1.

2.

3.

4.

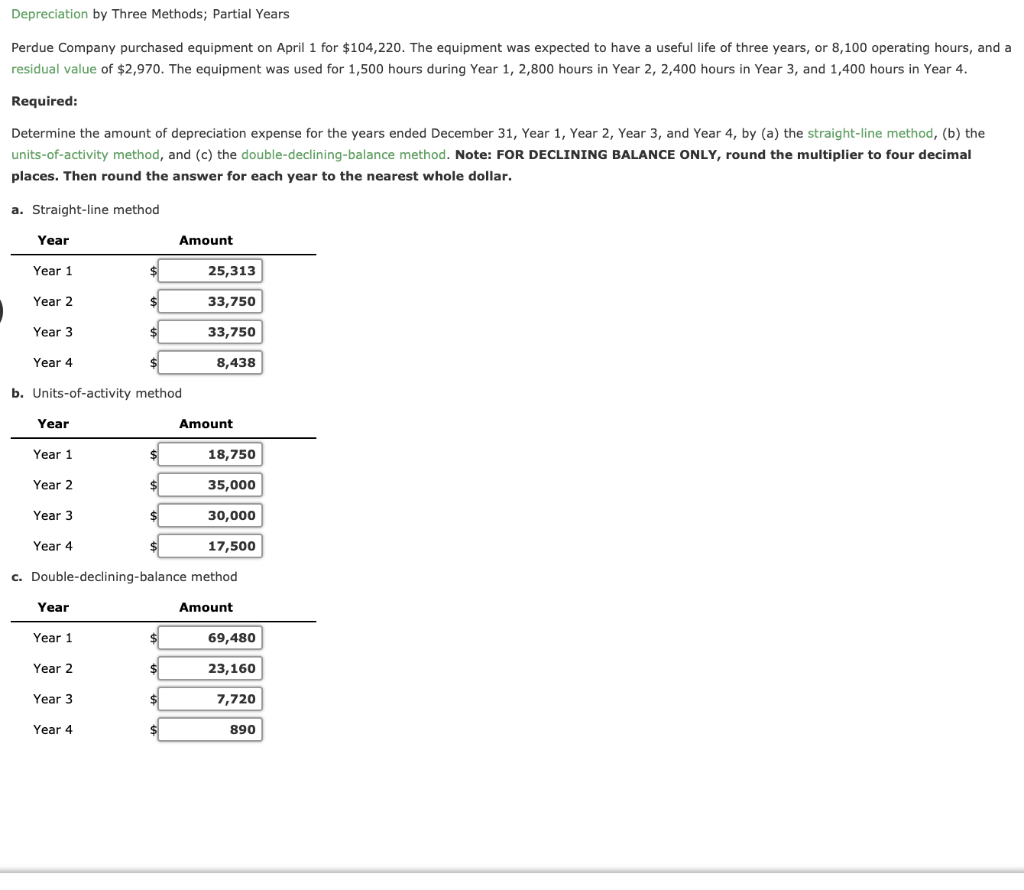

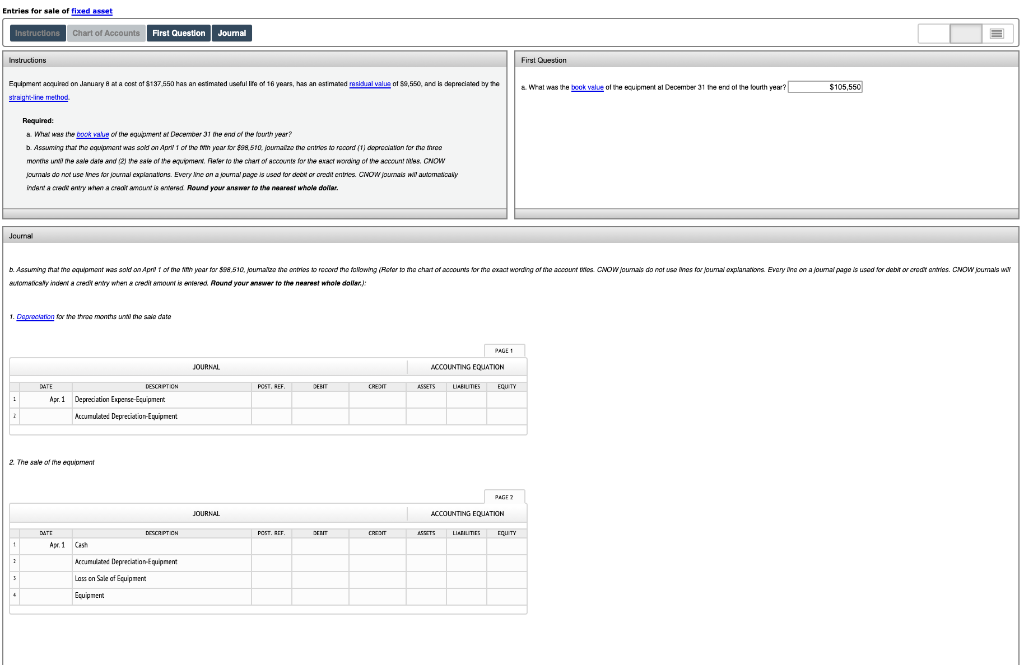

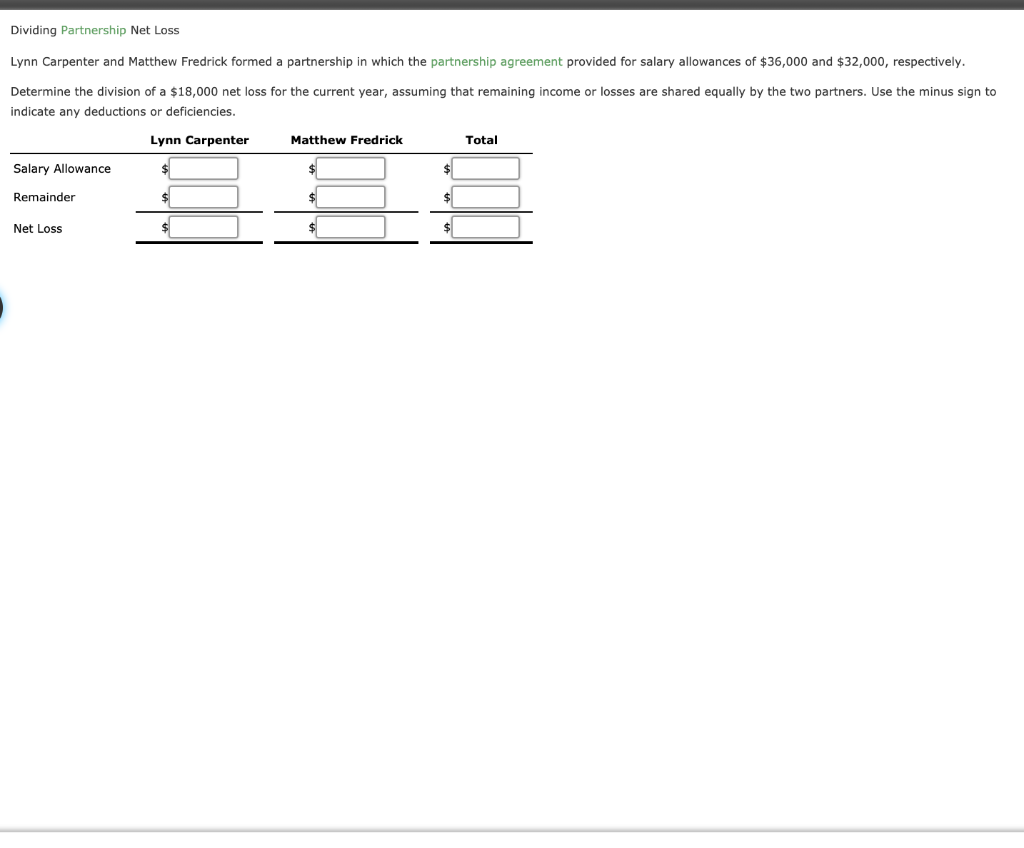

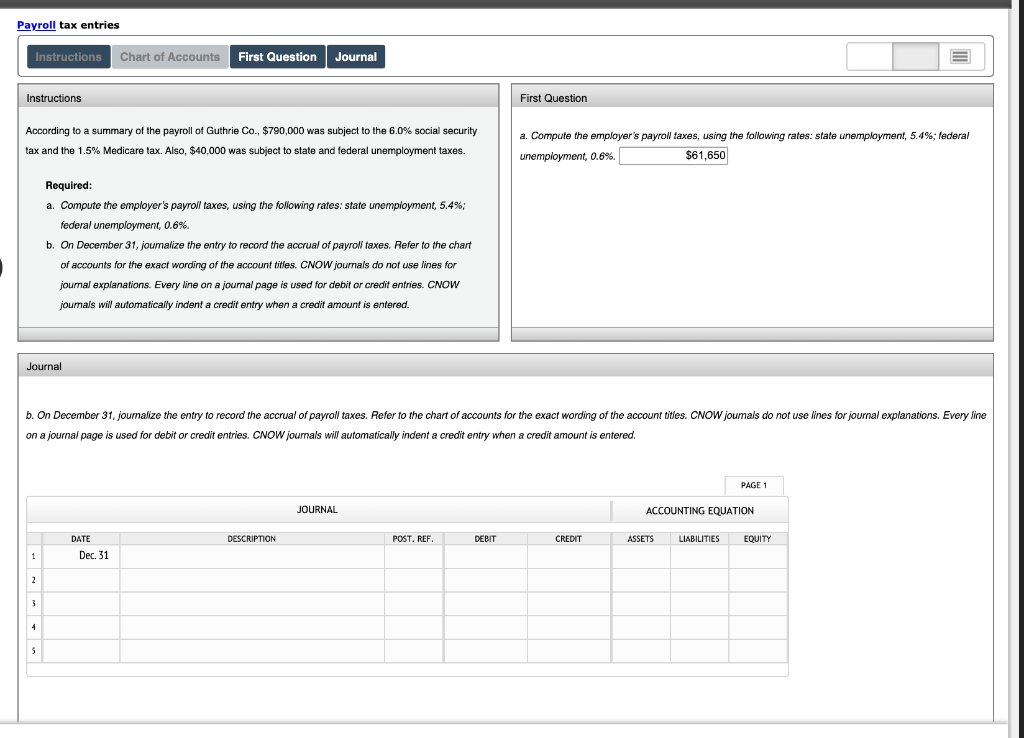

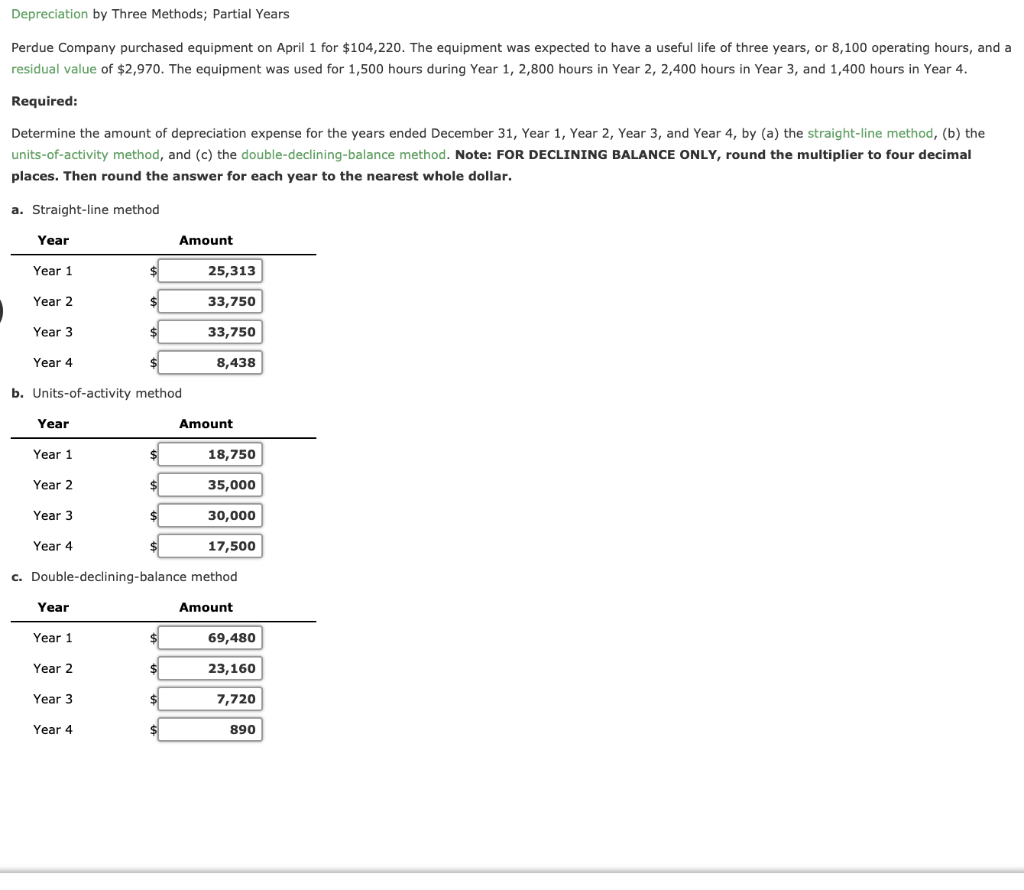

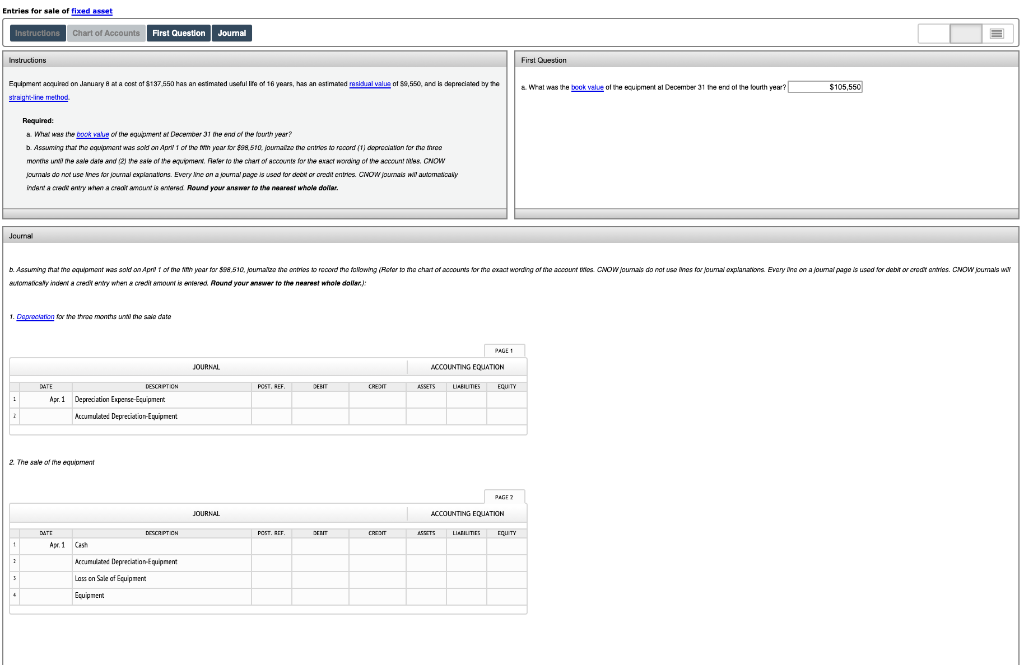

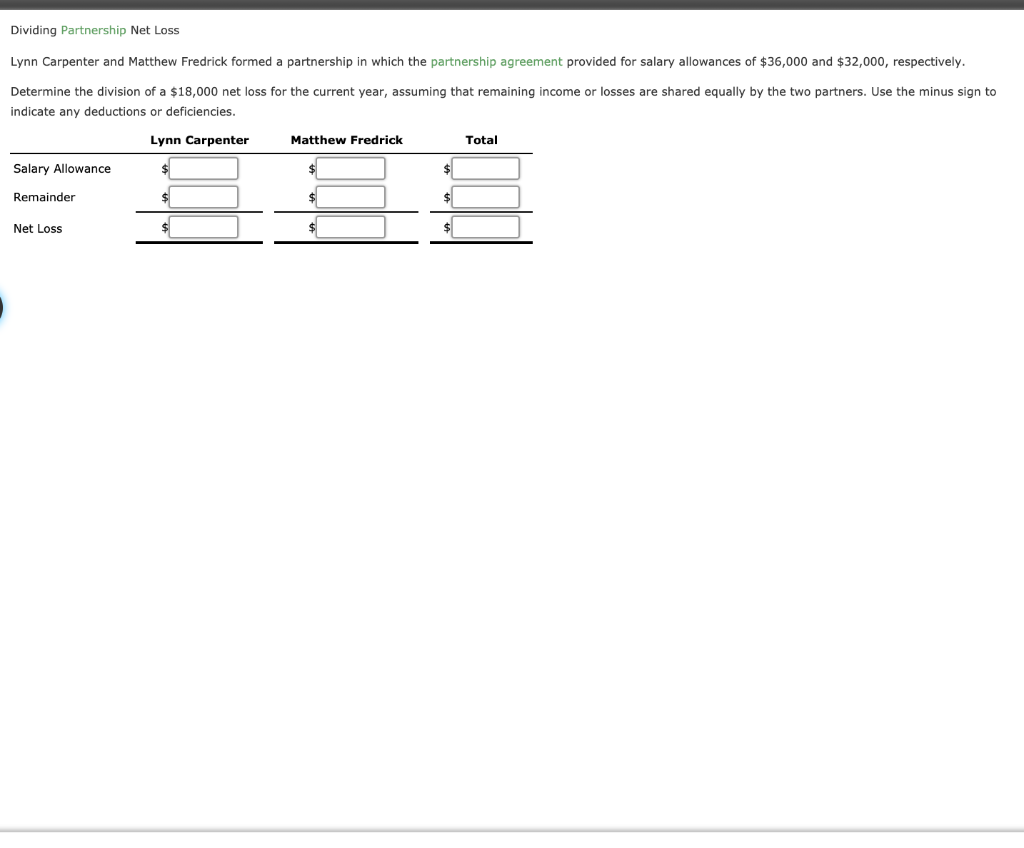

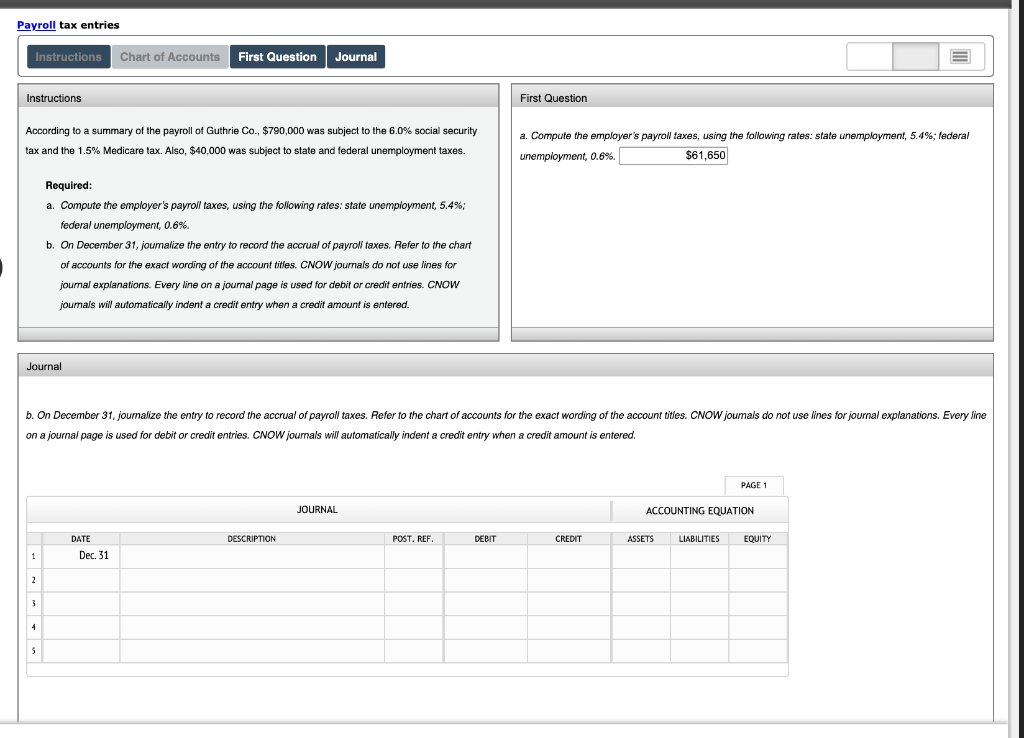

Depreciation by Three Methods; Partial Years Perdue Company purchased equipment on April 1 for $104,220. The equipment was expected to have a useful life of three years, or 8,100 operating hours, and a residual value of $2,970. The equipment was used for 1,500 