1.

2.

3.

4.

5.

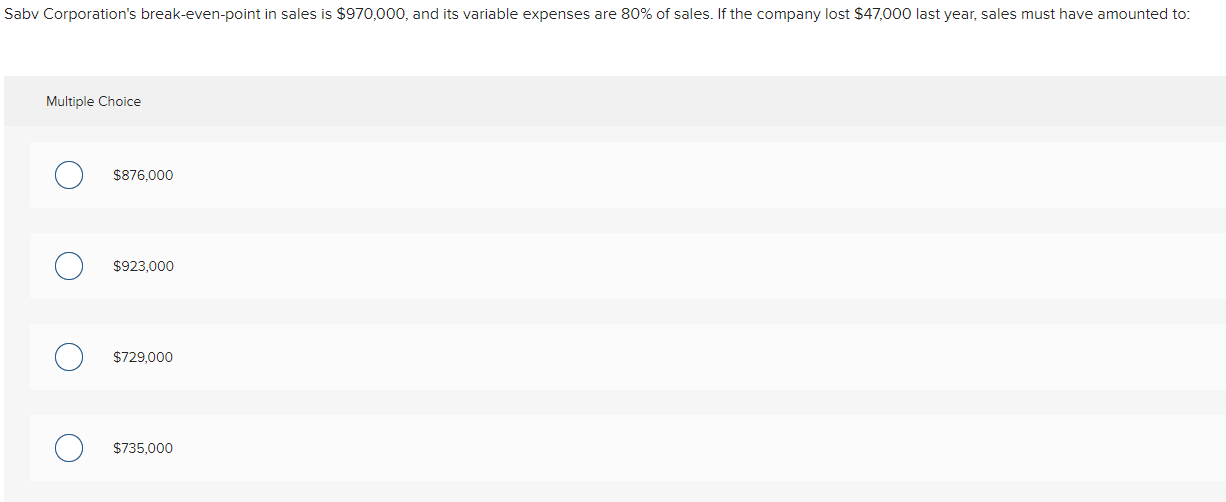

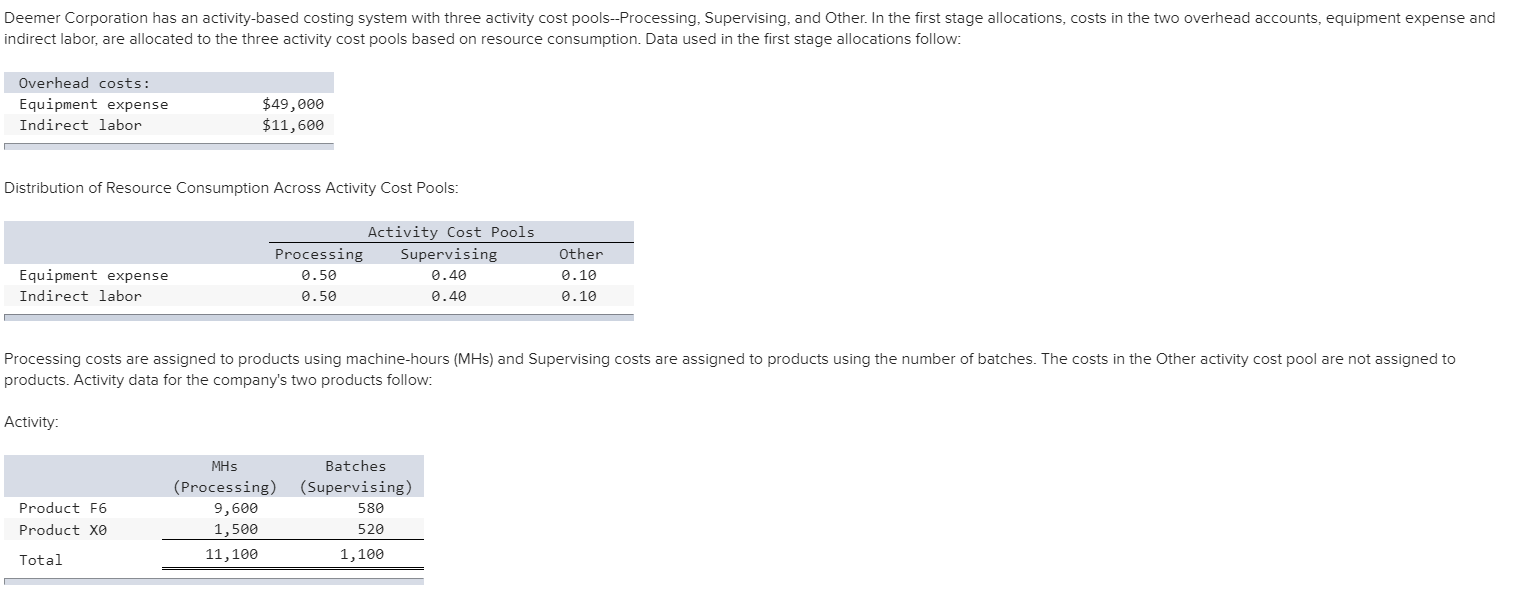

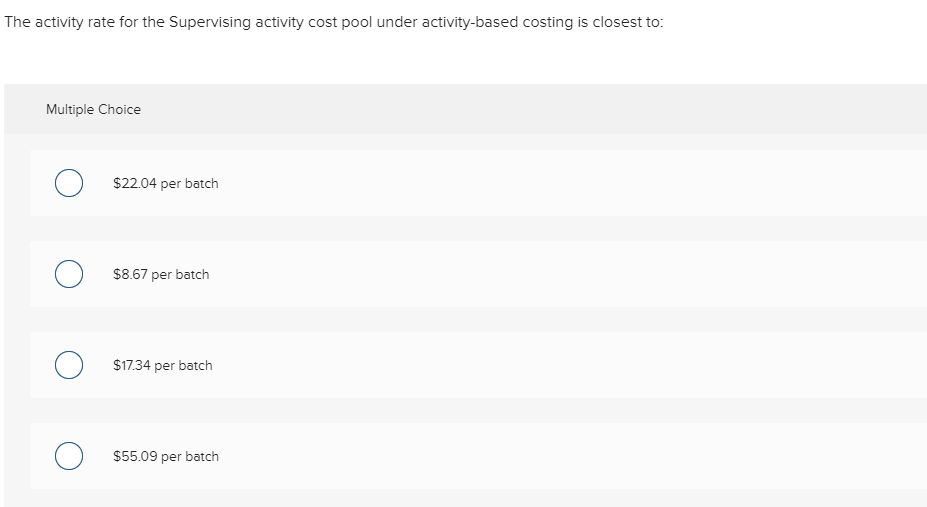

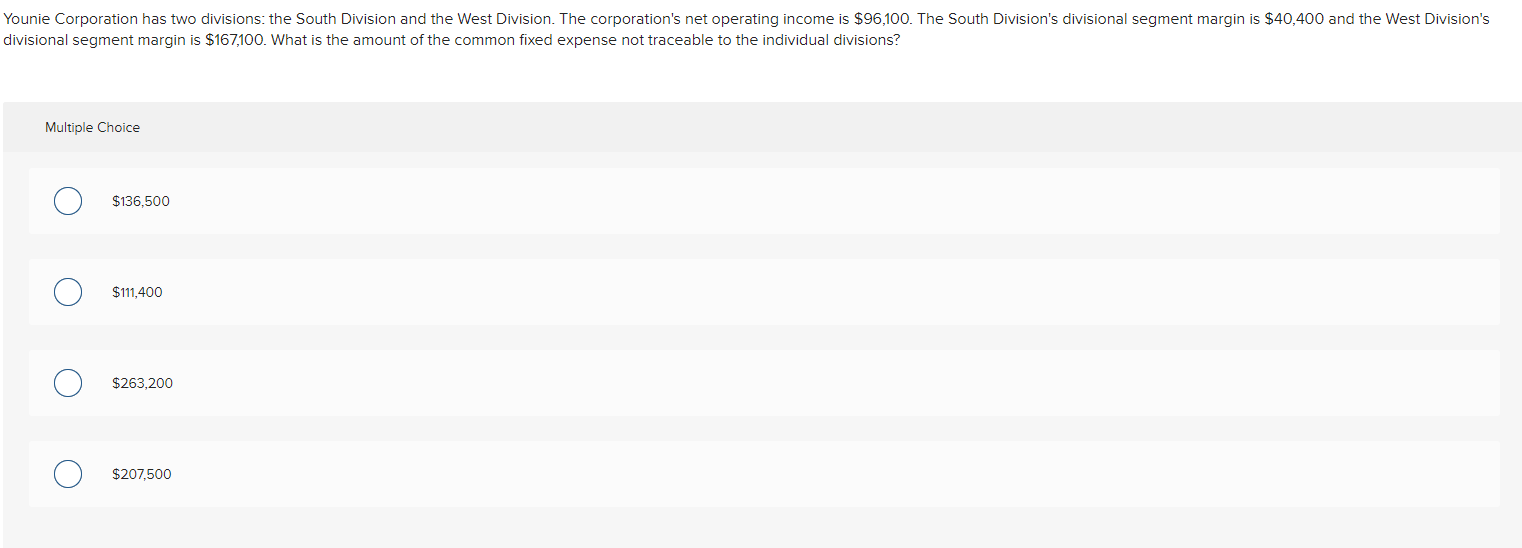

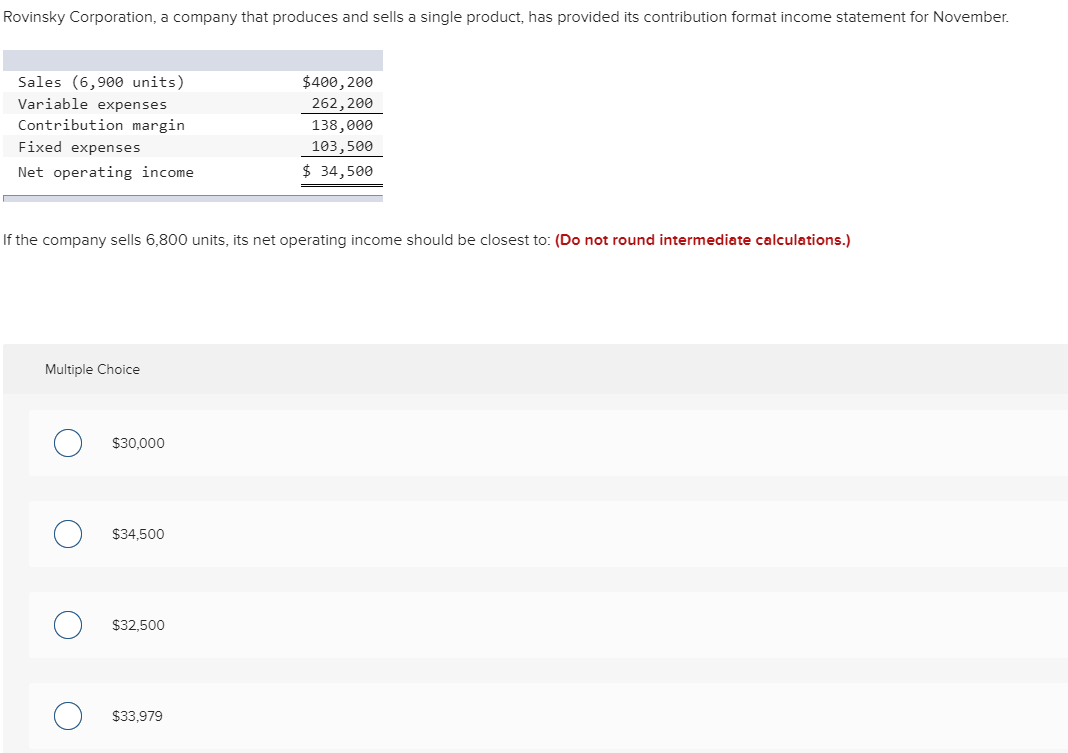

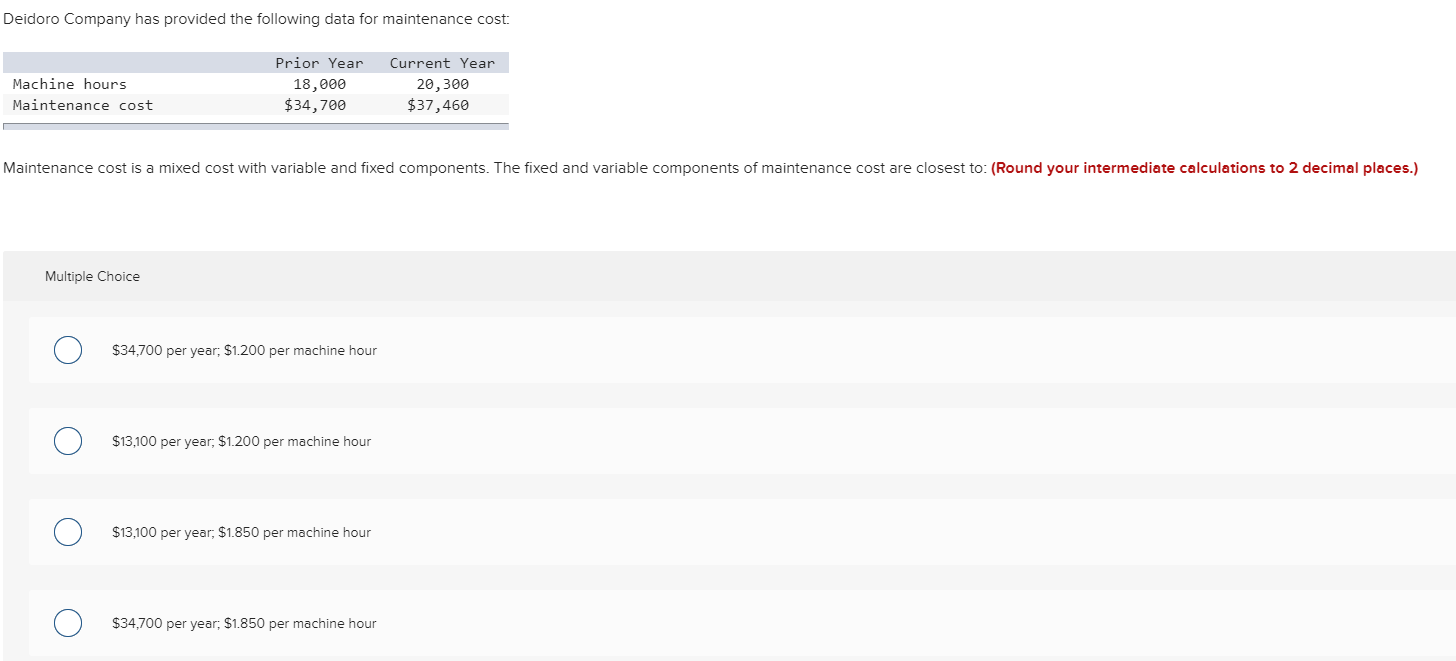

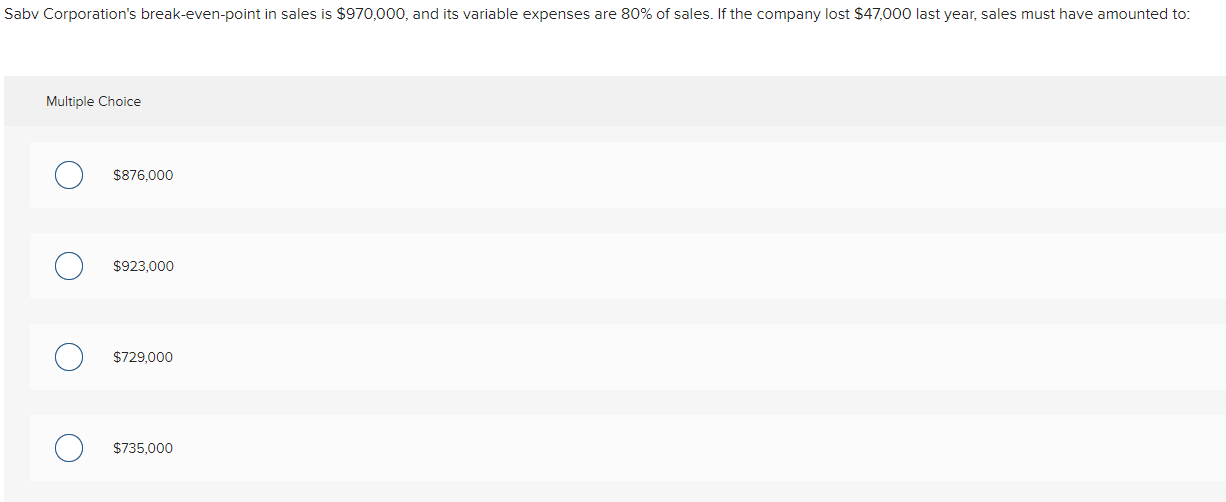

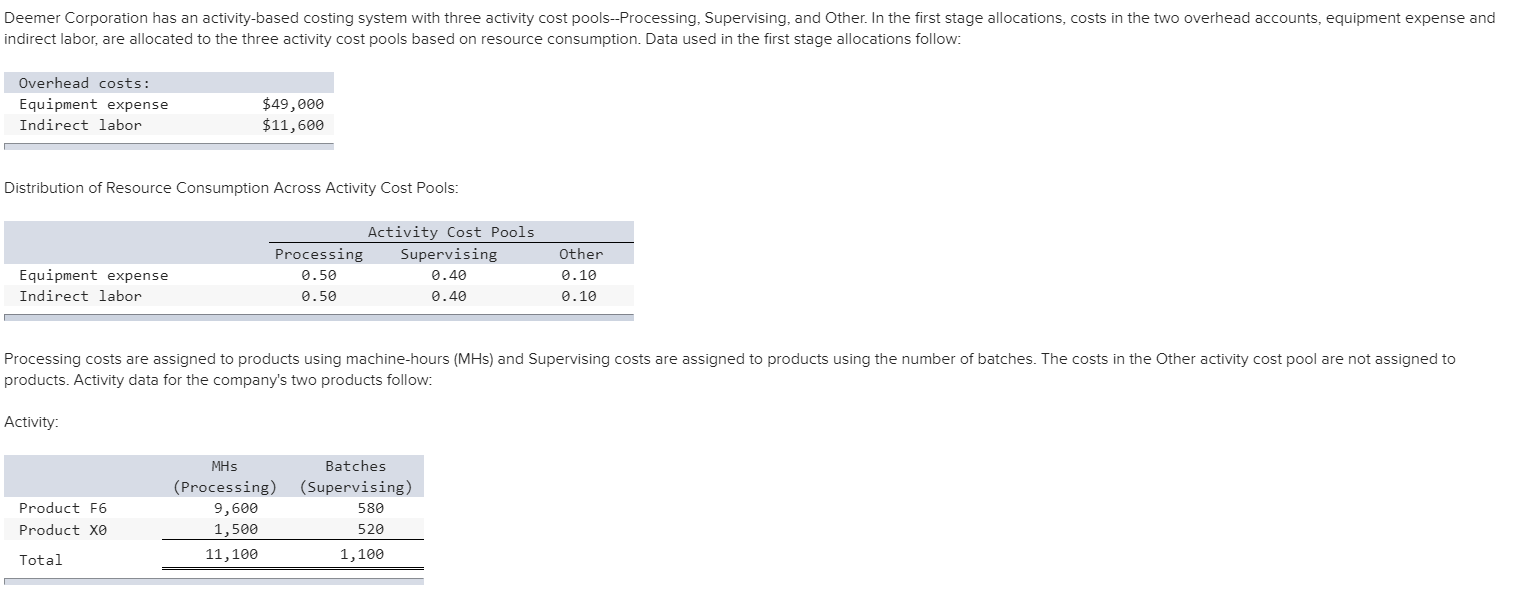

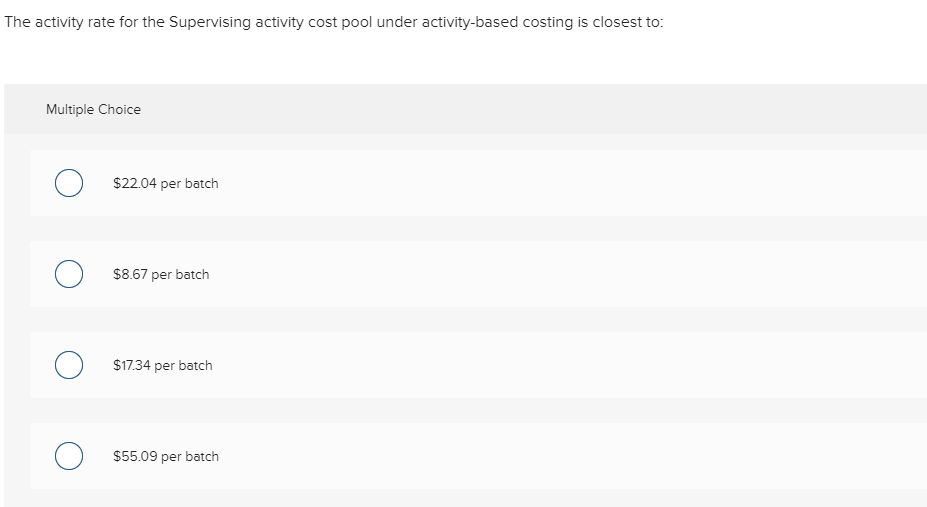

