Answered step by step

Verified Expert Solution

Question

1 Approved Answer

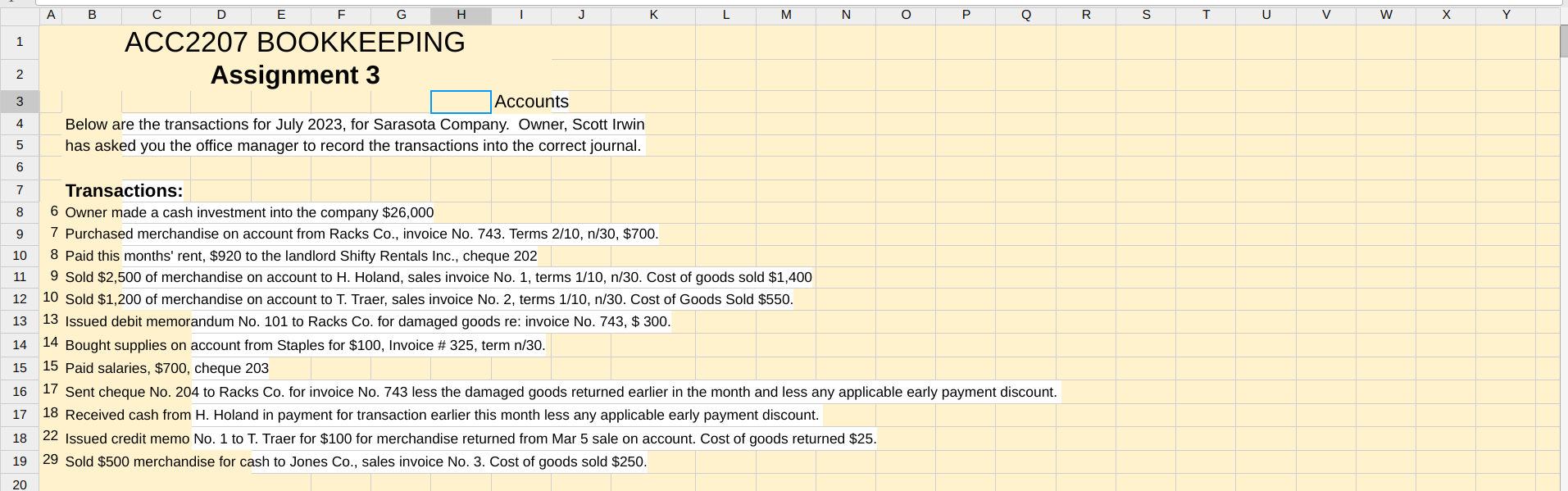