hours during Year 1, 2,800 hours in Year 2, 2,400 hours in Year 3, and 1,400 hours in Year 4. Required: Determine the amount of depreciation expense for the years ended December 31, Year 1, Year 2, Year 3, and Year 4, by (a) the straight-line method, (b) the units-of-activity method, and (c) the double-declining-balance method. Note: FOR DECLINING BALANCE ONLY, round the multiplier to four decimal places. Then round the answer for each year to the nearest whole dollar. a. Straight-line method Year Amount Year 1 25,313 Year 2 $ 33,750 Year 3 $ 33,750 Year 4 $ 8,438 b. Units-of-activity method Year Amount Year 1 18,750 Year 2 $ 35,000 Year 3 $ 30,000 Year 4 $ 17,500 c. Double-declining-balance method Year Amount Year 1 69,480 Year 2 23,160 Year 3 $ 7,720 Year 4 $ 890 Entries for sale of fixed asset Instructions Chart of Accounts First Question Journal Instructions First Question Equipment acquired on January at a cost of $187 550 has an estimated sul life of 18 years, has an estimated residual value of 56,550, and is depreciated by the stragiline method a. What was the book value of the scuipmental December 31 trend of the fourth year? $105,550 Required: a. Wha's heb altre gument of December 31 the end