Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) 2) 3) 4) No explanation is required. Need the correct answers.Thank you. Gail works for a Canadian public corporation. Three years ago she was

1)

2)

3)

4)

No explanation is required. Need the correct answers.Thank you.

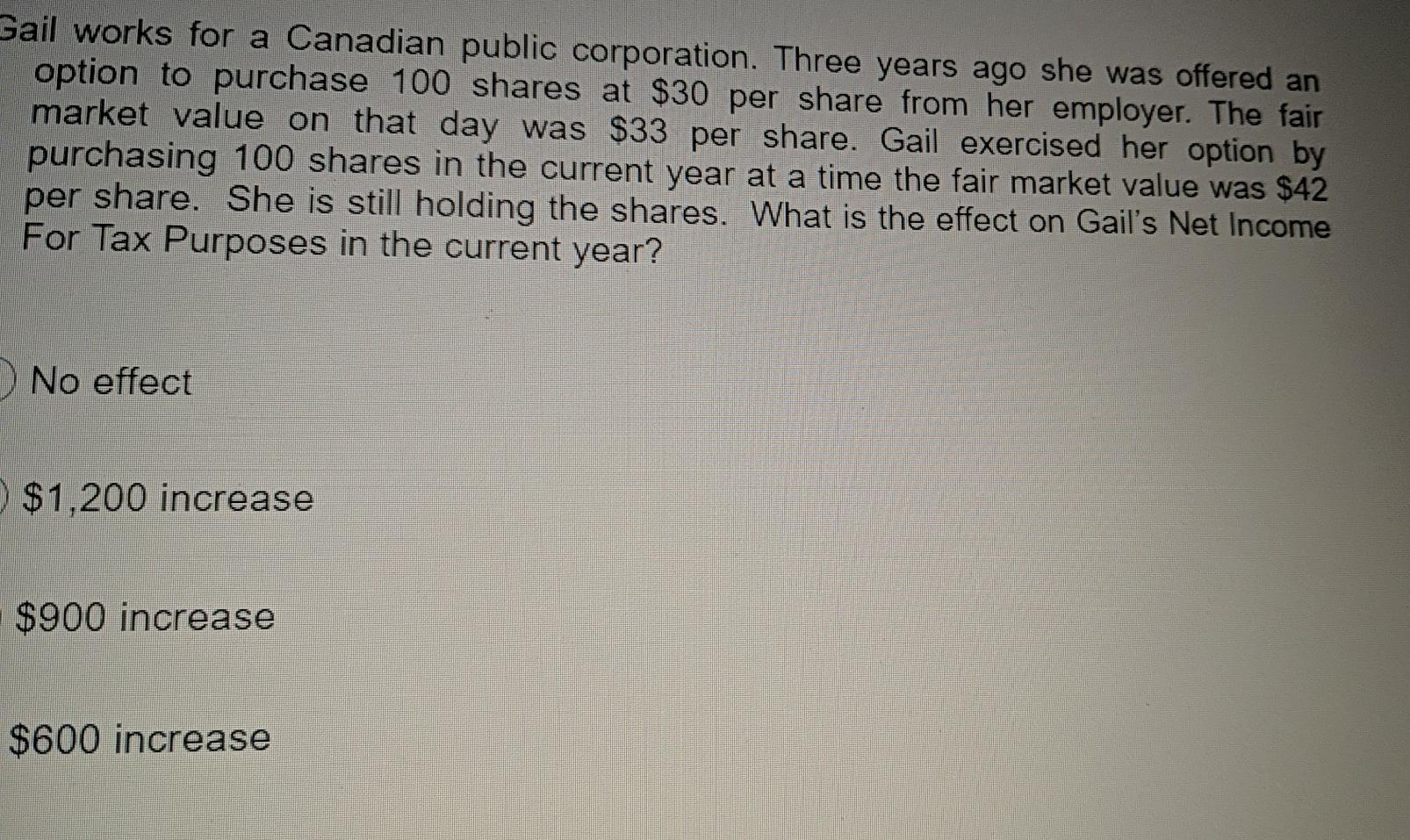

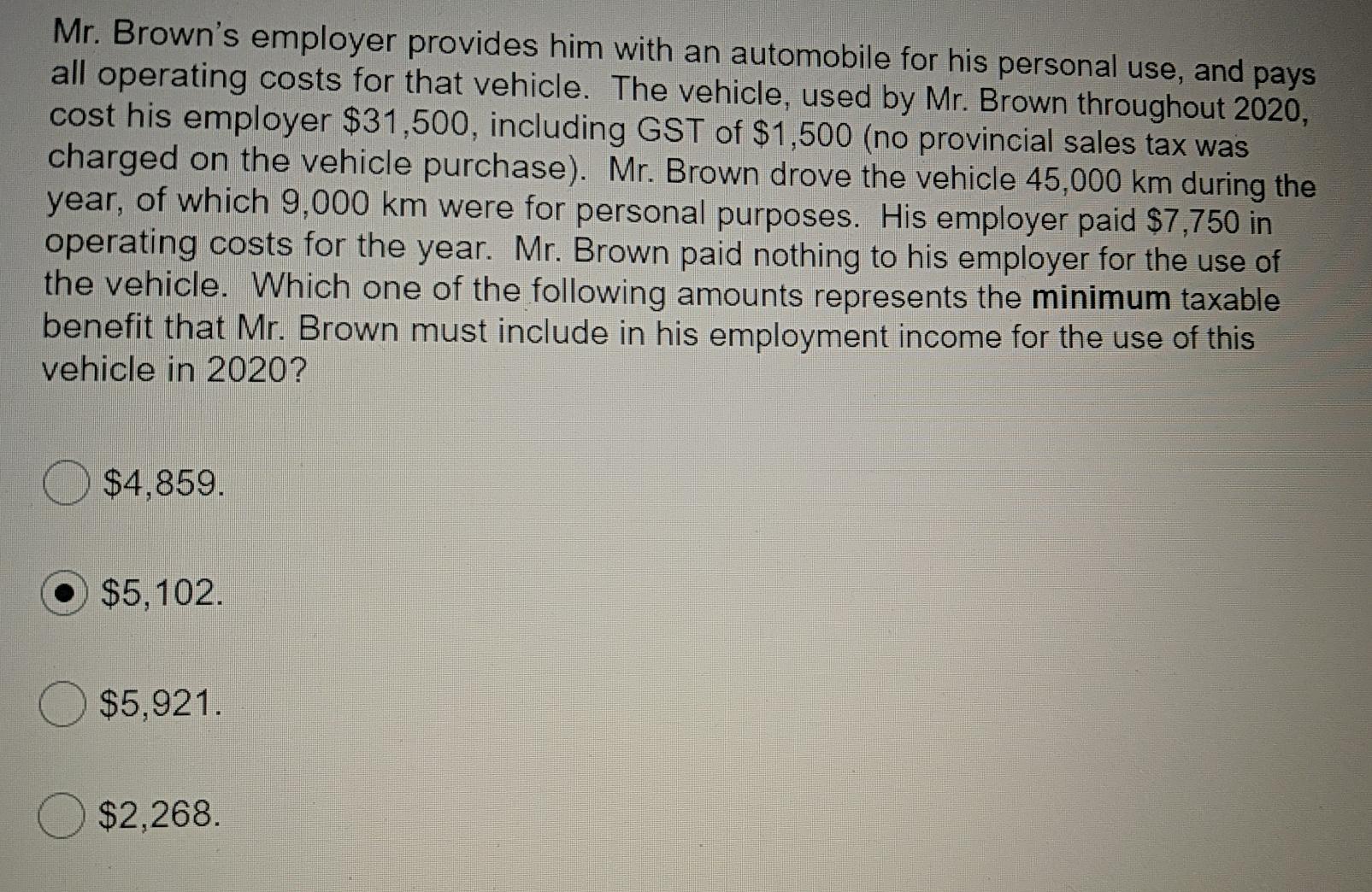

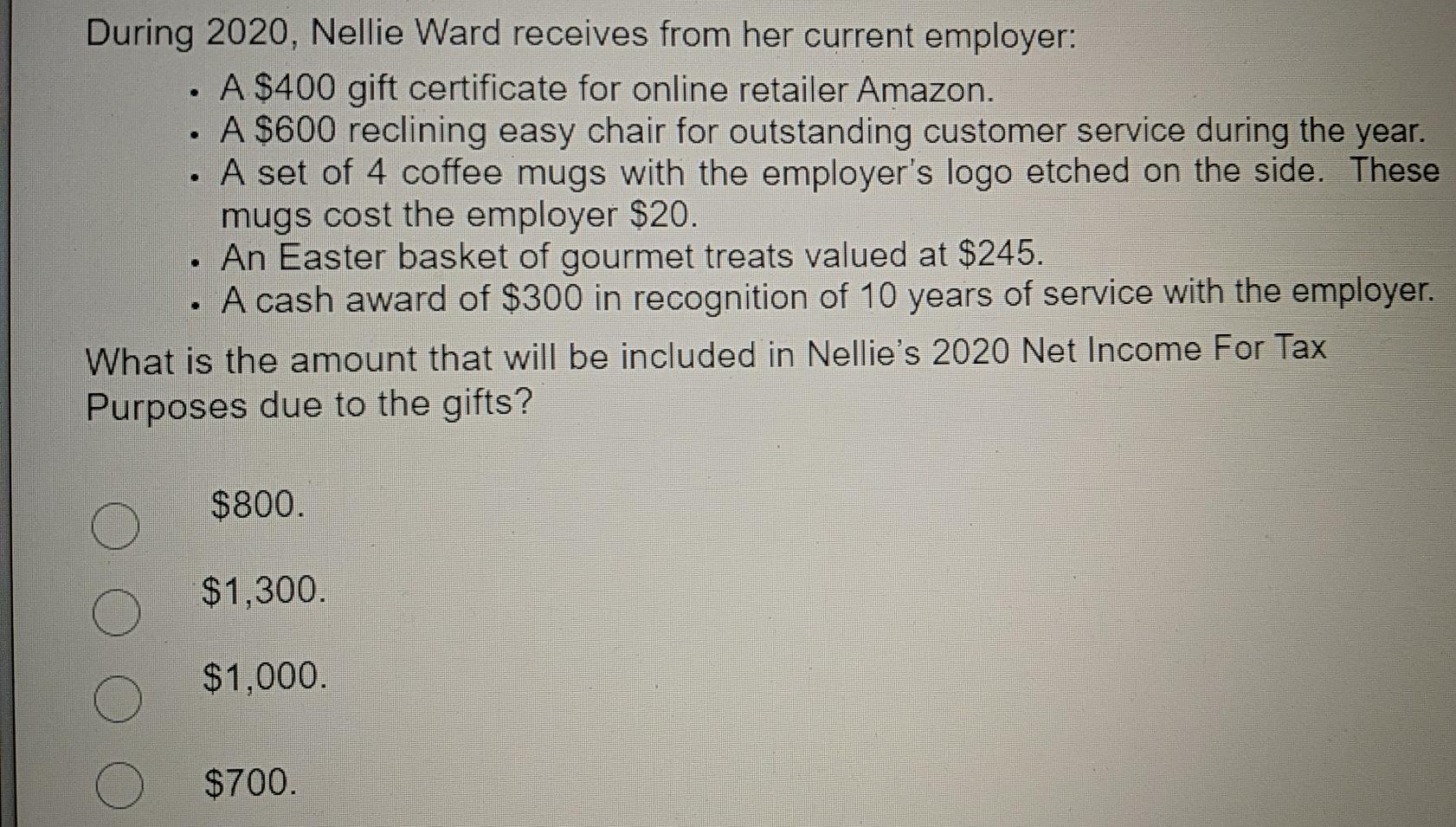

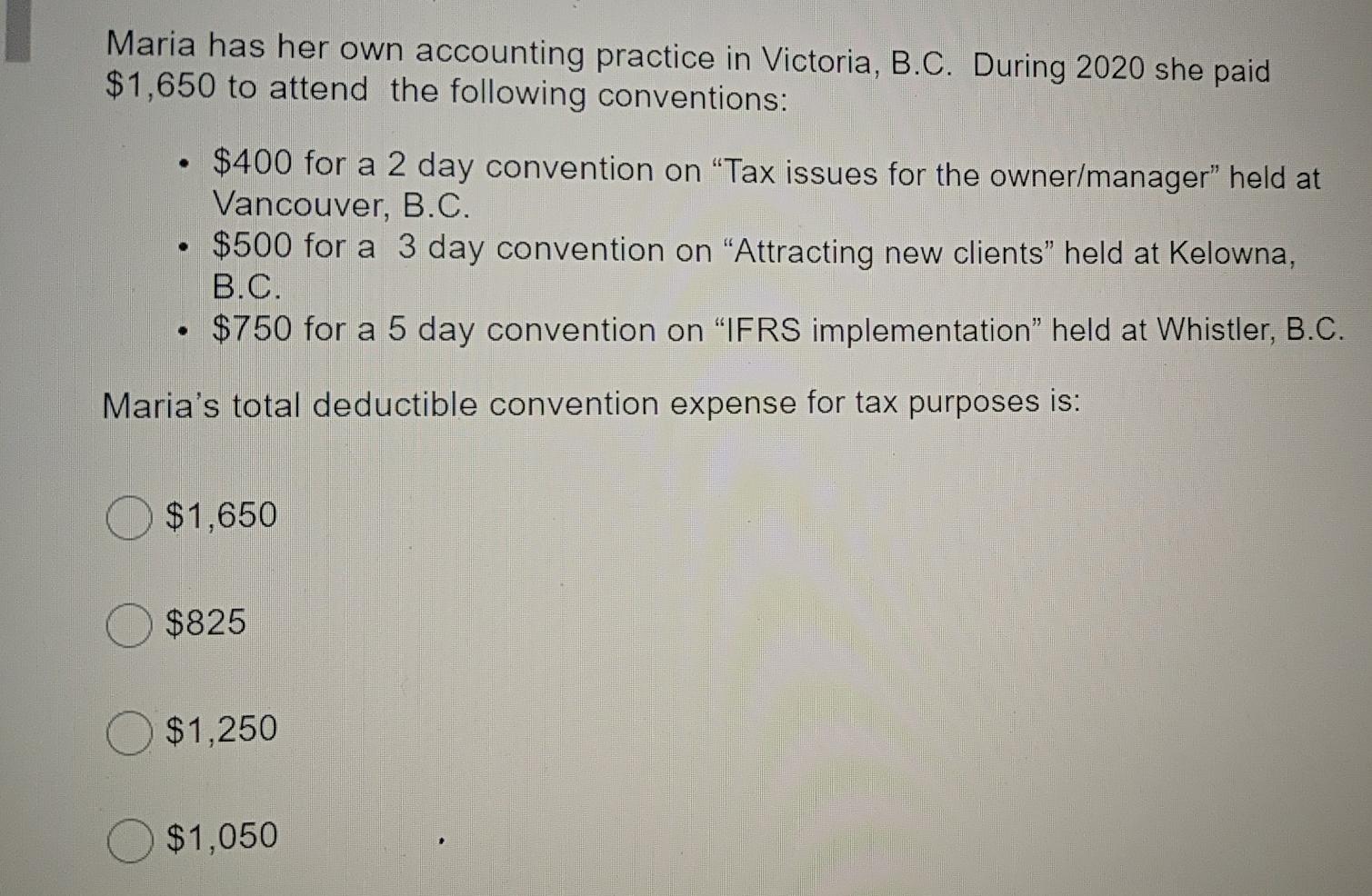

Gail works for a Canadian public corporation. Three years ago she was offered an option to purchase 100 shares at $30 per share from her employer. The fair market value on that day was $33 per share. Gail exercised her option by