Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. 2. 3. 4 5 Required information [The following information applies to the questions displayed below. Clopack Company manufactures one product that goes through one

1.

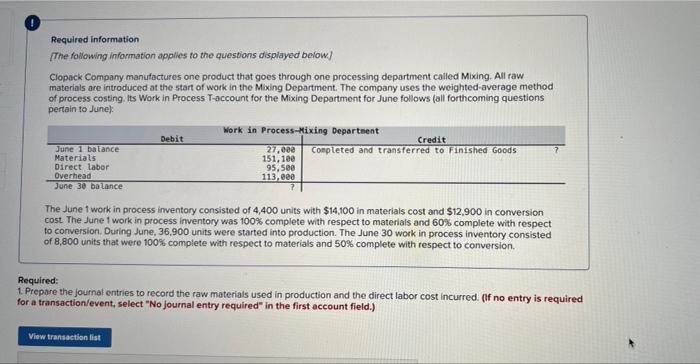

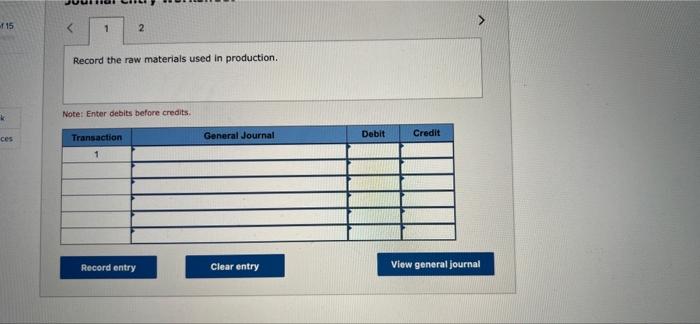

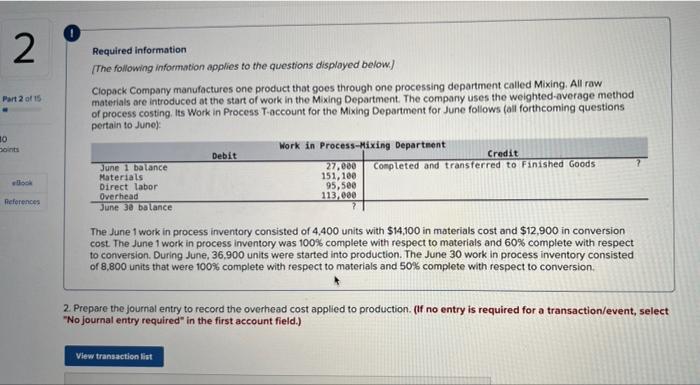

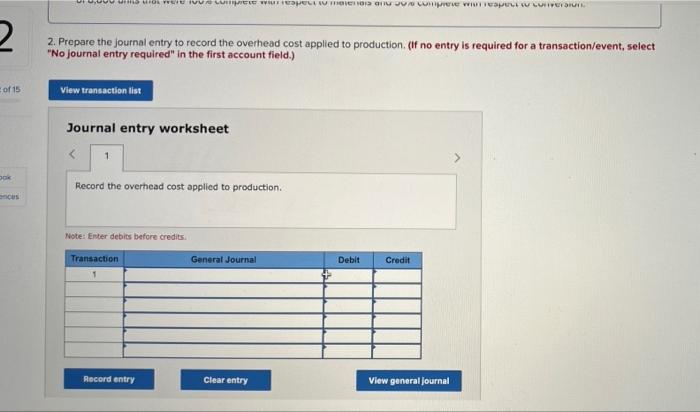

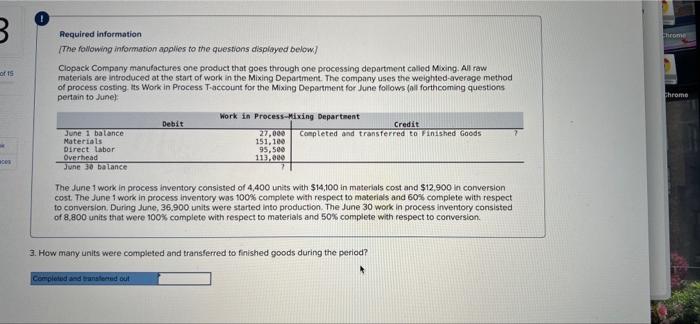

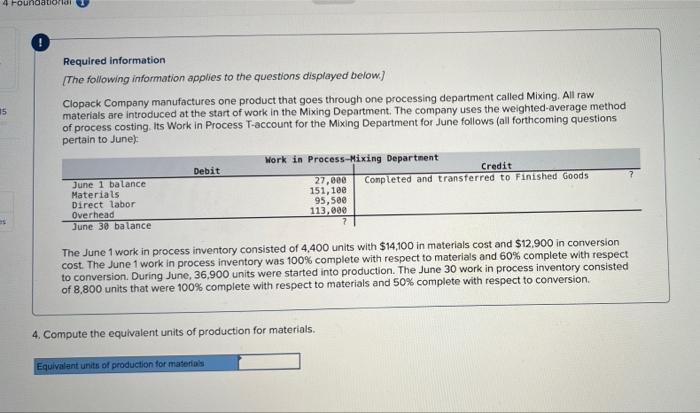

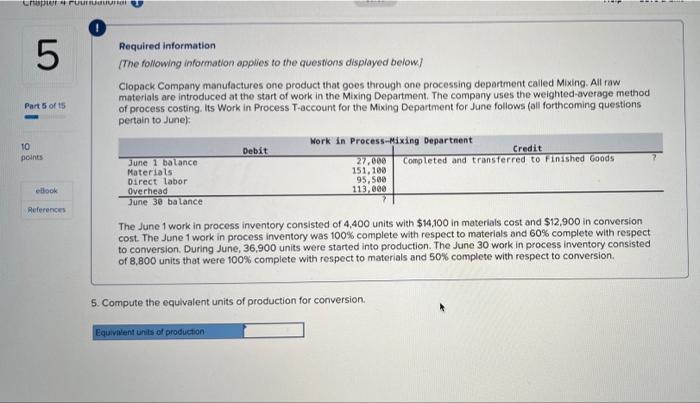

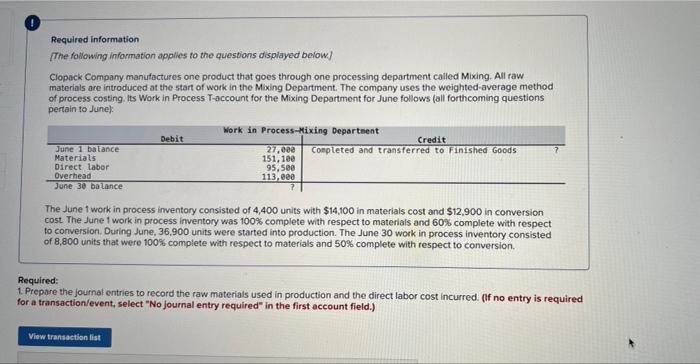

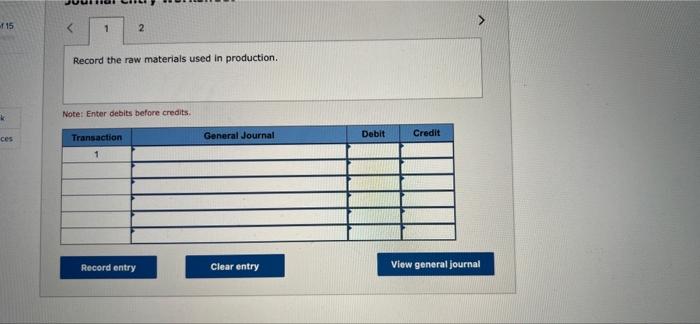

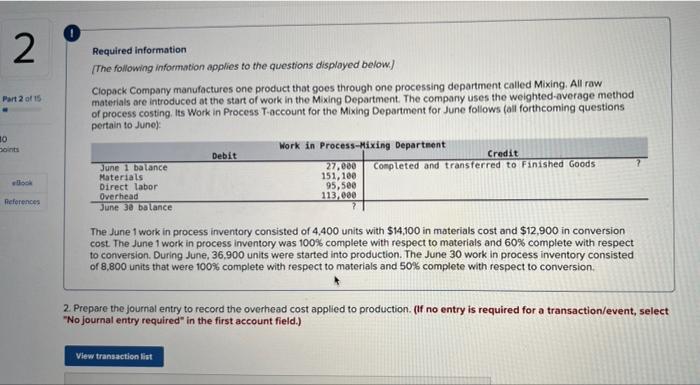

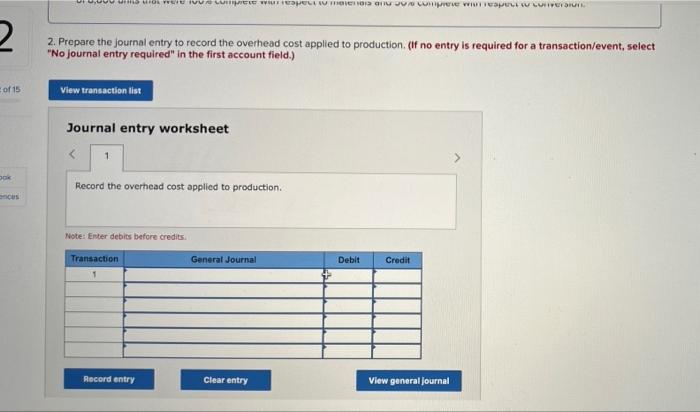

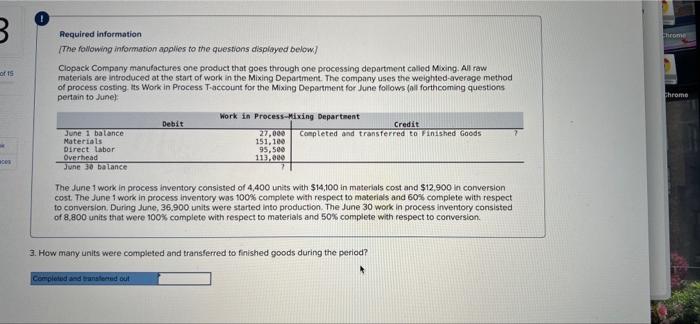

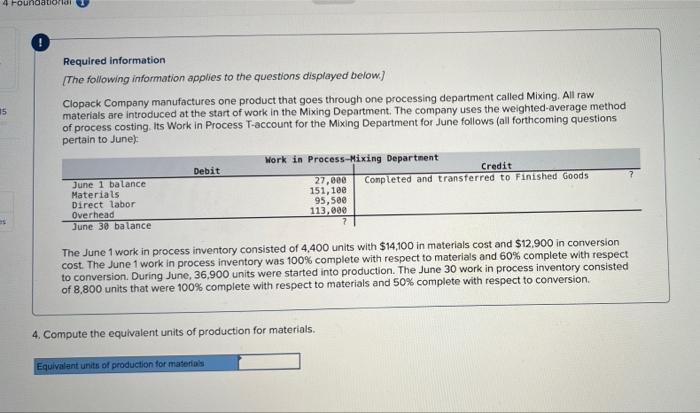

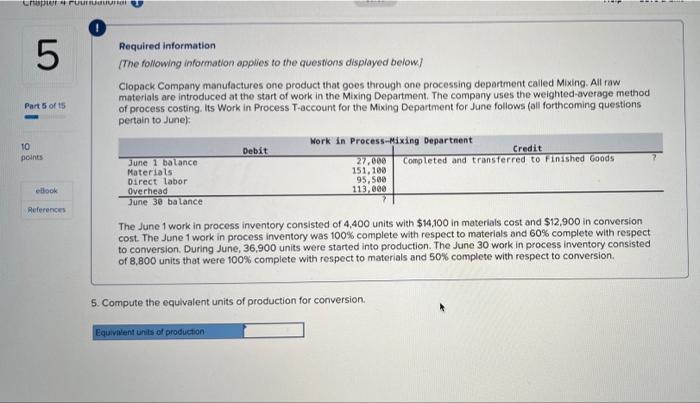

Required information [The following information applies to the questions displayed below. Clopack Company manufactures one product that goes through one processing department called Mixing. All raw materials are introduced at the start of work in the Mixing Department. The company uses the weighted-average method of process costing. Its Work in Process T-account for the Mixing Department for June follows (all forthcoming questions pertain to June): June 1 balance Materials Direct labor Overhead