Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. 2 . 3. 4. 5. The next dividend payment by Hoffman, Inc., will be $2.65 per share. The dividends are anticipated to maintain a

1.

2

.

3.

4.

5.

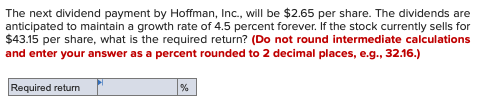

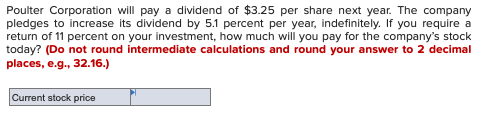

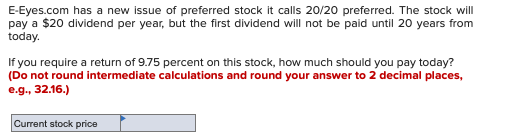

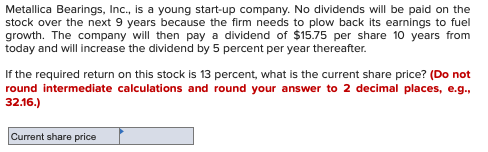

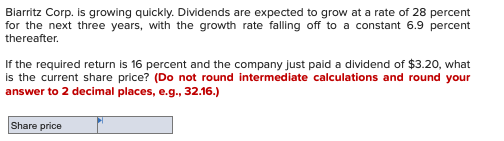

The next dividend payment by Hoffman, Inc., will be $2.65 per share. The dividends are anticipated to maintain a growth rate of 4.5 percent forever. If the stock currently sells for $43.15 per share, what is the required return? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Required return Poulter Corporation will pay a dividend of $3.25 per share next year. The company pledges to increase its dividend by 5.1 percent per year, indefinitely. If you require a return of 11 percent on your investment, how much will you pay for the company's stock today? (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Current stock price E-Eyes.com has a new issue of preferred stock it calls 20/20 preferred. The stock will pay a $20 dividend per year, but the first dividend will not be paid until 20 years from today If you require a return of 9.75 percent on this stock, how much should you pay today? (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Current stock price Metallica Bearings, Inc., is a young start-up company. No dividends will be paid on the stock over the next 9 years because the firm needs to plow back its earnings to fuel growth. The company will then pay a dividend of $15.75 per share 10 years from today and will increase the dividend by 5 percent per year thereafter. If the required return on this stock is 13 percent, what is the current share price? (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Current share price Biarritz Corp. is growing quickly. Dividends are expected to grow at a rate of 28 percent for the next three years, with the growth rate falling off to a constant 6.9 percent thereafter. If the required return is 16 percent and the company just paid a dividend of $3.20, what is the current share price? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Share price

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started