of the fourth year? b. Assuming tharthocquipment was sold on April 1 of the year for $58,510. journalize me entries to record (1) depreciation for the three morms wil me sele care and (2) the sale of the equipmen. Refer to the chart of accounts for the exact working or the accounts. CNOW joumals do not use Ines for joumal explanations. Every Ane on a ouma page is used for det or credit entries. CNOW Journals will automatically indent a credit Antry when a credit amount is a red Round your answer to the area whole dollar. Jeumel b. Assuming at the equipment was sold on April 7 of month year for 599,510. jumatze the ones to record the following (Rotor to me chart or accounts for the exact wording of the account is NOW una's do not use Ines for oumal explanations. Every Ane on a joumal page is used for debitor crcatantries. CNOW Cuma's way automatically inde a cred entry when credit mourired Pound your answer to the nearest whole dollar) 1. Daration for the the movies www me sa dato PAGE 1 MOCOUNTING EQUATION JOURNAL POST. REF DENT CRENT ASSETS LIABILITIES EQUITY 1 DATE DESCRIPTION Apr.1 Depreciation Experse-Ecupent Accumulated Depreciation Equipment 2 2 The sale of meer PAGE 2 JOURNAL ACCOUNTING EQUATION DESCRIPTION POST. SEE CREDIT ASSETS LIABILITIES EQUITY DUTE All 1 Cash 5 Accumulated Deprecationen Las on Sale of Gument Equipment 4 Dividing Partnership Net Loss Lynn Carpenter and Matthew Fredrick formed a partnership in which the partnership agreement provided for salary allowances of $36,000 and $32,000, respectively. Determine the division of a $18,000 net loss for the current year, assuming that remaining income or losses are shared equally by the two partners. Use the minus sign to indicate any deductions or deficiencies. Lynn Carpenter Matthew Fredrick Total Salary Allowance Remainder $ $ $ Net Loss