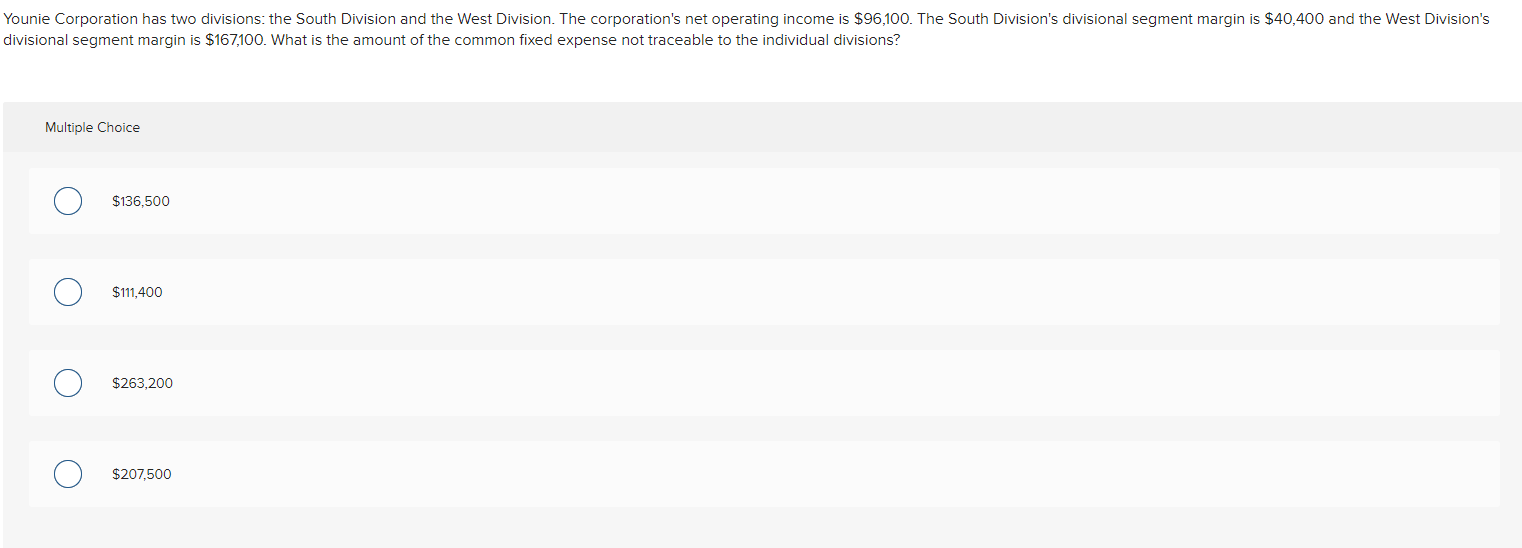

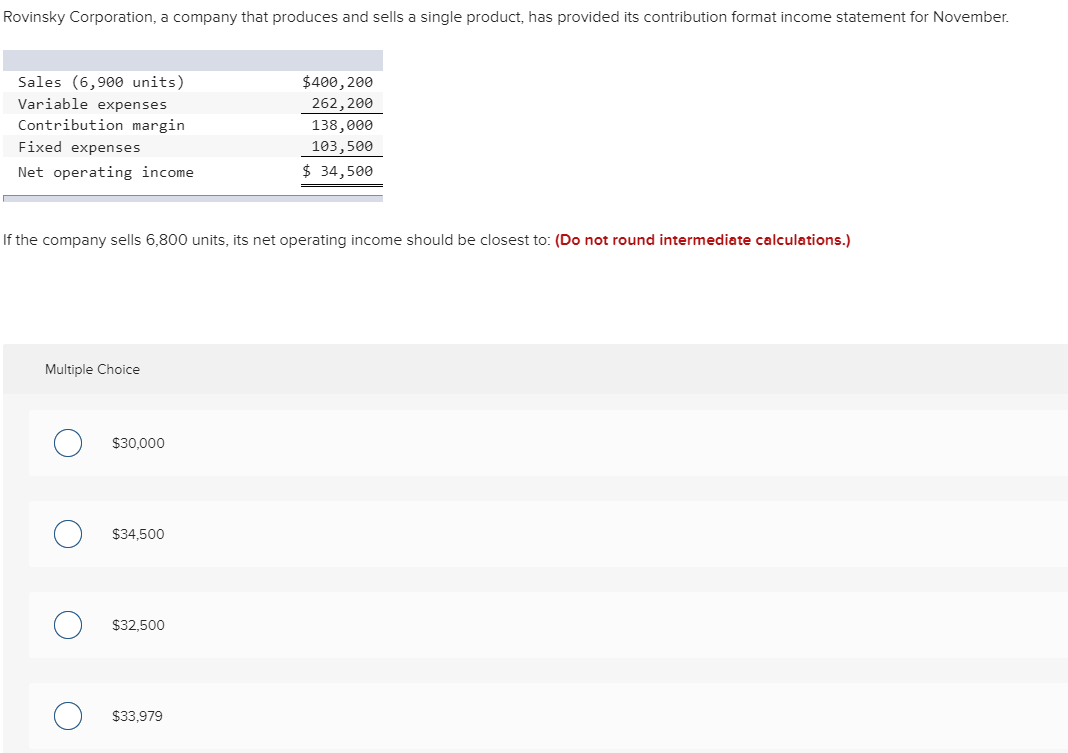

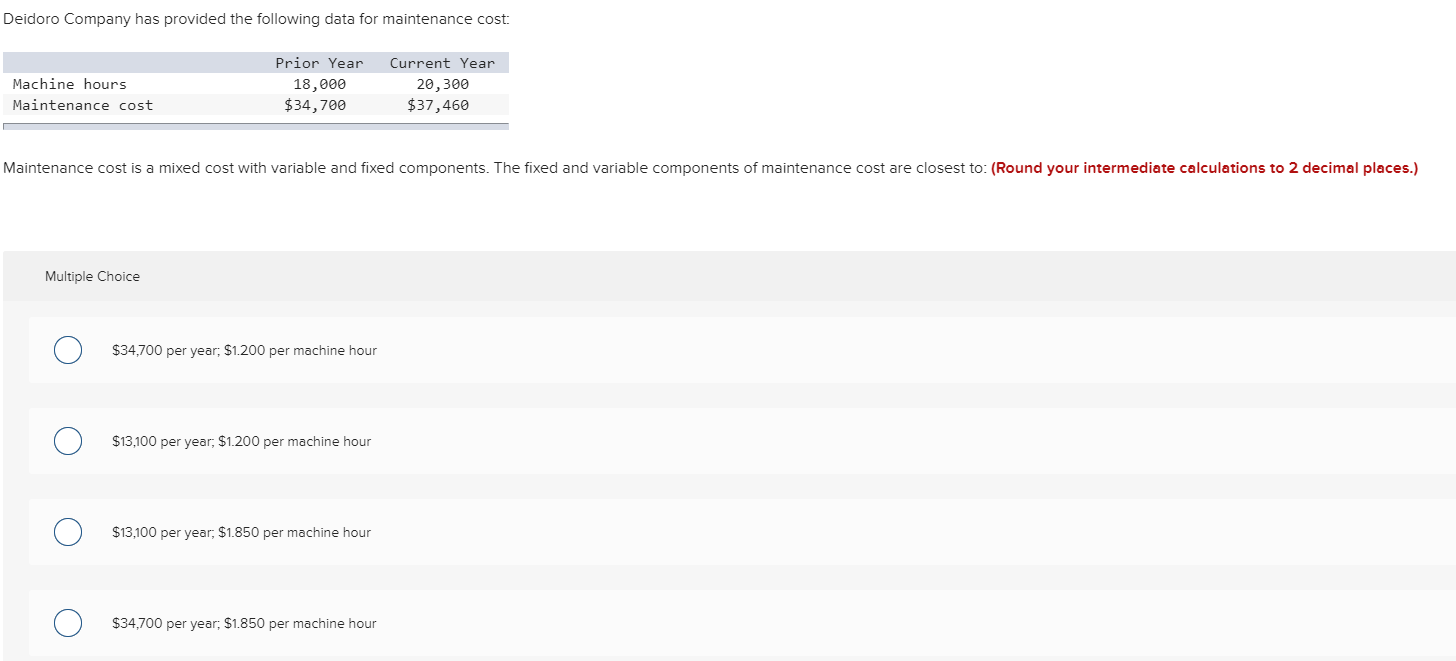

Saby Corporation's break-even-point in sales is $970,000, and its variable expenses are 80% of sales. If the company lost $47,000 last year, sales must have amounted to: Multiple Choice $876,000 $923,000 $729,000 O O $735,000 Deemer Corporation has an activity-based