Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) 2) 3) 4) 5) 6) QUESTION 7 A company has derivatives transactions with Banks A, B, and C which are worth +$20 million, -$15

1)

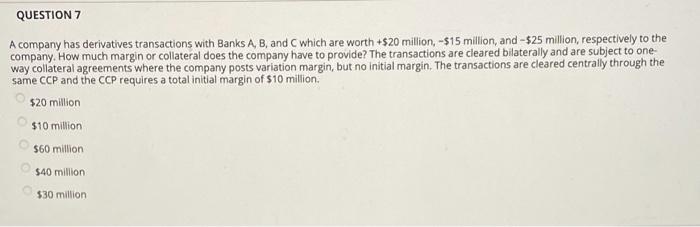

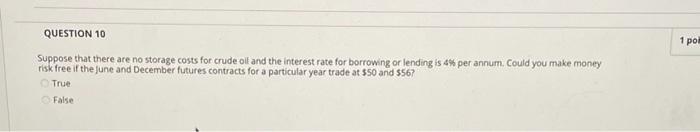

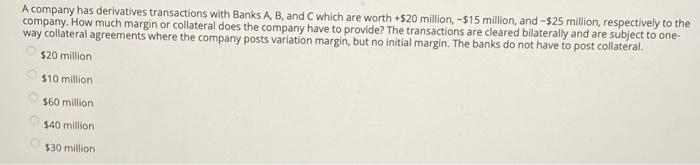

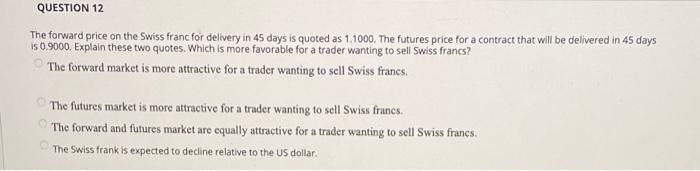

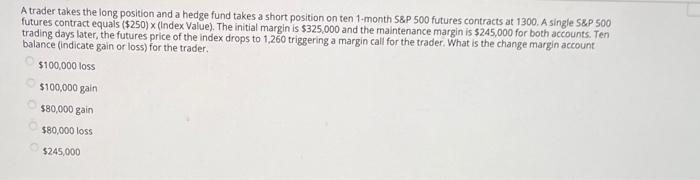

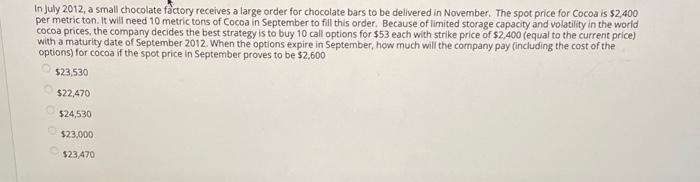

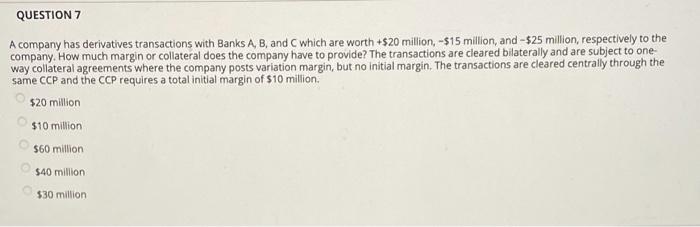

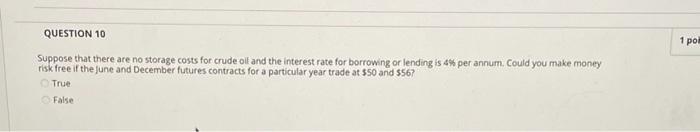

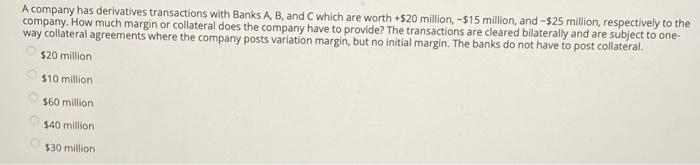

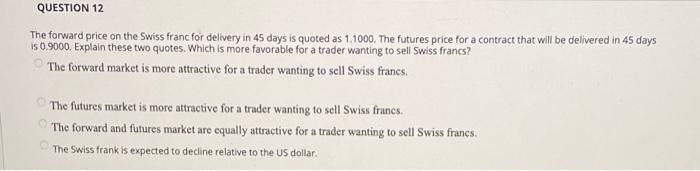

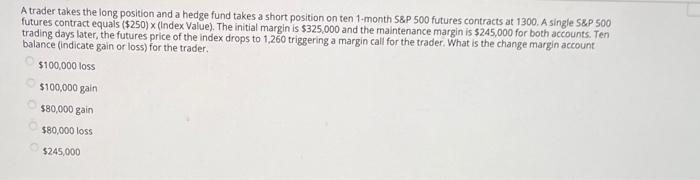

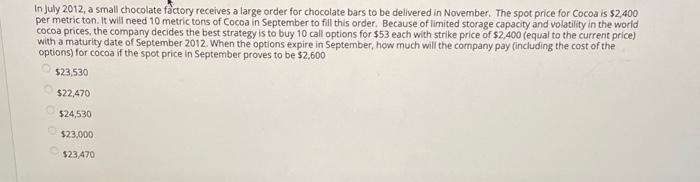

QUESTION 7 A company has derivatives transactions with Banks A, B, and C which are worth +$20 million, -$15 million, and - $25 million, respectively to the company. How much margin or collateral does the company have to provide? The transactions are cleared bilaterally and are subject to one way collateral agreements where the company posts variation margin, but no initial margin. The transactions are cleared centrally through the same CCP and the CCP requires a total initial margin of $10 million. $20 million $10 million $60 million $40 million $30 million 1 por QUESTION 10 Suppose that there are no storage costs for crude oil and the interest rate for borrowing or lending is 4% per annum. Could you make money risk free if the june and December futures contracts for a particular year trade at 350 and 5567 True False A company has derivatives transactions with Banks A, B, and C which are worth +$20 million, -$15 million, and -$25 million, respectively to the company. How much margin or collateral does the company have to provide? The transactions are cleared bilaterally and are subject to one- way collateral agreements where the company posts variation margin, but no initial margin. The banks do not have to post collateral. $20 