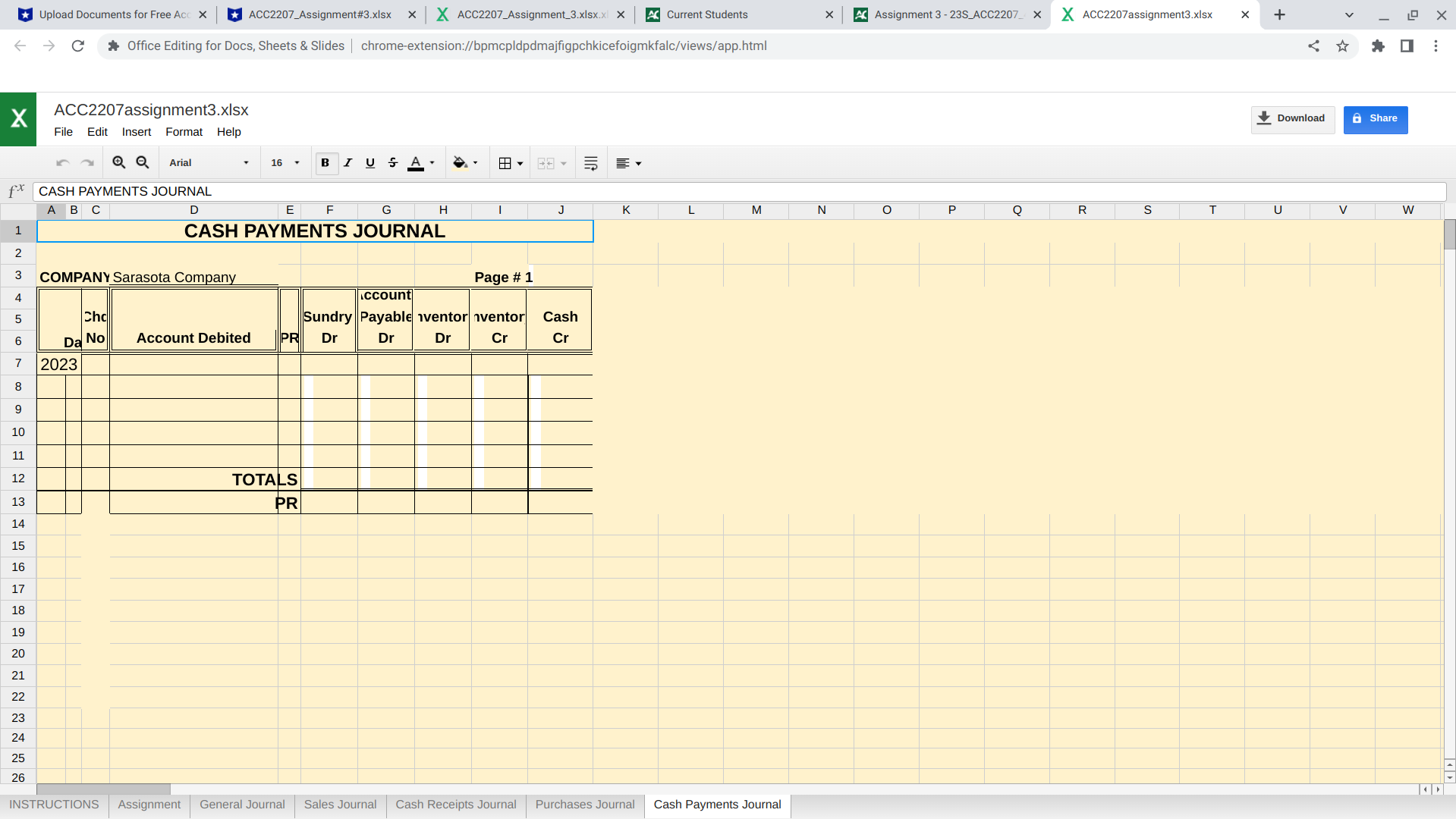

1 2 3 4 5 6 A B C D DE E F G ACC2207 BOOKKEEPING Assignment 3 H I J Accounts Below are