costing system with three activity cost pools--Processing, Supervising, and Other. In the first stage allocations, costs in the two overhead accounts, equipment expense and indirect labor, are allocated to the three activity cost pools based on resource consumption. Data used in the first stage allocations follow: Overhead costs: Equipment expense Indirect labor $49,000 $11,600 Distribution of Resource Consumption Across Activity Cost Pools: Equipment expense Indirect labor Activity Cost Pools Processing Supervising 0.50 0.40 0.50 0.40 Other 0.10 0.10 Processing costs are assigned to products using machine-hours (MHS) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow: Activity: Product F6 Product XO MHS (Processing) 9,600 1,500 11,100 Batches (Supervising) 580 520 1,100 Total The activity rate for the Supervising activity cost pool under activity-based costing is closest to: Multiple Choice 0 $22.04 per batch $8.67 per batch 0 $17.34 per batch $55.09 per batch Younie Corporation has two divisions: the South Division and the West Division. The corporation's net operating income is $96,100. The South Division's divisional segment margin is $40,400 and the West Division's divisional segment margin is $167,100. What is the amount of the common fixed expense not traceable to the individual divisions? Multiple Choice $136,500 O $111,400 O O $263,200 O $207,500 Rovinsky Corporation, a company that produces and sells a single product, has provided its contribution format income statement for November. Sales (6,900 units) Variable expenses Contribution margin Fixed expenses Net operating income $400,200 262,200 138,000 103,500 $ 34,500 If the company sells 6,800 units, its net operating income should be closest to: (Do not round intermediate calculations.) Multiple Choice O $30.000 O $34,500 $32,500 O $33,979 Deidoro Company has provided the following data for maintenance cost: Machine hours Maintenance cost Prior Year 18,000 $34,700 Current Year 20,300 $37,460 Maintenance cost is a mixed cost with variable and fixed components. The fixed and variable components of maintenance cost are closest to: (Round your intermediate calculations to 2 decimal places.) Multiple Choice $34,700 per year; $1.200 per machine hour O $13,100 per year, $1.200 per machine hour $13,100 per year, $1.850 per machine hour $34,700 per year, $1.850 per machine hour