 6 ) The U . S

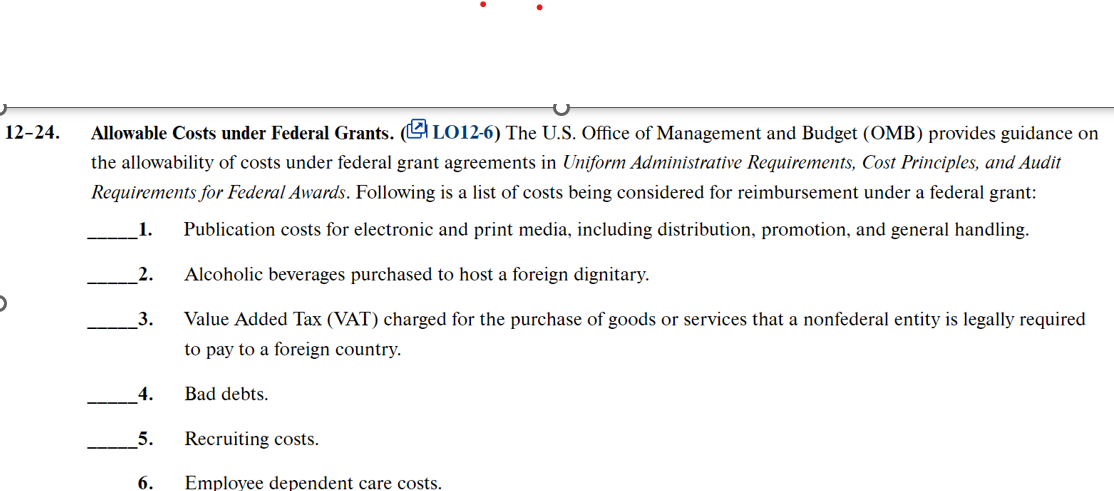

Allowable Costs under Federal Grants. LO The US Office of Management and Budget OMB provides guidance on

the allowability of costs under federal grant agreements in Uniform Administrative Requirements, Cost Principles, and Audit

Requirements for Federal Awards. Following is a list of costs being considered for reimbursement under a federal grant:

l Publication costs for electronic and print media, including distribution, promotion, and general handling.

Alcoholic beverages purchased to host a foreign dignitary.

Value Added Tax VAT charged for the purchase of goods or services that a nonfederal entity is legally required

to pay to a foreign country.

Bad debts.

Recruiting costs.

Employee dependent care costs.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started