million $10 million $60 million $40 million $30 million QUESTION 12 The forward price on the Swiss franc for delivery in 45 days is quoted as 1.1000. The futures price for a contract that will be delivered in 45 days 150.9000. Explain these two quotes. Which is more favorable for a trader wanting to sell Swiss francs? The forward market is more attractive for a trader wanting to sell Swiss francs. The futures market is more attractive for a trader wanting to sell Swiss francs. The forward and futures market are equally attractive for a trader wanting to sell Swiss francs. The Swiss frank is expected to decline relative to the US dollar. Atrader takes the long position and a hedge fund takes a short position on ten 1-month S&P 500 futures contracts at 1300. A single S&P 500 futures contract equals ($250) x (Index Value). The initial margin is $325,000 and the maintenance margin is $245,000 for both accounts. Ten trading days later, the futures price of the index drops to 1,260 triggering a margin call for the trader. What is the change margin account balance (indicate gain or loss) for the trader $100,000 loss $100,000 gain $80,000 gain $80,000 loss $245,000 In July 2012, a small chocolate factory receives a large order for chocolate bars to be delivered in November. The spot price for Cocoa s $2,400 per metric ton. It will need 10 metric tons of Cocoa in September to fill this order. Because of limited storage capacity and volatility in the world cocoa prices, the company decides the best strategy is to buy 10 call options for $53 each with strike price of $2,400 (equal to the current price) with a maturity date of September 2012. When the options expire in September, how much will the company pay (including the cost of the options) for cocoa if the spot price in September proves to be $2,600 $23,530 $22.470 $24,530 $23,000 $23.470

2)

3)

4)

5)

6)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started