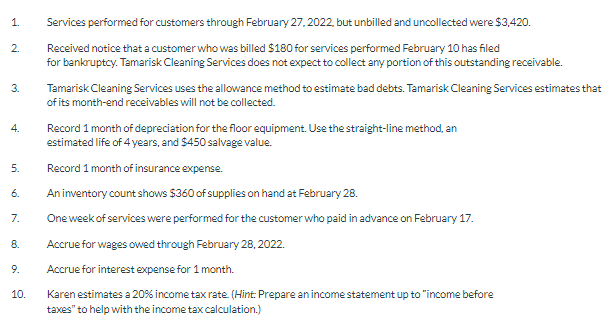

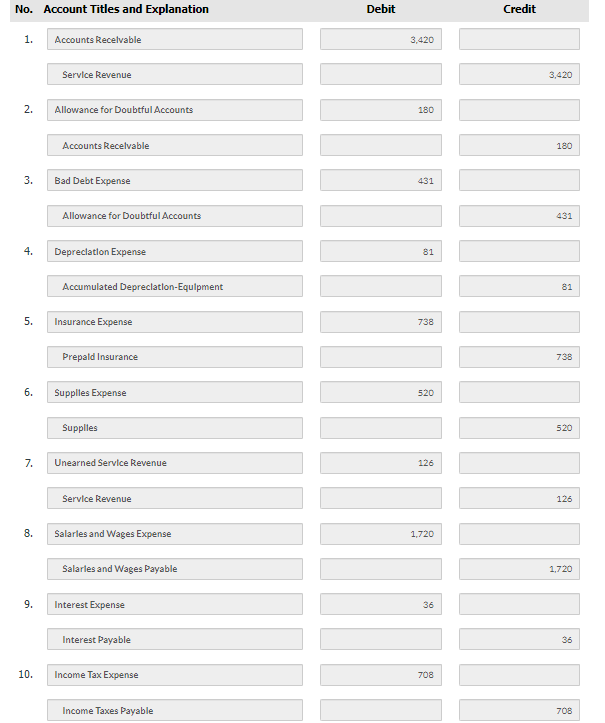

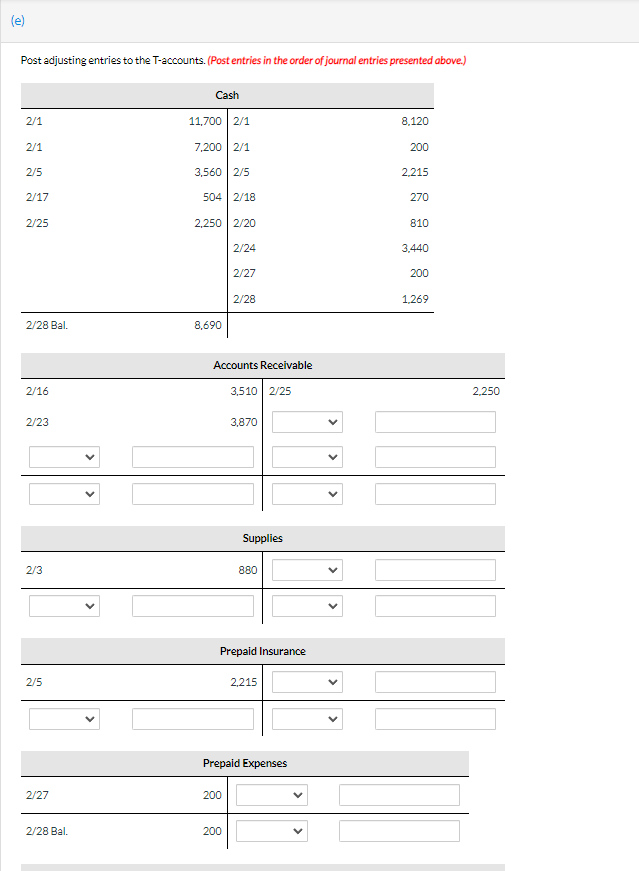

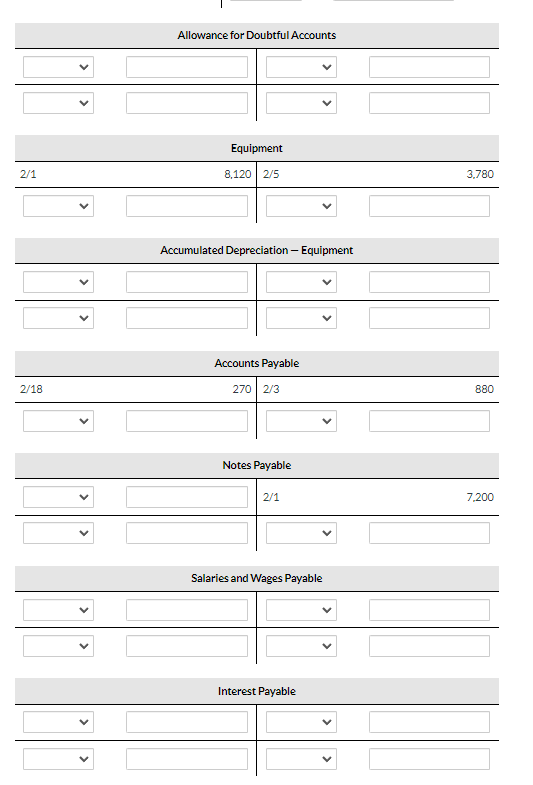

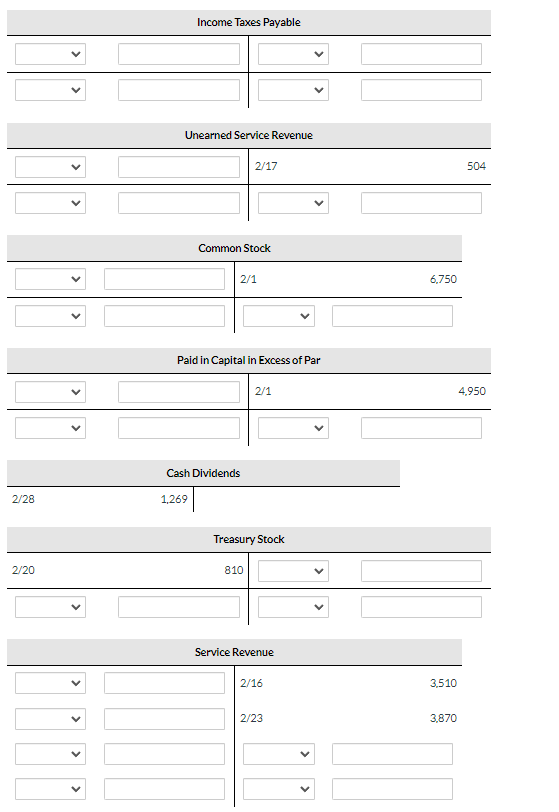

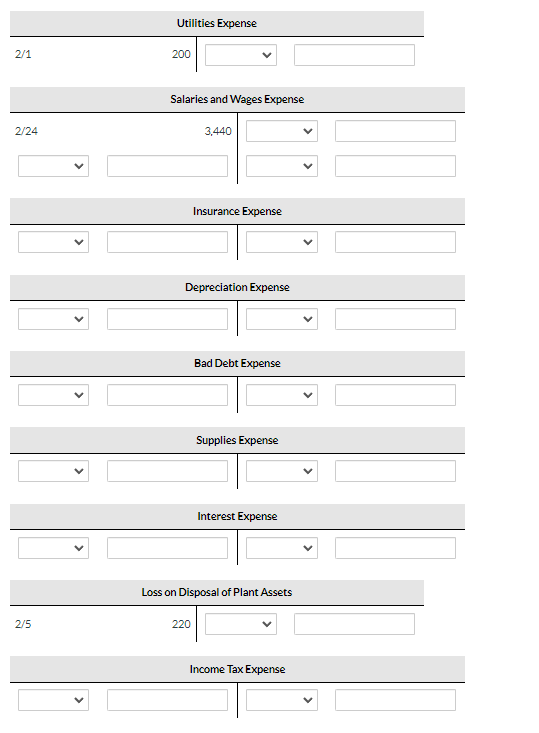

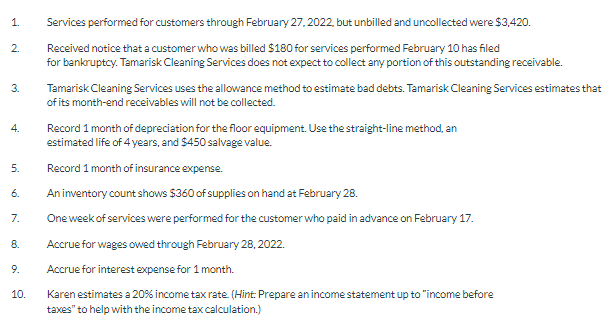

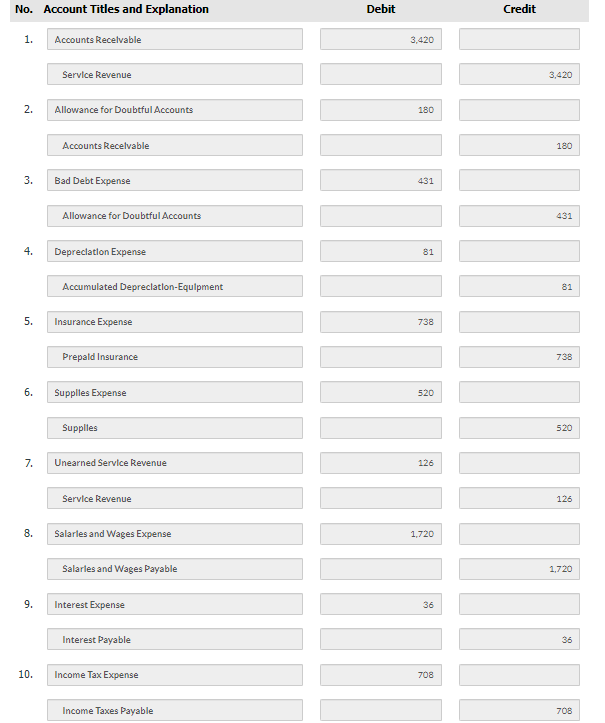

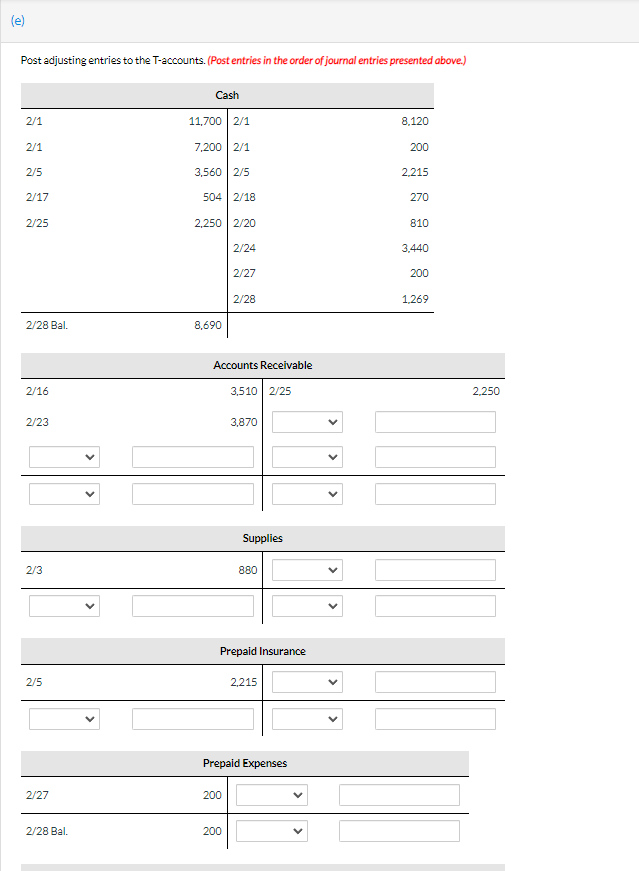

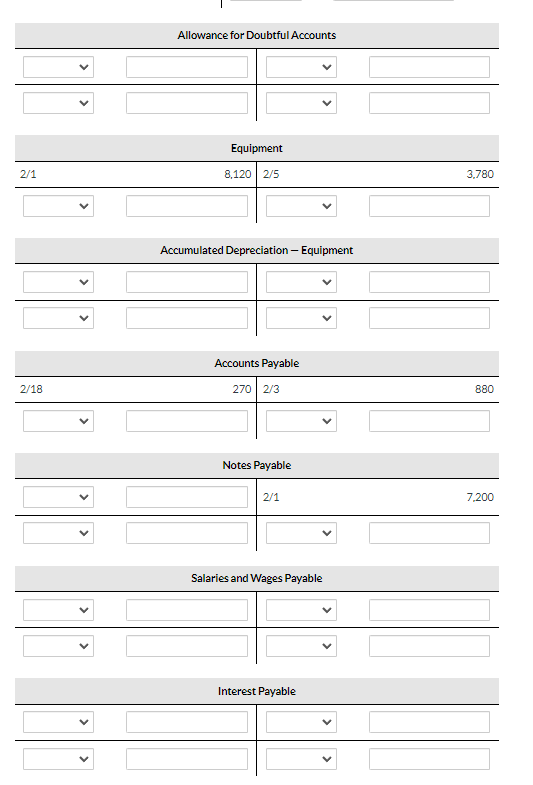

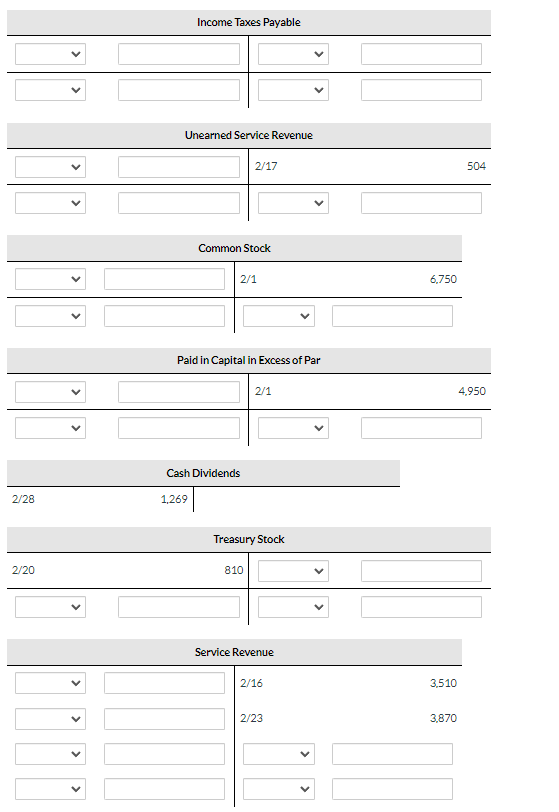

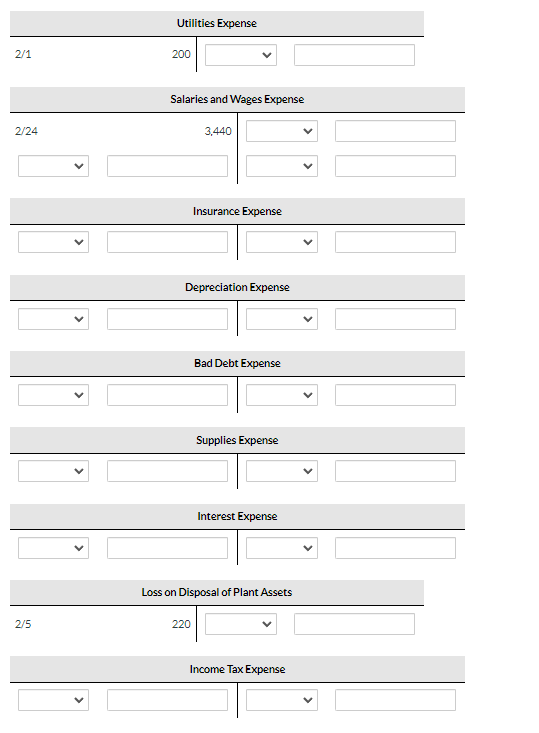

1. 2. 3. 4. 