purchasing 100 shares in the current year at a time the fair market value was $42 per share. She is still holding the shares. What is the effect on Gail's Net Income For Tax Purposes in the current year? No effect $1,200 increase $900 increase $600 increase Mr. Brown's employer provides him with an automobile for his personal use, and pays all operating costs for that vehicle. The vehicle, used by Mr. Brown throughout 2020, cost his employer $31,500, including GST of $1,500 (no provincial sales tax was charged on the vehicle purchase). Mr. Brown drove the vehicle 45,000 km during the year, of which 9,000 km were for personal purposes. His employer paid $7,750 in operating costs for the year. Mr. Brown paid nothing to his employer for the use of the vehicle. Which one of the following amounts represents the minimum taxable benefit that Mr. Brown must include in his employment income for the use of this vehicle in 2020? $4,859. $5,102. $5,921. $2,268. During 2020, Nellie Ward receives from her current employer: A $400 gift certificate for online retailer Amazon. A $600 reclining easy chair for outstanding customer service during the year. A set of 4 coffee mugs with the employer's logo etched on the side. These mugs cost the employer $20. An Easter basket of gourmet treats valued at $245. . A cash award of $300 in recognition of 10 years of service with the employer. What is the amount that will be included in Nellie's 2020 Net Income For Tax Purposes due to the gifts? $800. $1,300. $1,000. $700. Maria has her own accounting practice in Victoria, B.C. During 2020 she paid $1,650 to attend the following conventions: $400 for a 2 day convention on "Tax issues for the owner/manager" held at Vancouver, B.C. $500 for a 3 day convention on "Attracting new clients" held at Kelowna, B.C. $750 for a 5 day convention on "IFRS implementation" held at Whistler, B.C. Maria's total deductible convention expense for tax purposes is: $1,650 $825 $1,250 $1,050Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started