1.

2.

3.

4.

5.

6.

7.

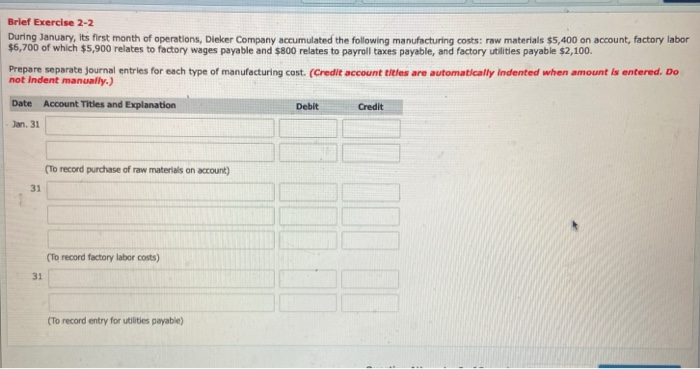

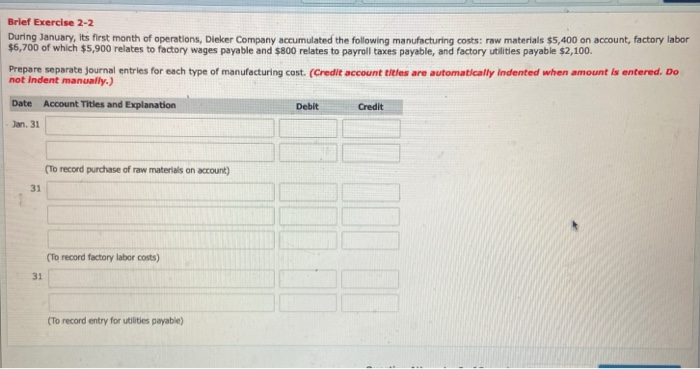

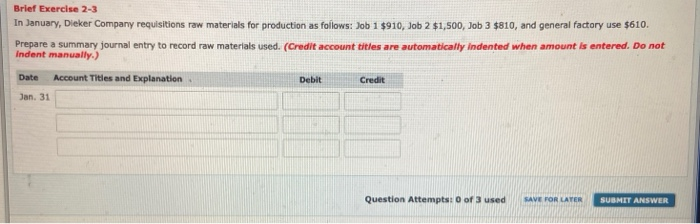

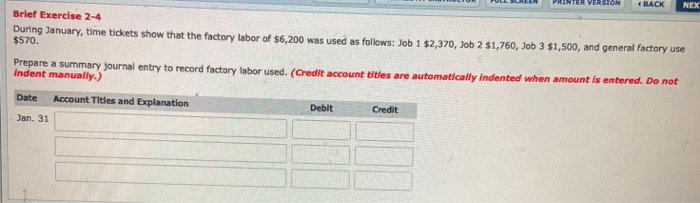

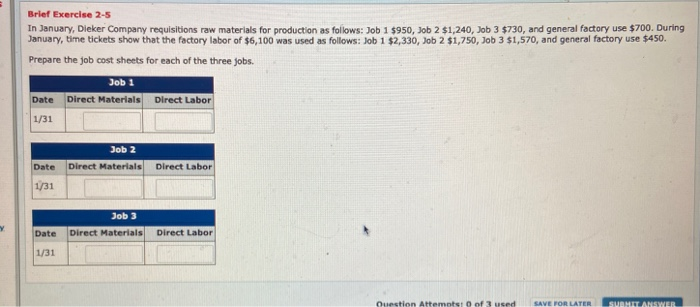

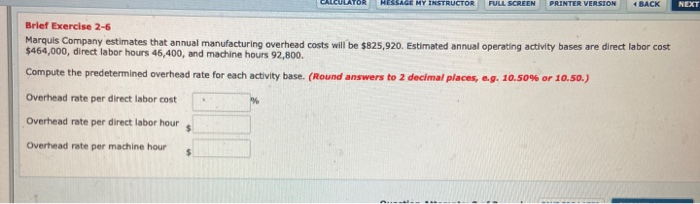

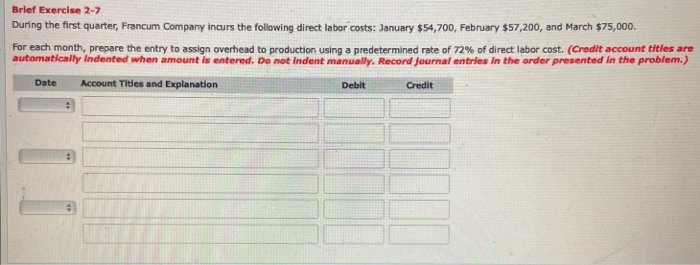

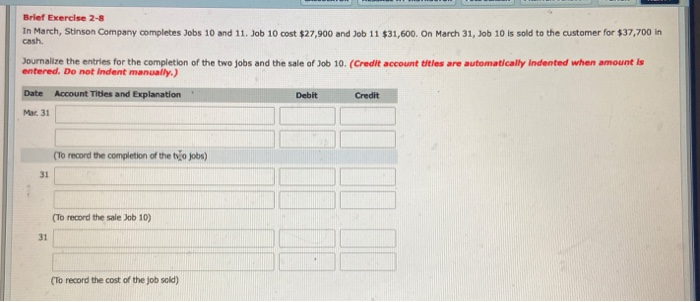

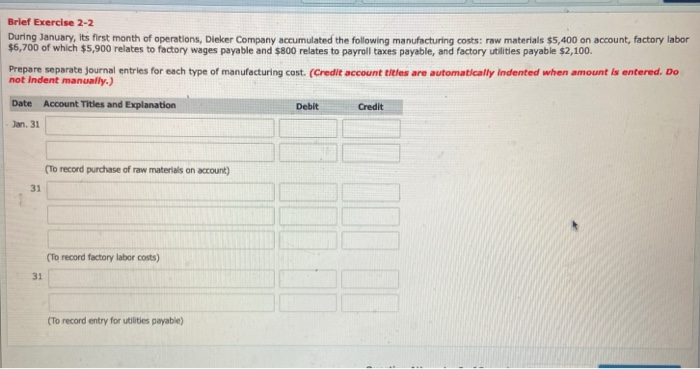

Brief Exercise 2-2 During January, its first month of operations, Dieker Company accumulated the following manufacturing costs: raw materials $5,400 on account, factory labor $6,700 of which $5,900 relates to factory wages payable and $800 relates to payroll taxes payable, and factory utilities payable $2,100. Prepare separate Journal entries for each type of manufacturing cost. (Credit account titles are automatically Indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Jan. 31 (To record purchase of raw materials on account) 31 (To record factory labor costs) 31 (To record entry for utilities payable) Brief Exercise 2-3 In January, Dieker Company requisitions raw materials for production as follows: Job 1 $910, Job 2 $1,500, Job 3 $810, and general factory use $610. Prepare a summary journal entry to record raw materials used. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Jan. 31 Question Attempts: 0 of 3 used SAVE FOR LATER SUBMIT ANSWER PRINTER VERSION + BACK NEX Brief Exercise 2-4 During January, time tickets show that the factory labor of $6,200 was used as follows: Job 1 $2,370, Job 2 $1,760, Job 3 $1,500, and general factory use $570. Prepare a summary journal entry to record factory labor used. (Credit account titles are automatically indented when amount is entered. Do not Indent manually.) Date Account Tities and Explanation Debit Credit Jan. 31 Brief Exercise 2-5 In January, Dieker Company requisitions raw materials for production as follows: Job 1 $950, Job 2 $1,240, Job 3 $730, and general factory use $700. During January, time tickets show that the factory labor of $6,100 was used as follows: Job 1 $2,330, Job 2 $1,750, Job 3 $1,570, and general factory use $450. Prepare the job cost sheets for each of the three jobs. Job 1 Date Direct Materials Direct Labor 1/31 Job 2 Direct Materials Date Direct Labor 1/31 Job 3 Direct Materials Date Direct Labor 1/31 Question Attempts of 3 used SAVE FOR LATER SUBMIT ANSWER ESSAGE MY INSTRUCTOR FULL SCREEN PRINTER VERSION 1 BACK NEXT Brief Exercise 2-6 Marquis Company estimates that annual manufacturing overhead costs will be $825,920. Estimated annual operating activity bases are direct labor cost $464,000, direct labor hours 46,400, and machine hours 92,800. Compute the predetermined overhead rate for each activity base. (Round answers to 2 decimal places, 0.9. 10.50% or 10.50.) Overhead rate per direct labor cost Overhead rate per direct labor hour Overhead rate per machine hour Brief Exercise 2-7 During the first quarter, Francum Company incurs the following direct labor costs: January $54,700, February $57,200, and March $75,000. For each month, prepare the entry to assign overhead to production using a predetermined rate of 72% of direct labor cost. (Credit account titles are automatically indented when amount is entered. Do not Indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit Brief Exercise 2-8 In March, Stinson Company completes Jobs 10 and 11. Job 10 cost $27,900 and Job 11 $31,600. On March 31, Job 10 is sold to the customer for $37,700 in Journalize the entries for the completion of the two jobs and the sale of Job 10. (Credit account titles are automatically indented when amount is entered. Do not Indent manually.) Account Titles and Explanation Credit Mar 31 Date Debit (To record the completion of the tvo jobs) 31 (To record the sale Job 10) 31 (To record the cost of the job sold)