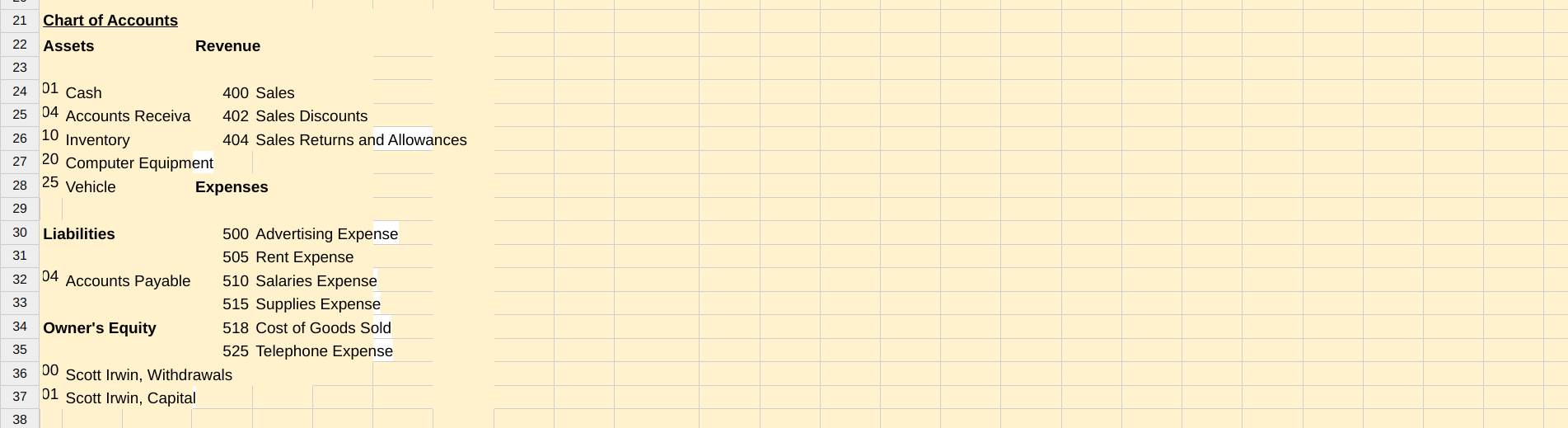

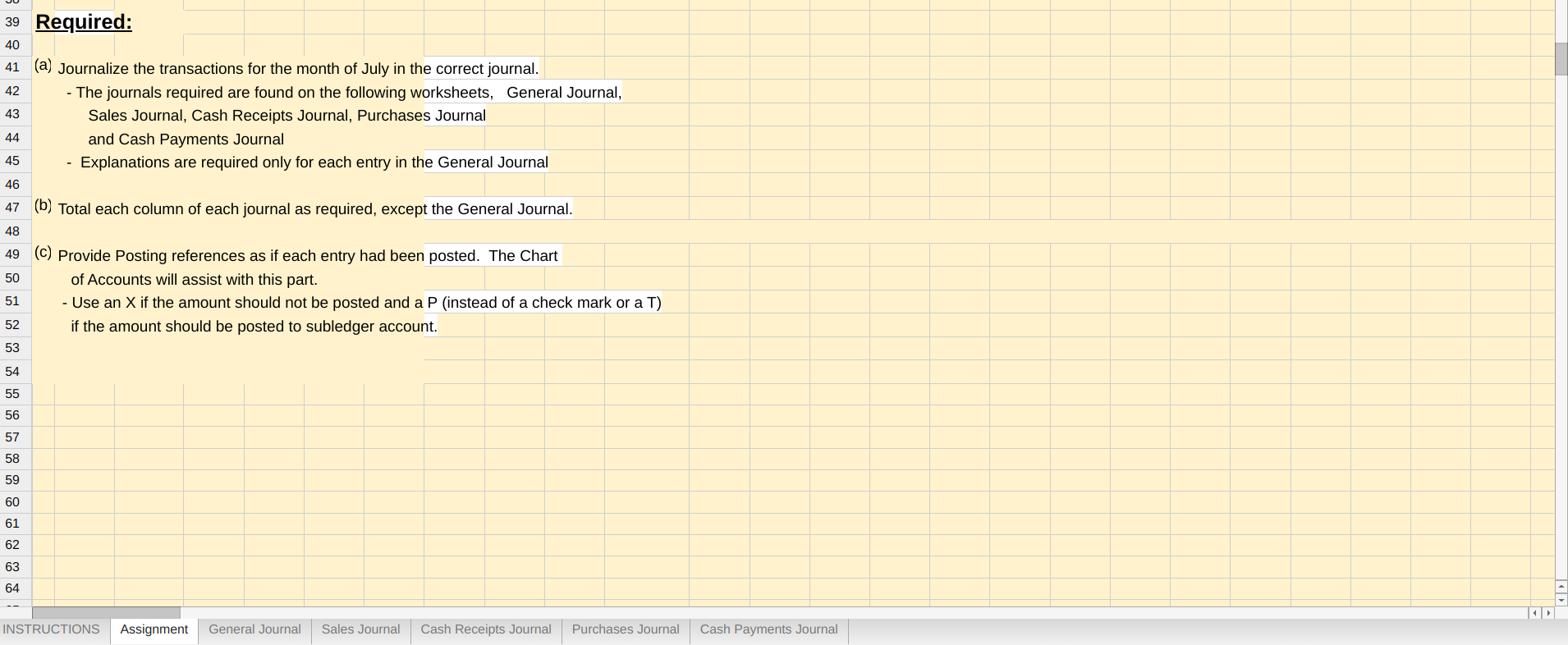

1 2 3 4 5 6 A B C D DE E F G ACC2207 BOOKKEEPING Assignment 3 H I J Accounts Below are the transactions for July 2023, for Sarasota Company. Owner, Scott Irwin has asked you the office manager to record the transactions into the correct journal. K L M N O P Q 7 Transactions: 8 6 Owner made a cash investment into the company $26,000 9 7 Purchased merchandise on account from Racks Co., invoice No. 743. Terms 2/10, n/30, $700. 10 8 Paid this months' rent, $920 to the landlord Shifty Rentals Inc., cheque 202 11 9 Sold $2,500 of merchandise on account to H. Holand, sales invoice No. 1, terms 1/10, n/30. Cost of goods sold $1,400 12 10 Sold $1,200 of merchandise on account to T. Traer, sales invoice No. 2, terms 1/10, n/30. Cost of Goods Sold $550. 13 13 Issued debit memorandum No. 101 to Racks Co. for damaged goods re: invoice No. 743, $ 300. 14 14 Bought supplies on account from Staples for $100, Invoice # 325, term n/30. 15 15 Paid salaries, $700, cheque 203 16 17 Sent cheque No. 204 to Racks Co. for invoice No. 743 less the damaged goods returned earlier in the month and less any applicable early payment discount. 17 18 Received cash from H. Holand in payment for transaction earlier this month less any applicable early payment discount. 18 22 Issued credit memo No. 1 to T. Traer for $100 for merchandise returned from Mar 5 sale on account. Cost of goods returned $25. 19 29 Sold $500 merchandise for cash to Jones Co., sales invoice No. 3. Cost of goods sold $250. 20 R S T U V W X Y 21 Chart of Accounts 22 Assets 23 24 01 Cash 25 04 Accounts Receiva 26 10 Inventory 27 20 Computer Equipment 28 25 Vehicle 29 30 Liabilities 31 32 04 Accounts Payable 33 34 Owner's Equity 35 Revenue 400 Sales 402 Sales Discounts 404 Sales Returns and Allowances Expenses 500 Advertising Expense 505 Rent Expense 510 Salaries Expense 515 Supplies Expense 518 Cost of Goods Sold 525 Telephone Expense 36 00 Scott Irwin, Withdrawals 37 01 Scott Irwin, Capital 38 39 Required: 40 41 (a) Journalize the transactions for the month of July in the correct journal. 42 43 - The journals required are found on the following worksheets, General Journal, Sales Journal, Cash Receipts Journal, Purchases Journal and Cash Payments Journal Explanations are required only for each entry in the General Journal 44 45 46 47 (b) Total each column of each journal as required, except the General Journal. 48 49 (C) Provide Posting references as if each entry had been posted. The Chart 50 of Accounts will assist with this part. 51 - Use an X if the amount should not be posted and a P (instead of a check mark or a T) 52 if the amount should be posted to subledger account. 