Answered step by step

Verified Expert Solution

Question

1 Approved Answer

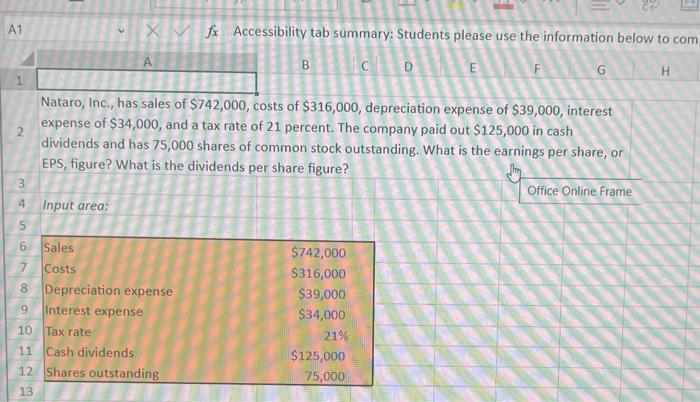

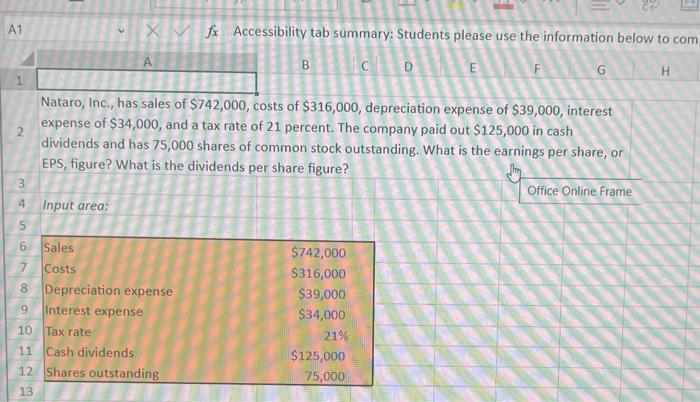

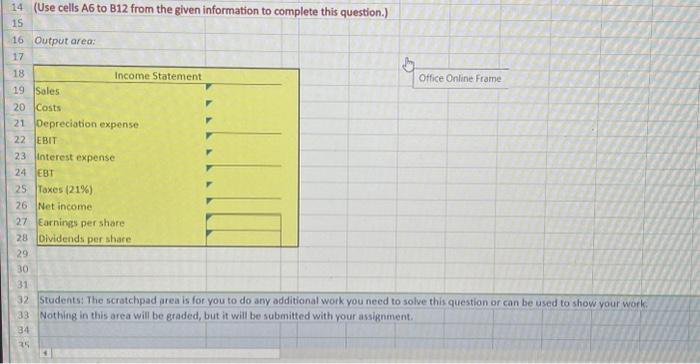

1) 2) 3) 4) fx Accessibility tab summary: Students please use the information below to com A B C D E F G H Nataro,

1)