June 30 balance Debit Work in Process-Mixing Department View transaction list Credit 27,000 Completed and transferred to Finished Goods 151,100 95,500 113,000 The June 1 work in process inventory consisted of 4,400 units with $14,100 in materials cost and $12,900 in conversion cost. The June 1 work in process inventory was 100% complete with respect to materials and 60% complete with respect to conversion. During June, 36,900 units were started into production. The June 30 work in process inventory consisted of 8,800 units that were 100% complete with respect to materials and 50% complete with respect to conversion. Required: 1. Prepare the journal entries to record the raw materials used in production and the direct labor cost incurred. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 15 k ces 1 2 Record the raw materials used in production. Note: Enter debits before credits. Transaction 1 Record entry General Journal Clear entry Debit Credit View general journal 2 Part 2 of 15 10 ellook References Required information [The following information applies to the questions displayed below.) Clopack Company manufactures one product that goes through one processing department called Mixing. All raw materials are introduced at the start of work in the Mixing Department. The company uses the weighted-average method of process costing. Its Work in Process T-account for the Mixing Department for June follows (all forthcoming questions pertain to June): June 1 balance Materials Direct labor Overhead June 30 balance Debit Work in Process-Mixing Department View transaction list 27,000 151, 100 95,500 113,000 Credit Completed and transferred to Finished Goods ? The June 1 work in process inventory consisted of 4,400 units with $14,100 in materials cost and $12,900 in conversion cost. The June 1 work in process inventory was 100% complete with respect to materials and 60% complete with respect to conversion. During June, 36,900 units were started into production. The June 30 work in process inventory consisted of 8,800 units that were 100% complete with respect to materials and 50% complete with respect to conversion. 2. Prepare the journal entry to record the overhead cost applied to production. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 2 2. Prepare the journal entry to record the overhead cost applied to production. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) of 15 010,000 is id were le compte espect to main compete winneapeLL IN CURIER ook View transaction list Journal entry worksheet

2.

3.

4

5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started