Answered step by step

Verified Expert Solution

Question

1 Approved Answer

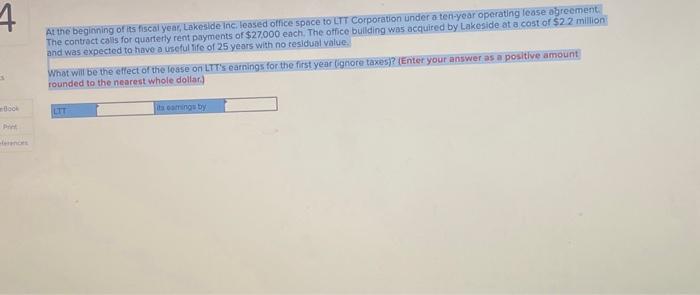

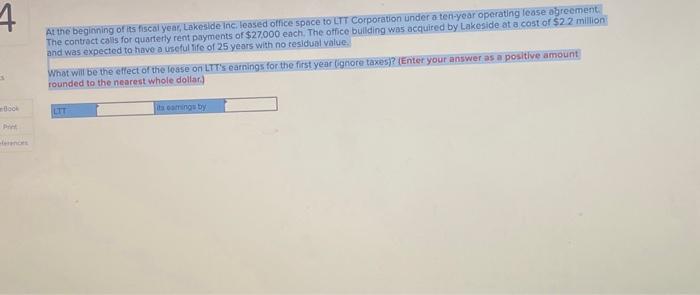

1- 2- 3- 4- At the begioning of tis fiscol yea, Lokeslde inc. leased office space to LTT Corporation under a ten-yoar operating lease agreement.

1-

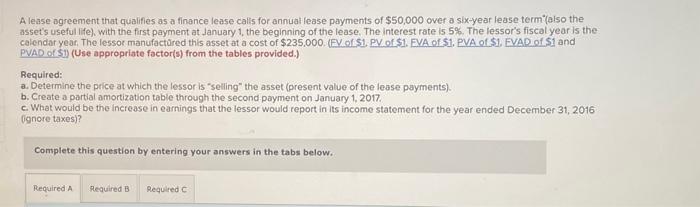

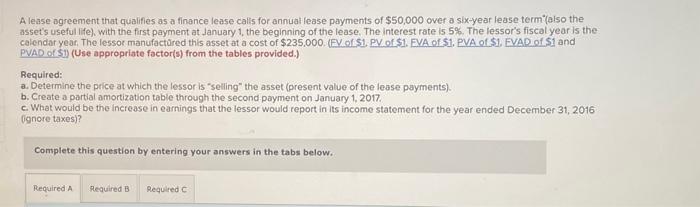

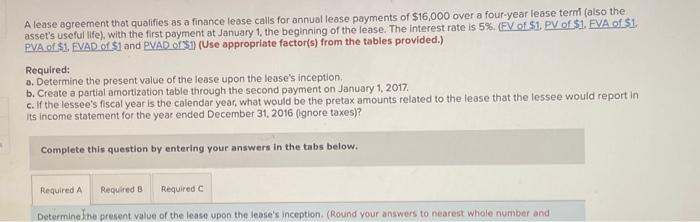

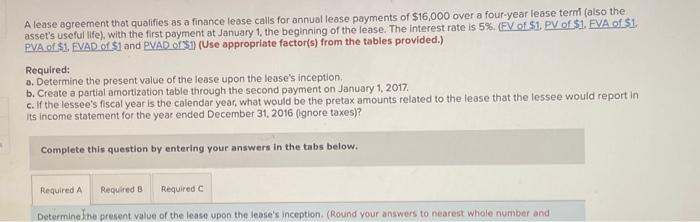

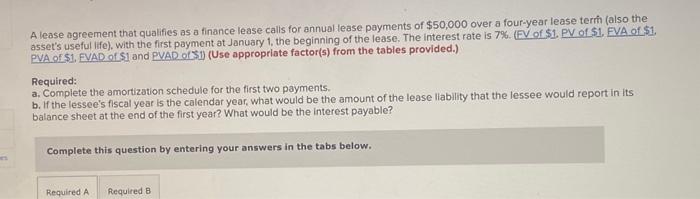

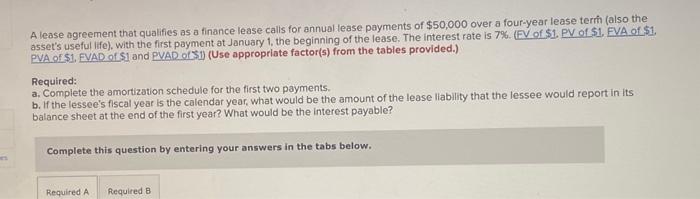

At the begioning of tis fiscol yea, Lokeslde inc. leased office space to LTT Corporation under a ten-yoar operating lease agreement. The contract colis for quarterly rent payments of $27,000 each. The office bullding was acquited by Lakoside at a cost of $22 million? and was expected to havo e usseful life of 25 years with no residual value. What will be the effect of the losse on LTTs earnings for the first year (ighore taxes)? (Enter your answer as a positive amount tounded to the nearest whole dollar) A lease agreement that qualifies as a finance lease calis for annual lease payments of $50,000 over a six-year lease term (also the asset's useful life), with the first payment at January 1, the beginning of the lease. The interest rate is 5%. The lessor's fiscal year is the calendar year, The lessor manufactured this asset at a cost of \$235,000. (EV of \$1. PV of \$1. EVA of \$1, PVA of \$1, EVAD of S1 and PVAD of Si) (Use appropriate factor(s) from the tables provided.) Required: a. Determine the price at which the lessor is "selling" the asset (present value of the lease payments). b. Create a partial amortization table through the second payment on January 1, 2017. c. What would be the increase in earnings that the lessor would report in its income statement for the year ended December 31,2016 (ignore taxes)? Complete this question by entering your answers in the tabs below. A lease agreement that qualifies as a finance lease calls for annual lease payments of $16,000 over a four-year lease termi (aiso the asset's useful life), with the first payment at January 1 , the beginning of the lease. The interest rate is 5%. (FV of S1, PV of \$1. FVA of S1, PVA of \$1, EVAD of \$1 and PVAD of'S1) (Use appropriate factor(s) from the tables provided.) Required: o. Determine the present value of the lease upon the lease's inception. b. Create a partial amortization table through the second payment on January 1, 2017. c. If the lessee's fiscal year is the calendar year, what would be the pretax amounts related to the lease that the lessee would report in its income statement for the year ended December 31, 2016 (ignore taxes)? Complete this question by entering your answers in the tabs below. A lease agreement that qualifies as a finance lease calls for annual lease payments of $50,000 over a four-year lease term (also the asset's useful life), with the first payment at January 1 , the beginning of the lease. The interest rate is 7%. (FV of $1. PV of $1, FVA of $1, PVA OF S1. EVAD of S1 and PVAD of (\$1) (Use appropriate factor(s) from the tables provided.) Required: a. Complete the amortization schedule for the first two payments. b. If the lessee's fiscal year is the calendar year, what would be the amount of the lease liablity that the lessee would report in its balance sheet at the end of the first year? What would be the interest payable? Complete this question by entering your answers in the tabs below

2-

3-

4-

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started