5. Services performed for customers through February 27.2022 but unbilled and uncollected were $3,420. Received notice that a customer who was billed $180 for services performed February 10 has filed for bankruptcy. Tamarisk Cleaning Services does not expect to collect any portion of this outstanding receivable. Tamarisk Cleaning Services uses the allowance method to estimate bad debts. Tamarisk Cleaning Services estimates that of its month-end receivables will not be collected. Record 1 month of depreciation for the floor equipment. Use the straight-line method, an estimated life of 4 years, and $450 salvage value. Record 1 month of insurance expense. An inventory count shows $360 of supplies on hand at February 28. One week of services were performed for the customer who paid in advance on February 17. Accrue for wages owed through February 28,2022. Accrue for interest expense for 1 month. Karen estimates a 20% income tax rate. (Hint: Prepare an income statement up to "income before taxes" to help with the income tax calculation.) 6. 7. B. 9. 10. No. Account Titles and Explanation Debit Credit 1. Accounts Receivable 3,420 Service Revenue 3,420 2. Allowance for Doubtful Accounts 180 Accounts Receivable 180 3. Bad Debt Expense 431 Allowance for Doubtful Accounts 431 4. Depreciation Expense 81 Accumulated Depreciation-Equipment 81 5. Insurance Expense 738 Prepaid Insurance 738 6. Supplies Expense 520 Supplies 520 7. Unearned Service Revenue 126 Service Revenue 126 8. Salaries and Wages Expense 1,720 Salaries and Wages Payable 1,720 9. Interest Expense 36 Interest Payable 36 10. Income Tax Expense 708 Income Taxes Payable 708 le) Post adjusting entries to the T-accounts. (Post entries in the order of journal entries presented above.) Cash 11,700 2/1 2/1 8.120 2/1 7,200 2/1 200 2/5 3,560 2/5 2.215 2/17 5042/18 270 2/25 2.250 2/20 810 2/24 3,440 2/27 200 2/28 1.269 2/28 Bal. 8,690 Accounts Receivable 2/16 3,510 2/25 2.250 2/23 3,870 Supplies 2/3 880 Prepaid Insurance 2/5 2.215 Prepaid Expenses 2/27 200 2/28 Bal. 200 Allowance for Doubtful Accounts Equipment 2/1 8.120 2/5 3.780 Accumulated Depreciation - Equipment Accounts Payable 2/18 270 2/3 880 Notes Payable 2/1 7.200 Salaries and Wages Payable Interest Payable Income Taxes Payable Unearned Service Revenue 2/17 504 Common Stock 2/1 6.750 Paid in Capital in Excess of Par 2/1 4,950 Cash Dividends 2/28 1,269 Treasury Stock 2/20 810 Service Revenue 2/16 3,510 2/23 3,870