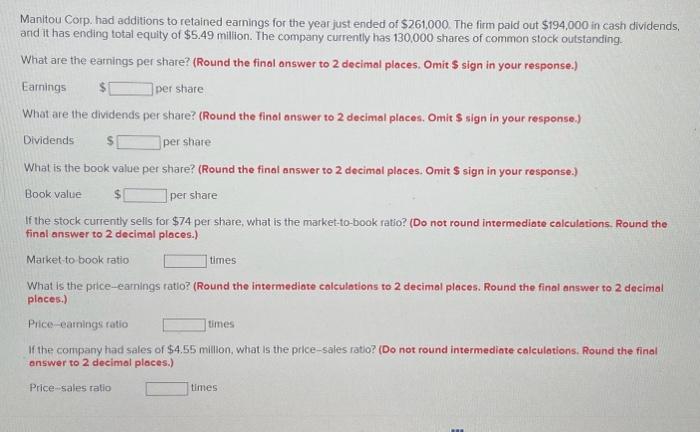

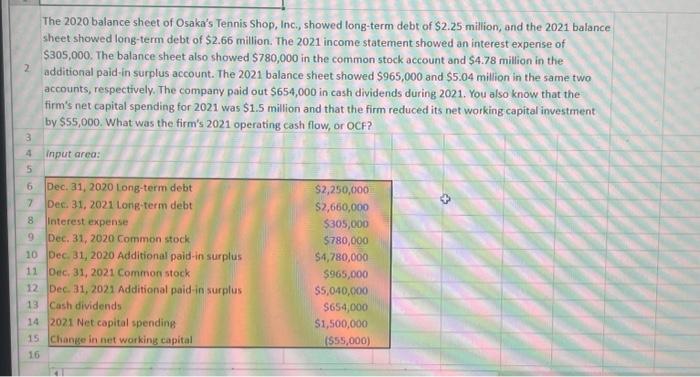

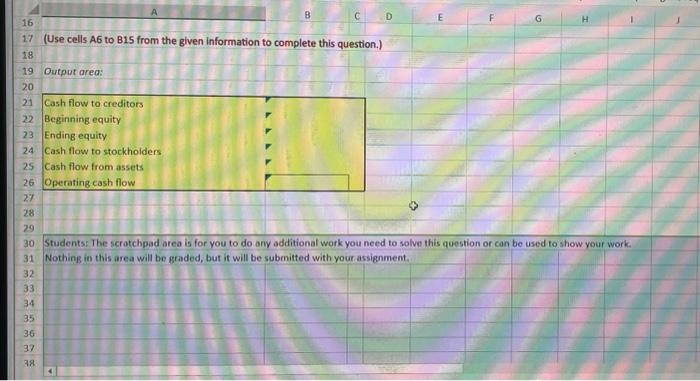

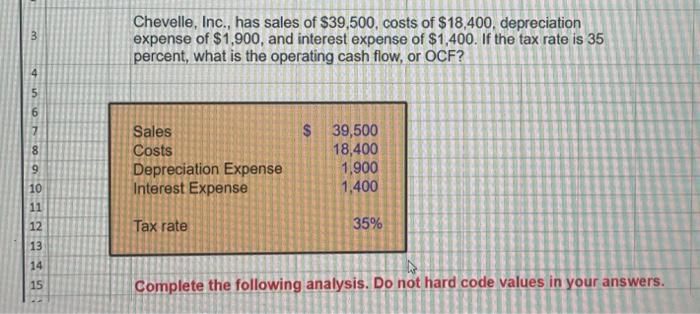

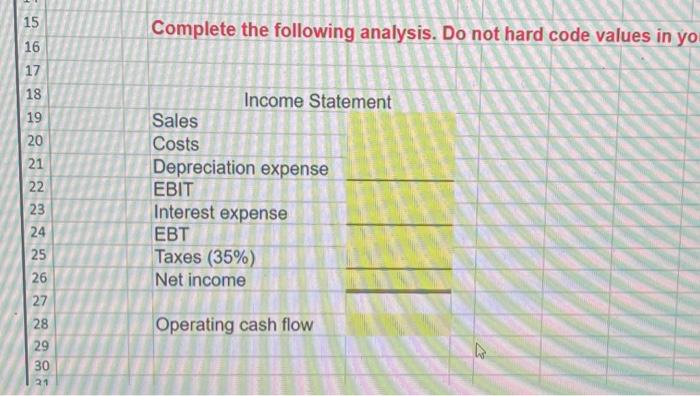

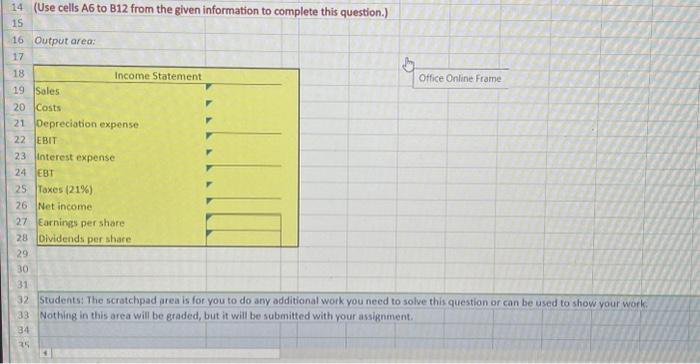

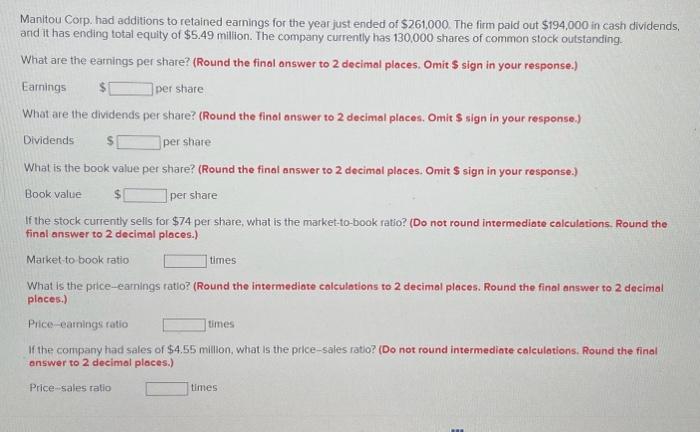

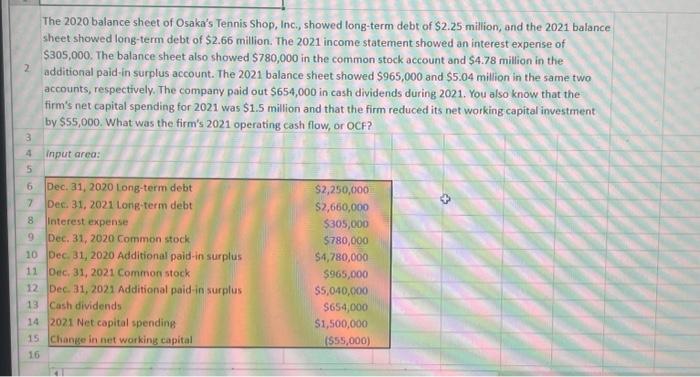

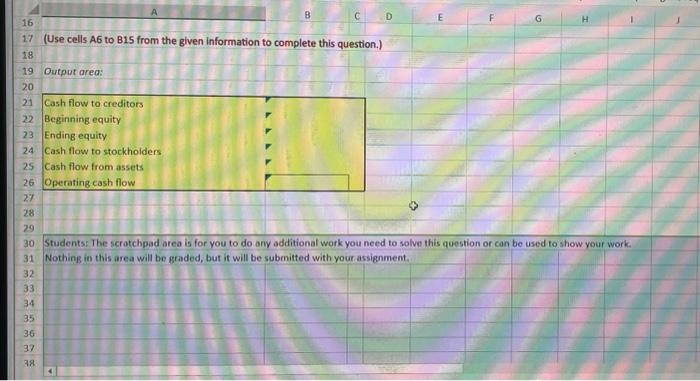

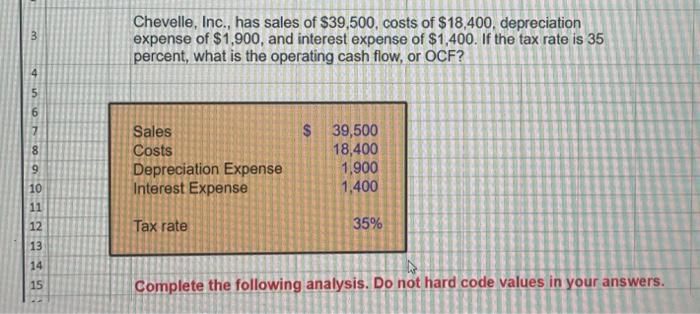

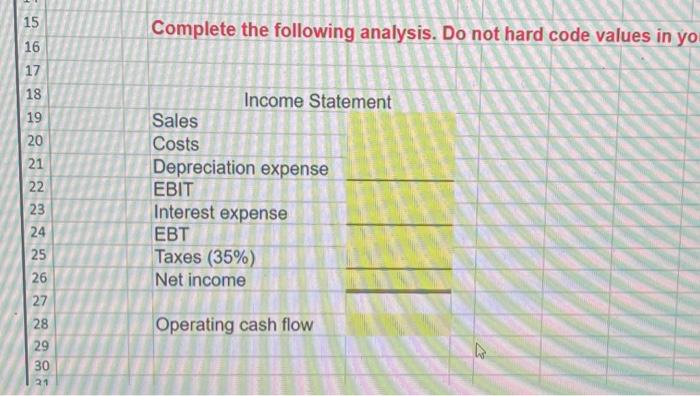

fx Accessibility tab summary: Students please use the information below to com A B C D E F G H Nataro, Inc., has sales of $742,000, costs of $316,000, depreciation expense of $39,000, interest expense of $34,000, and a tax rate of 21 percent. The company paid out $125,000 in cash dividends and has 75,000 shares of common stock outstanding. What is the earnings per share, or EPS, figure? What is the dividends per share figure? Complete the following analysis. Do not hard code values in yo Manitou Corp. had additions to retained earnings for the year just ended of $261,000. The firm paid out $194,000 in cash dividends, and it has ending total equity of $5.49 million. The company currently has 130,000 shares of common stock outstanding. What are the earnings per share? (Round the finol answer to 2 decimal places. Omit $ sign in your response.) Earnings per shate What are the dividends per share? (Round the final answer to 2 decimal places. Omit \$ sign in your response.) Dividends per share What is the book value per share? (Round the final answer to 2 decimal places. Omit S sign in your response.) Book value per share If the stock currently selis for $74 per share, what is the market-to-book ratio? (Do not round intermediate calculations, Round the final answer to 2 decimal