53 54 55 56 57 58 59 60 61 62 63 64 INSTRUCTIONS Assignment General Journal Sales Journal Cash Receipts Journal Purchases Journal Cash Payments Journal X LU 24 (a) 25 30 31 Quiz 9- Bookkeeping X A Current Students X 33 ACC2207assignment3.xlsx File Edit Insert Format Help 34 38 Sign In Office Editing for Docs, Sheets & Slides| chrome-extension://bpmcpldpdmajfigpchkicefoigmkfalc/views/app.html Arial 12 BIUS A 63 fx Please be sure that each entry in this assignment is posted in ONE JOURNAL ONLY. (Use the information that you have learned in the past 4 lessons to help you place your entries into the correct journal). C D F G H J K Q R S T U A B E I L M N O P What type of transactions are recorded to which journal? X M Your answer is ready X 26 General Journal - the only transactions recorded in this journal are as follows: 27 Return of goods to a supplier 28 Return of goods by a customer 29 Sales Journal - transactions recorded in this journal include one type ONLY - goods sold on account to a customer Cash Receipts Journal - transactions recorded in this journal include all entries that include a receipt of cash. It does not matter what the receipt of cash is for, if cash is received then the transaction gets recorded in this journal. Purchases Journal - transactions recorded in this journal include all entries that record the purchase of any type of asset, expense, or inventory on account. If a credit to accounts payable is recorded then the transactions gets recorded . Course Hero 88 32 Cash Payments Journal - transactions recorded in the journal include all entries that require a disbursement or payment of cash. The payment of cash can be on account, for assets such as inventory, or day to day expenses. 39 40 41 (C) 42 43 44 Posting References 45 X The most important point to remember: Each transaction is recorded in ONLY one of the above journals. If you record a transaction in more than one journal then you have incorrectly recorded the entry twice. The rules of double entry accounting still apply to each entry (ALCREW). Debits = Credits always 35 36 37 (b) Why do we have to total each column of the special journals? Totals of the journals - A total must be calculated for each column in all journals except the General Journal. The totals must balance, total of the debit columns must equal the total of he How and why are posting references used in the special journals? Course Hero INSTRUCTIONS Assignment General Journal Sales Journal Cash Receipts Journal Purchases Journal Cash Payments Journal X 43368194 (557x168 X X ACC2207assignmen X V + Download W X Share LO Y X X ACC2207assignment3.xlsx File Edit Insert Format Help Q Q fx GENERAL JOURNAL A B 1 2 4 6 8 ACC2207_Assignment#3.xlsx X X ACC2207_Assignment_3.xlsx.xx A Current Students Office Editing for Docs, Sheets & Slides| chrome-extension://bpmcpldpdmajfigpchkicefoigmkfalc/views/app.html 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 Upload Documents for Free Acc X Arial COMPANY NAME: 16 D GENERAL JOURNAL E B I USA. F Page #1 Sarasota Company Da Account Titles and De P. RR (DebiR (Credit 2023 G H 18.8 I J K L M N INSTRUCTIONS Assignment General Journal Sales Journal Cash Receipts Journal Purchases Journal Cash Payments Journal X O A Assignment 3-23S_ACC2207 P Q R S X X ACC2207assignment3.xlsx T U V W X + Download X Y Share Z LO X AA X 4 fx SALES JOURNAL A B ~~~5555555ES6 10 12 1 2 3 COMPANY NAME: 13 14 15 16 17 18 19 20 22 Upload