1

.

2

.

3

.

4

.

5

.

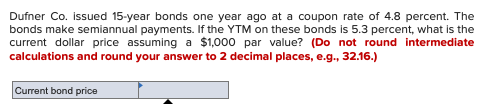

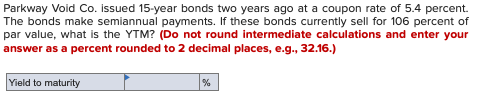

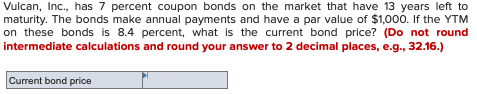

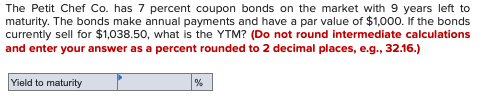

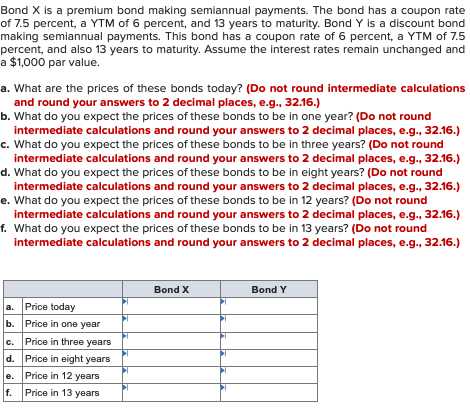

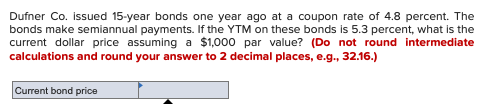

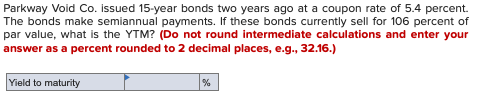

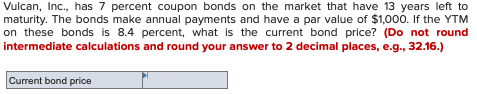

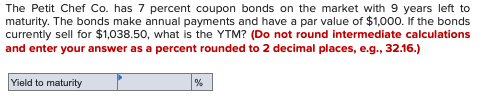

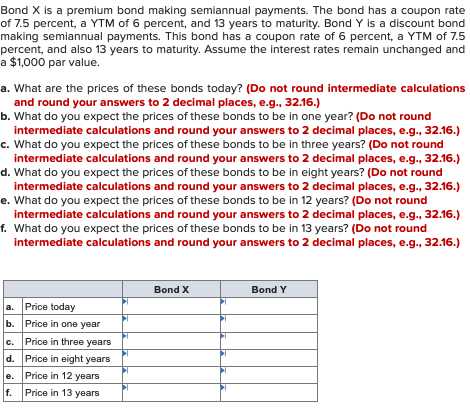

go at a coupons is 5.3 percent termediate Dufner Co. Issued 15-year bonds one year ago at a coupon rate of 4.8 percent. The bonds make semiannual payments. If the YTM on these bonds is 5.3 percent, what is the current dollar price assuming a $1,000 par value? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Current bond price Parkway Vold Co. Issued 15-year bonds two years ago at a coupon rate of 5.4 percent. The bonds make semiannual payments. If these bonds currently sell for 106 percent of par value, what is the YTM? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Yield to maturity Vulcan, Inc., has 7 percent coupon bonds on the market that have 13 years left to maturity. The bonds make annual payments and have a par value of $1,000. If the YTM on these bonds is 8.4 percent, what is the current bond price? (Do not round Intermediate calculations and round your answer to 2 decimal places. e.a.. 32.16.) Current bond price The Petit Chef Co. has 7 percent coupon bonds on the market with 9 years left to maturity. The bonds make annual payments and have a par value of $1,000. If the bonds currently sell for $1,038.50, what is the YTM? (Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Yield to maturity Bond X is a premium bond making semiannual payments. The bond has a coupon rate of 7.5 percent, a YTM of 6 percent, and 13 years to maturity. Bond Y is a discount bond making semiannual payments. This bond has a coupon rate of 6 percent, a YTM of 7.5 percent, and also 13 years to maturity. Assume the interest rates remain unchanged and a $1,000 par value. a. What are the prices of these bonds today? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. What do you expect the prices of these bonds to be in one year? (Do not round Intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. What do you expect the prices of these bonds to be in three years? (Do not round Intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) d. What do you expect the prices of these bonds to be in eight years? (Do not round Intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) e. What do you expect the prices of these bonds to be in 12 years? (Do not round Intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) f. What do you expect the prices of these bonds to be in 13 years? (Do not round Intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Bond X Bond Y a. Price today b. Price in one year Price in three years d. Price in eight years e. Price in 12 years f. Price in 13 years