places.) Market-to book ratio times What is the price-earnings ratio? (Round the intermediate calculations to 2 decimal places. Round the final answer to 2 decimal places.) Price-earnings ratio times If the company had sales of $4.55 million, what is the price-sales ratio? (Do not round intermediate calculations. Round the final answer to 2 decimal places.) Price-sales ratio times Chevelle, Inc., has sales of $39,500, costs of $18,400, depreciation expense of $1,900, and interest expense of $1,400. If the tax rate is 35 percent, what is the operating cash flow, or OCF? Complete the following analysis. Do not hard code values in your answers. 4 (Use cells A6 to B12 from the given information to complete this question.) 6 Outputarea: 32 Students: The scratchpad area is for you to do any additional work you need to solve this question or can be used to show your work. Nothing in this area will be graded, but it will be submitted with your assignment. The 2020 balance sheet of Osaka's Tennis Shop, Inc, showed long-term debt of $2.25 million, and the 2021 balance sheet showed long-term debt of $2.66 million. The 2021 income statement showed an interest expense of $305,000. The balance sheet also showed $780,000 in the common stock account and $4.78 million in the additional paid-in surplus account. The 2021 balance sheet showed $965,000 and $5.04 million in the same two accounts, respectively. The company paid out $654,000 in cash dividends during 2021 . You also know that the firm's net capital spending for 2021 was $1.5 million and that the firm reduced its net working capital investment by $55,000. What was the firm's 2021 operating cash flow, or OCF

2)

3)

4)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started