Documents for Free Acc X ACC2207_Assignment#3.xlsx X X ACC2207_Assignment_3.xlsx.xx A Current Students Office Editing for Docs, Sheets & Slides| chrome-extension://bpmcpldpdmajfigpchkicefoigmkfalc/views/app.html 23 ACC2207assignment3.xlsx File Edit Insert Format Help Q Q Arial 2023 E F SALES JOURNAL Daustomer Account: D 16 # B I US Page #1 Sarasota Company Terms Inv PR Dr. Acct Dr. Cost of TOTALS PR G H Goods Sold Cr. Salesr. Inventory I 118.8 J K L M INSTRUCTIONS Assignment General Journal Sales Journal Cash Receipts Journal Purchases Journal Cash Payments Journal N X A Assignment 3-23S_ACC2207 O P Q X X ACC2207assignment3.xlsx R S T X + Download U V Share LO X W X 1 2 3 4 Q Q Arial fx CASH RECEIPTS JOURNAL A B C D 5 6 7 Upload Documents for Free Acc X ACC2207assignment3.xlsx File Edit Insert Format Help ACC2207_Assignment#3.xlsx X X ACC2207_Assignment_3.xlsx.xx A Current Students Office Editing for Docs, Sheets & Slides| chrome-extension://bpmcpldpdmajfigpchkicefoigmkfalc/views/app.html Da 2023 8 9 10 11 12 13 TOTA 14 PR 15 16 17 18 19 20 21 22 23 24 COMPANY NAM Sarasota Company Accounts E Cash Dr 16 B I US G F CASH RECEIPTS JOURNAL H Cost of Sales Goods Sold Dr eceivab Sales ventory Discounts Cr Cr 118.8 I Sundry J Page # 1 Amount Dr Account Name PR Cr JII K L M INSTRUCTIONS Assignment General Journal Sales Journal Cash Receipts Journal Purchases Journal Cash Payments Journal N X A Assignment 3-23S_ACC2207 O P Q X R X ACC2207assignment3.xlsx S T U X + Download V W Share LO X X X ACC2207assignment3.xlsx File Edit Insert Format Help Q Q Arial fx PURCHASES JOURNAL A B 1 2 3 450 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 Upload Documents for Free Acc X ACC2207_Assignment#3.xlsx X X ACC2207_Assignment_3.xlsx.xx A Current Students Office Editing for Docs, Sheets & Slides| chrome-extension://bpmcpldpdmajfigpchkicefoigmkfalc/views/app.html COMPANY NAME: Da 2023 Supplier (AP) Sub-ledger Account D T Inv. 16 E G PURCHASES JOURNAL F B I USA. TOTALS PR ccount Payable nventor # Terms PF Cr Dr | Page #1 118.8 J Sundry DR K Account PR Amount L M N INSTRUCTIONS Assignment General Journal Sales Journal Cash Receipts Journal Purchases Journal Cash Payments Journal O X A Assignment 3-23S_ACC2207 P Q R S X X ACC2207assignment3.xlsx T U V X + W Download X Y Share LO X Z X 9 10 Q Q fx CASH PAYMENTS JOURNAL A B C D 11 12 13 14 15 16 17 18 19 20 21 22 23 24 Upload Documents for Free Acc X 25 26 ACC2207assignment3.xlsx File Edit Insert Format Help ACC2207_Assignment#3.xlsx X X ACC2207_Assignment_3.xlsx.xx A Current Students Office Editing for Docs, Sheets & Slides| chrome-extension://bpmcpldpdmajfigpchkicefoigmkfalc/views/app.html 1 2 3 COMPANY Sarasota Company 4 5 6 7 8 Da 2023 Chc No Arial 16 E G CASH PAYMENTS JOURNAL Account Debited B I US F TOTALS PR H 118.8 | J Page #1 Account Sundry Payable ventor nventor Cash PR Dr Dr Dr Cr Cr K L M INSTRUCTIONS Assignment General Journal Sales Journal Cash Receipts Journal Purchases Journal Cash Payments Journal X N A Assignment 3-23S_ACC2207 O P Q X X ACC2207assignment3.xlsx R S T X + Download U V Share LO X W

