Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) 2) 3) 4) 5) Magpie Corporation uses the total cost concept of product pricing. Below is the cost information for the production and sale

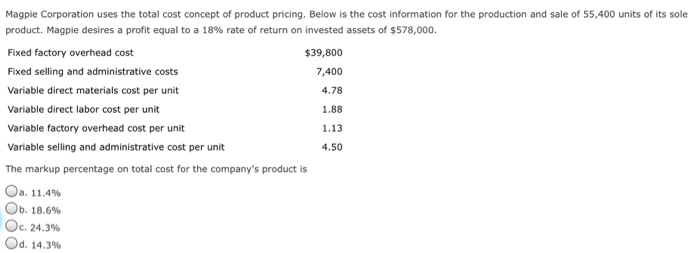

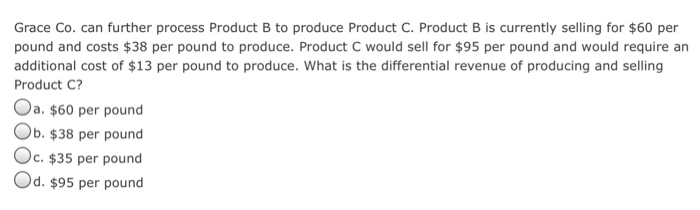

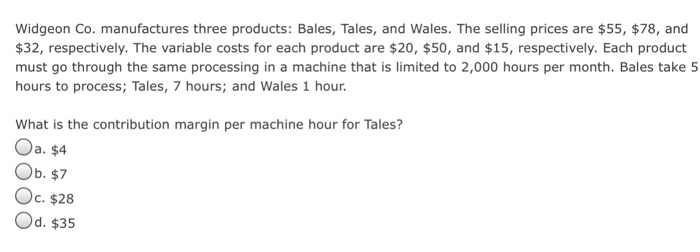

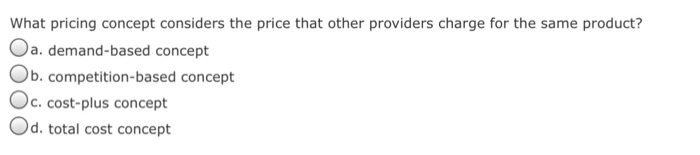

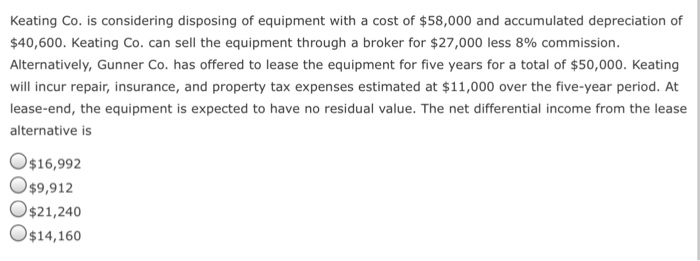

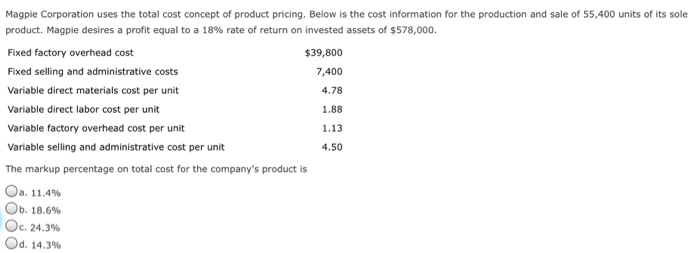

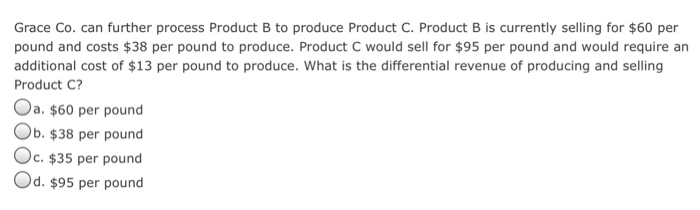

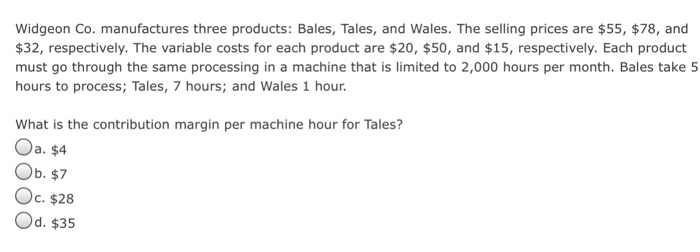

1)

Magpie Corporation uses the total cost concept of product pricing. Below is the cost information for the production and sale of 55,400 units of its sole product. Magpie desires a profit equal to a 18% rate of return on invested assets of $578,000. Fixed factory overhead cost Fixed selling and administrative costs Variable direct materials cost per unit Variable direct labor cost per unit Variable factory overhead cost per unit Variable selling and administrative cost per unit The markup percentage on total cost for the company's product is $39,800 7,400 4.78 1.88 1.13 4.50 a. 11.4% b. 18.6% , 24.3% od, 14.3% Grace Co. can further process Product B to produce Product C. Product B is currently selling for $60 per pound and costs $38 per pound to produce. Product C would sell for $95 per pound and would require an additional cost of $13 per pound to produce. What is the differential revenue of producing and selling Product C? Oa. $60 per pound Ob. $38 per pound Oc. $35 per pound Od. $95 per pound Widgeon Co. manufactures three products: Bales, Tales, and Wales. The selling prices are $55, $78, and $32, respectively. The variable costs for each product are $20, $50, and $15, respectively. Each product must go through the same processing in a machine that is limited to 2,000 hours per month. Bales take 5 hours to process; Tales, 7 hours; and Wales 1 hour. What is the contribution margin per machine hour for Tales? Oa. $4 Ob. $7 Oc. $28 Od. $35 What pricing concept considers the price that other providers charge for the same product? Oa. demand-based concept Ob. competition-based concept c.cost-plus concept Od. total cost concept Keating Co. is considering disposing of equipment with a cost of $58,000 and accumulated depreciation of $40,600, Keating Co. can sell the equipment through a broker for $27,000 less 8% commission. Alternatively, Gunner Co. has offered to lease the equipment for five years for a total of $50,000. Keating will incur repair, insurance, and property tax expenses estimated at $11,000 over the five-year period. At lease-end, the equipment is expected to have no residual value. The net differential income from the lease alternative is O$16,992 o$9,912 O$21,240 O$14,160

2)

3)

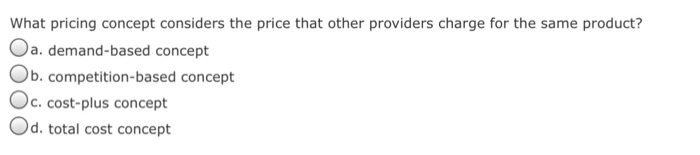

4)

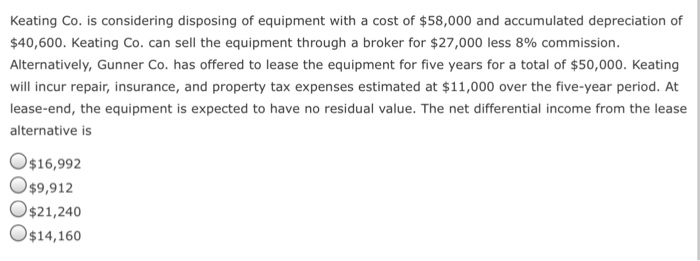

5)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started