1.

2.

3.

4.

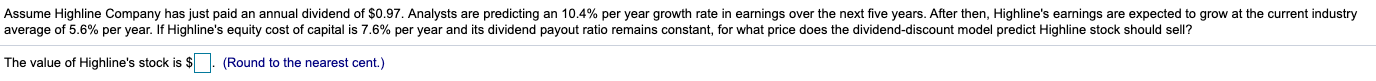

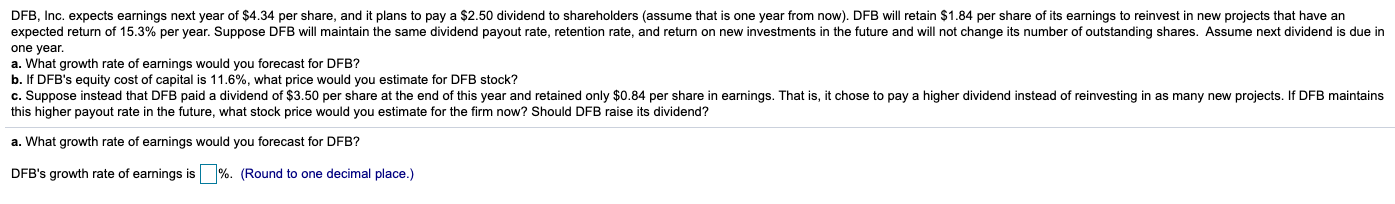

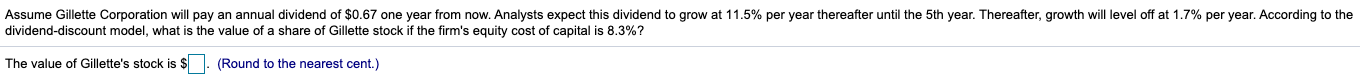

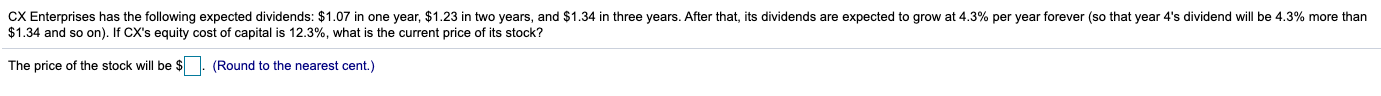

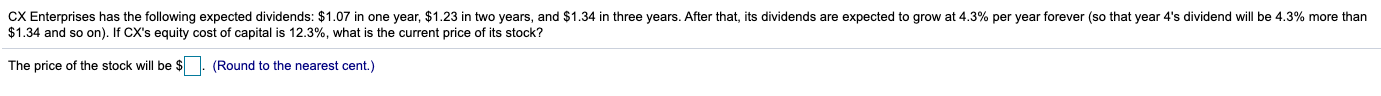

Assume Highline Company has just paid an annual dividend of $0.97. Analysts are predicting an 10.4% per year growth rate in earnings over the next five years. After then, Highline's earnings are expected to grow at the current industry average of 5.6% per year. If Highline's equity cost of capital is 7.6% per year and its dividend payout ratio remains constant, for what price does the dividend-discount model predict Highline stock should sell? The value of Highline's stock is $ (Round to the nearest cent.) DFB, Inc. expects earnings next year of $4.34 per share, and it plans to pay a $2.50 dividend to shareholders (assume that is one year from now). DFB will retain $1.84 per share of its earnings to reinvest in new projects that have an expected return of 15.3% per year. Suppose DFB will maintain the same dividend payout rate, retention rate, and return on new investments in the future and will not change its number of outstanding shares. Assume next dividend due in one year. a. What growth rate of earnings would you forecast for DFB? b. If DFB's equity cost of capital is 11.6%, what price would you estimate for DFB stock? c. Suppose instead that DFB paid a dividend of $3.50 per share at the end of this year and retained only $0.84 per share in earnings. That is, it chose to pay a higher dividend instead of reinvesting in as many new projects. If DFB maintains this higher payout rate in the future, what stock price would you estimate for the firm now? Should DFB raise its dividend? a. What growth rate of earnings would you forecast for DFB? DFB's growth rate of earnings is %. (Round to one decimal place.) Assume Gillette Corporation will pay an annual dividend of $0.67 one year from now. Analysts expect this dividend to grow at 11.5% per year thereafter until the 5th year. Thereafter, growth will level off at 1.7% per year. According to the dividend-discount model, what is the value of a share of Gillette stock if the firm's equity cost of capital is 8.3%? The value of Gillette's stock is $. (Round to the nearest cent.) CX Enterprises has the following expected dividends: $1.07 in one year, $1.23 in two years, and $1.34 in three years. After that, its dividends are expected to grow at 4.3% per year forever (so that year 4's dividend will be 4.3% more than $1.34 and so on). If CX's equity cost of capital is 12.3%, what is the current price of its stock? The price of the stock will be $ (Round to the nearest cent.)