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Assignment 3 Sarasota Company Transactions a Journalize the transactions for the month of July General Journal Date Account Titles and Explanation Debit Credit Jul 6 Cash 26000 Scott Irwin Capital 260...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

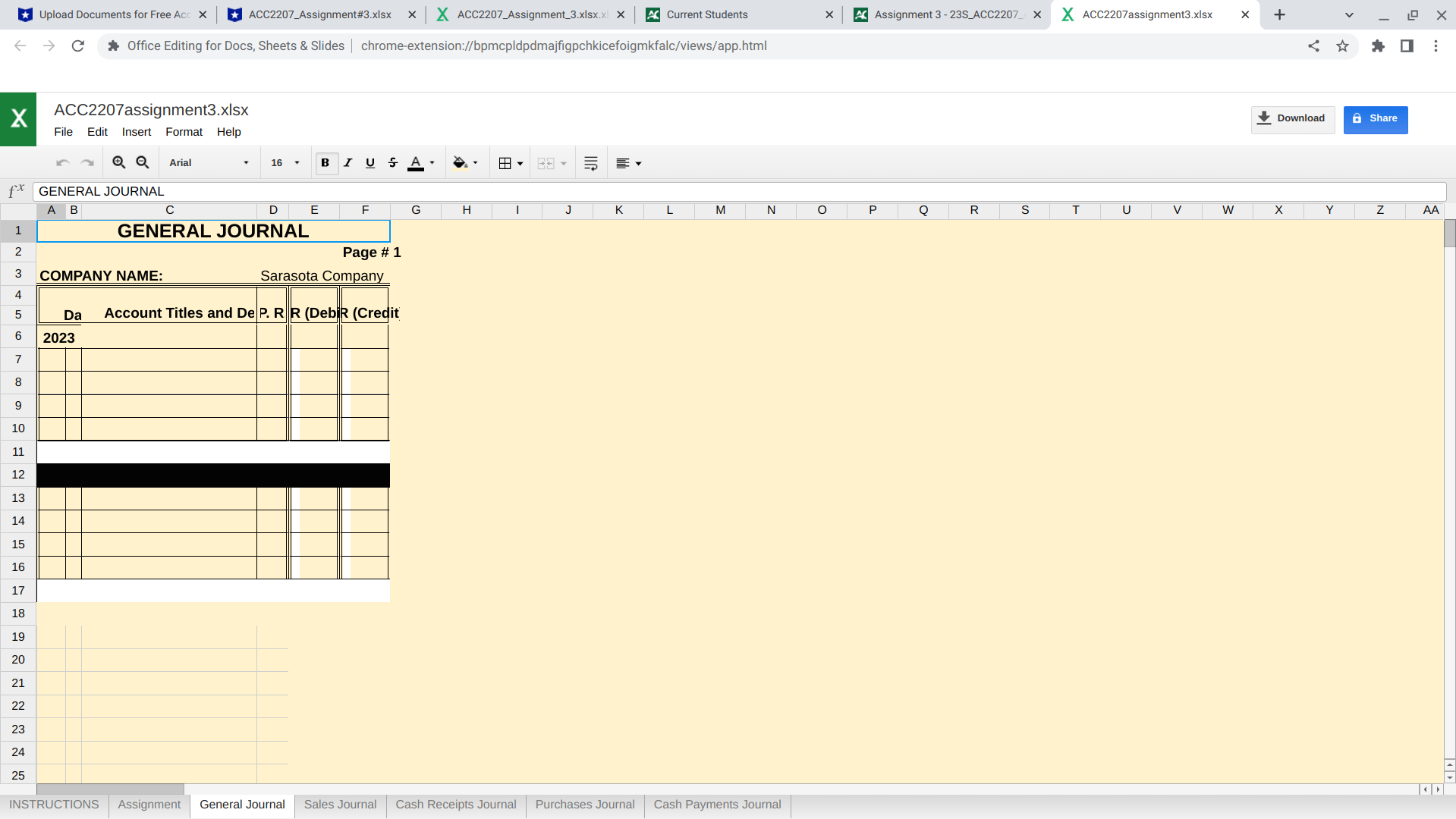

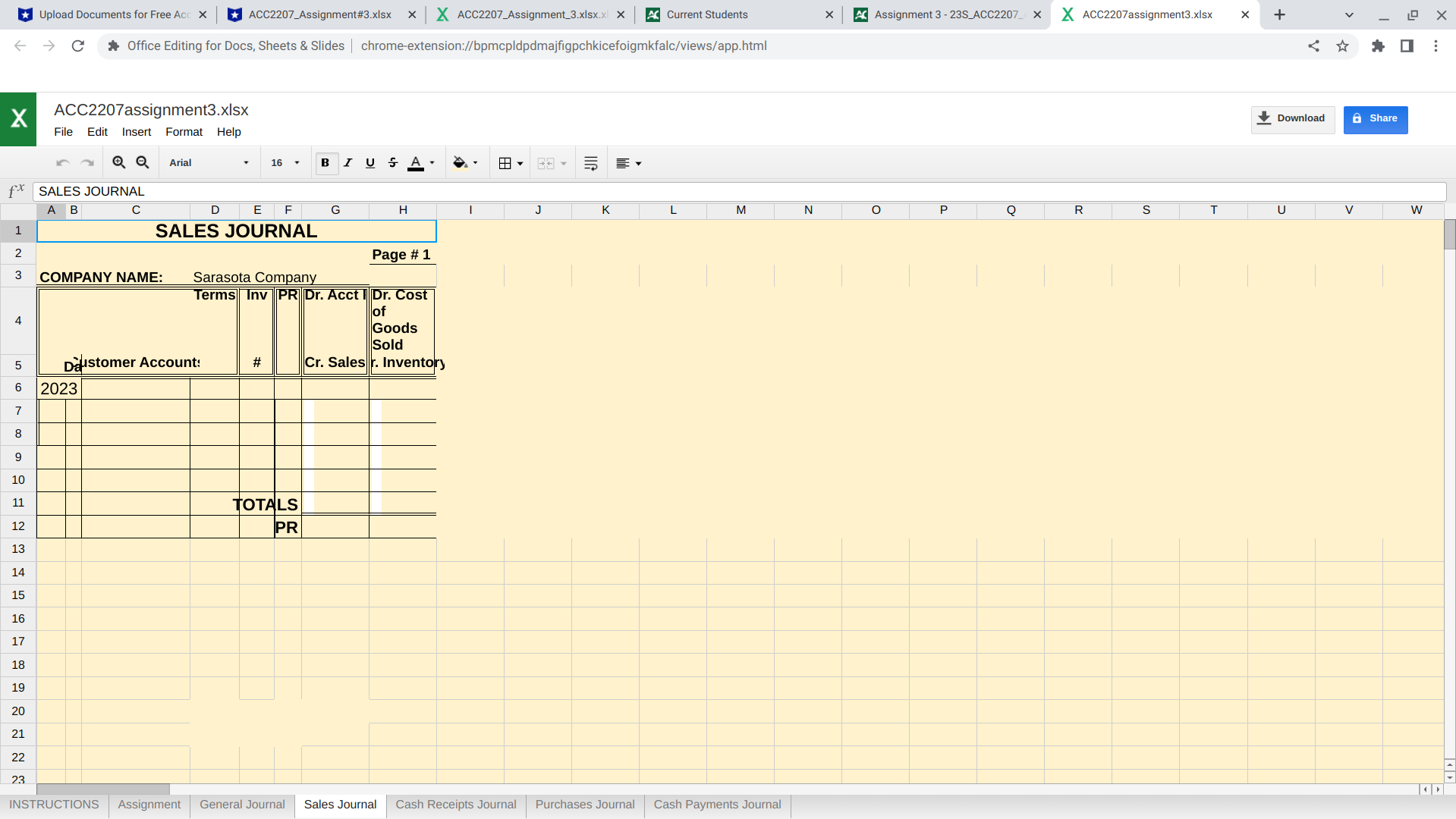

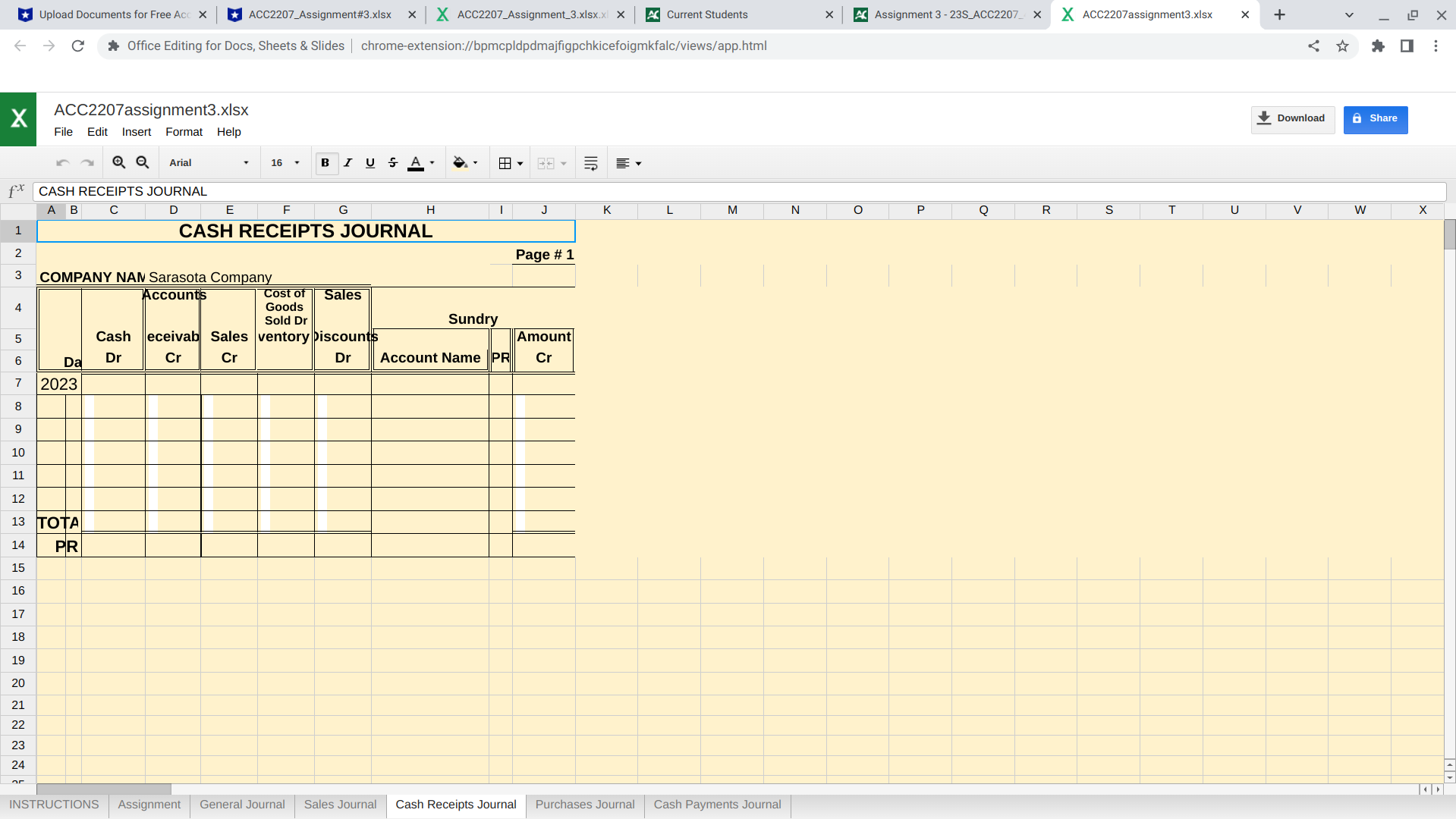

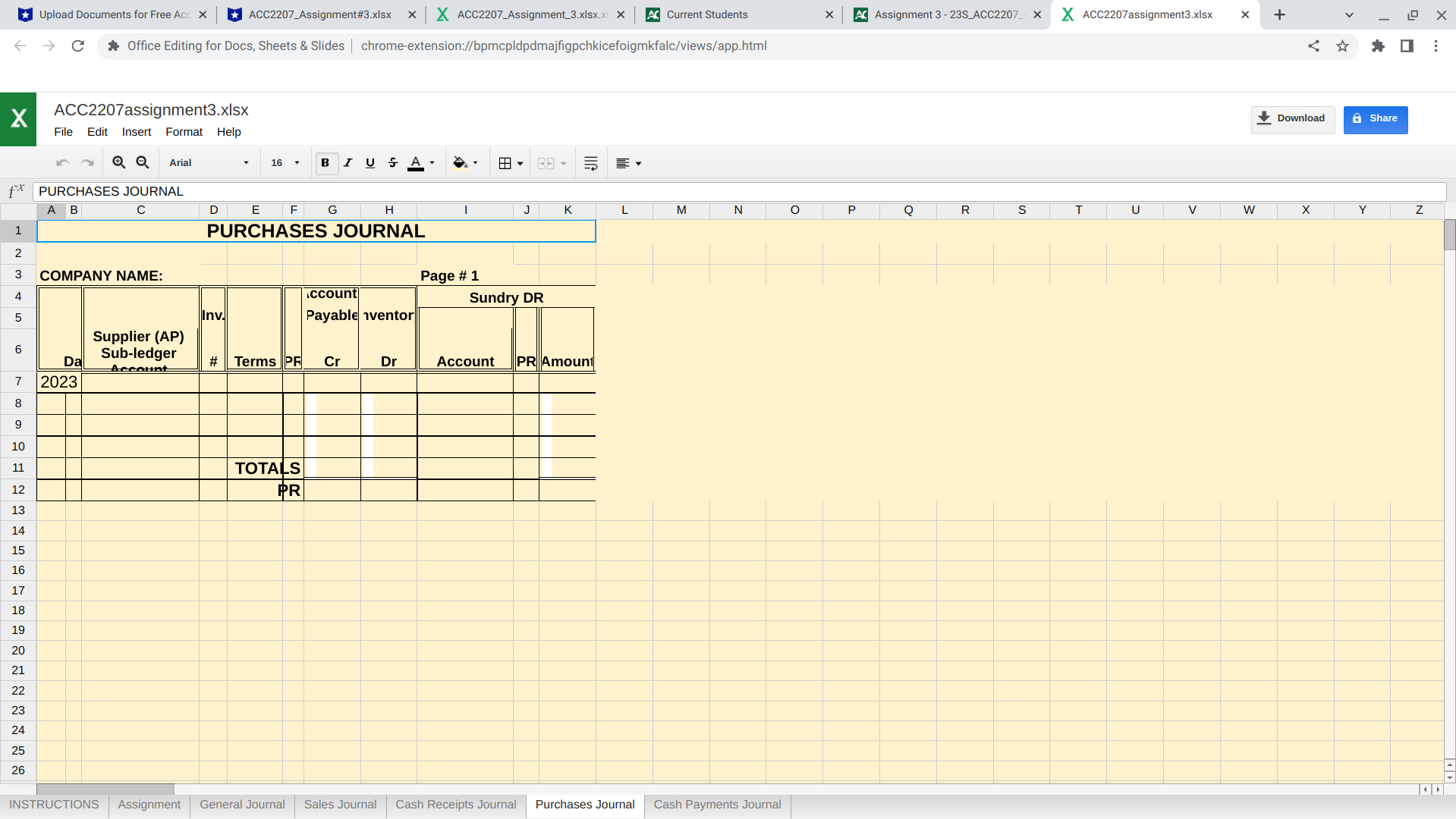

Get Started