Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) 2) 3) 4) Only need the correct answers, explanation is not required. Thank you. Which of the following statements with respect to allowances is

1)

2)

3)

4)

Only need the correct answers, explanation is not required. Thank you.

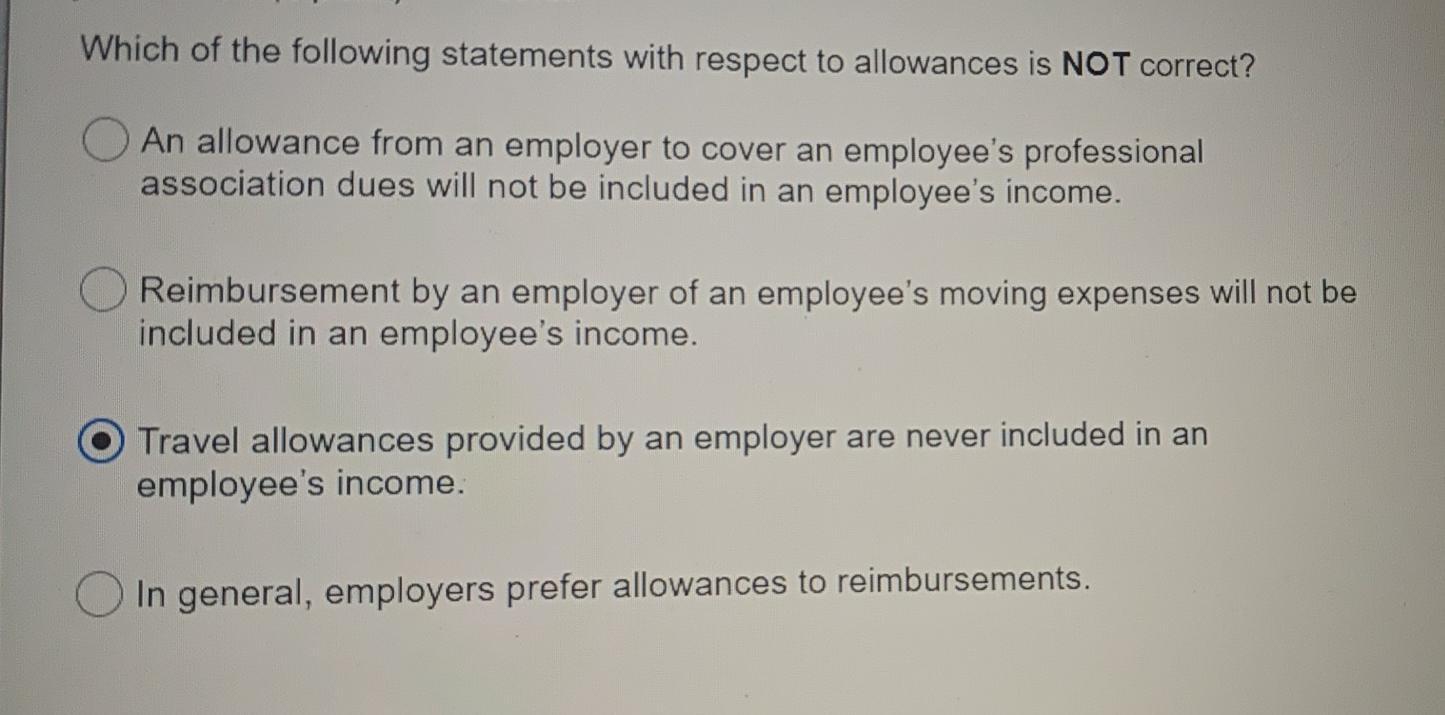

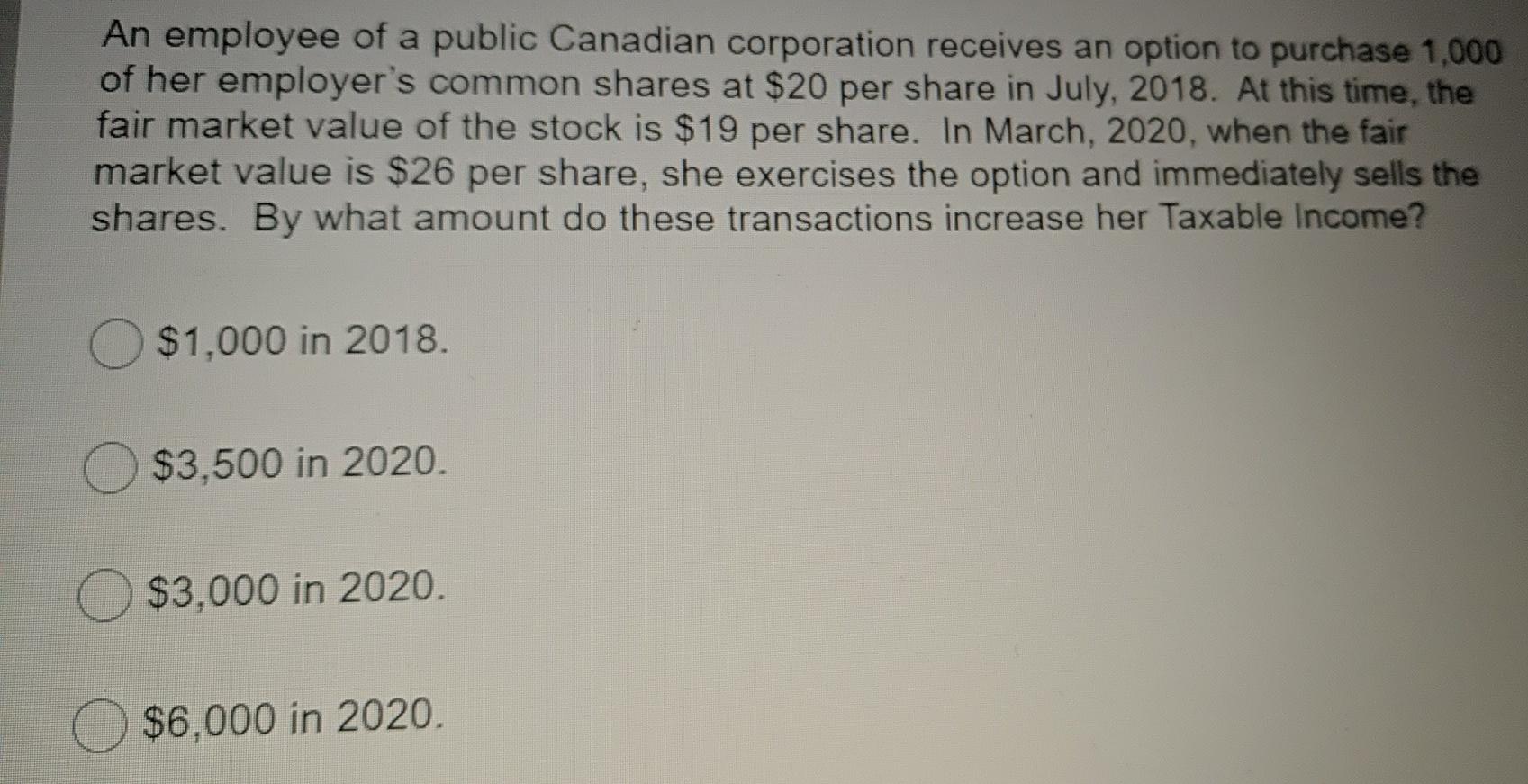

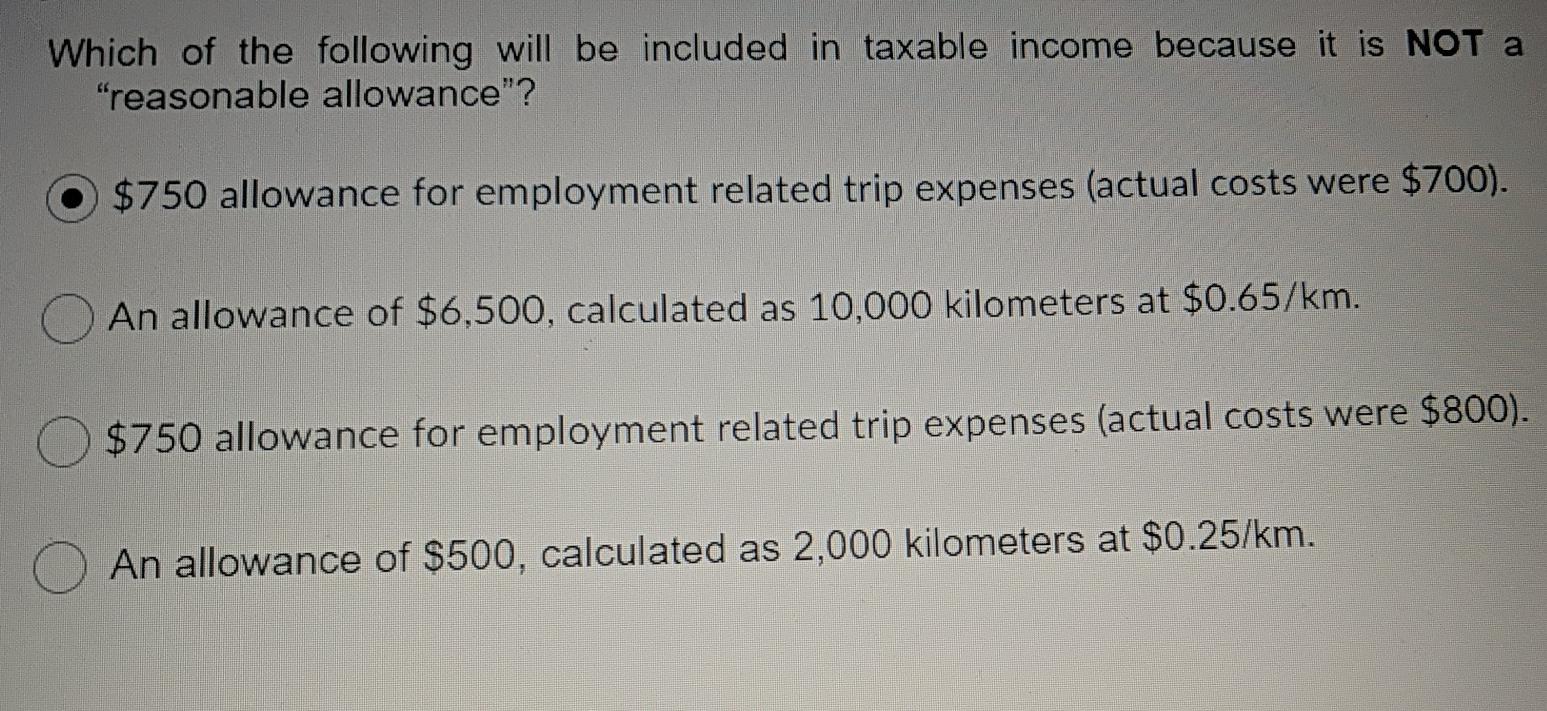

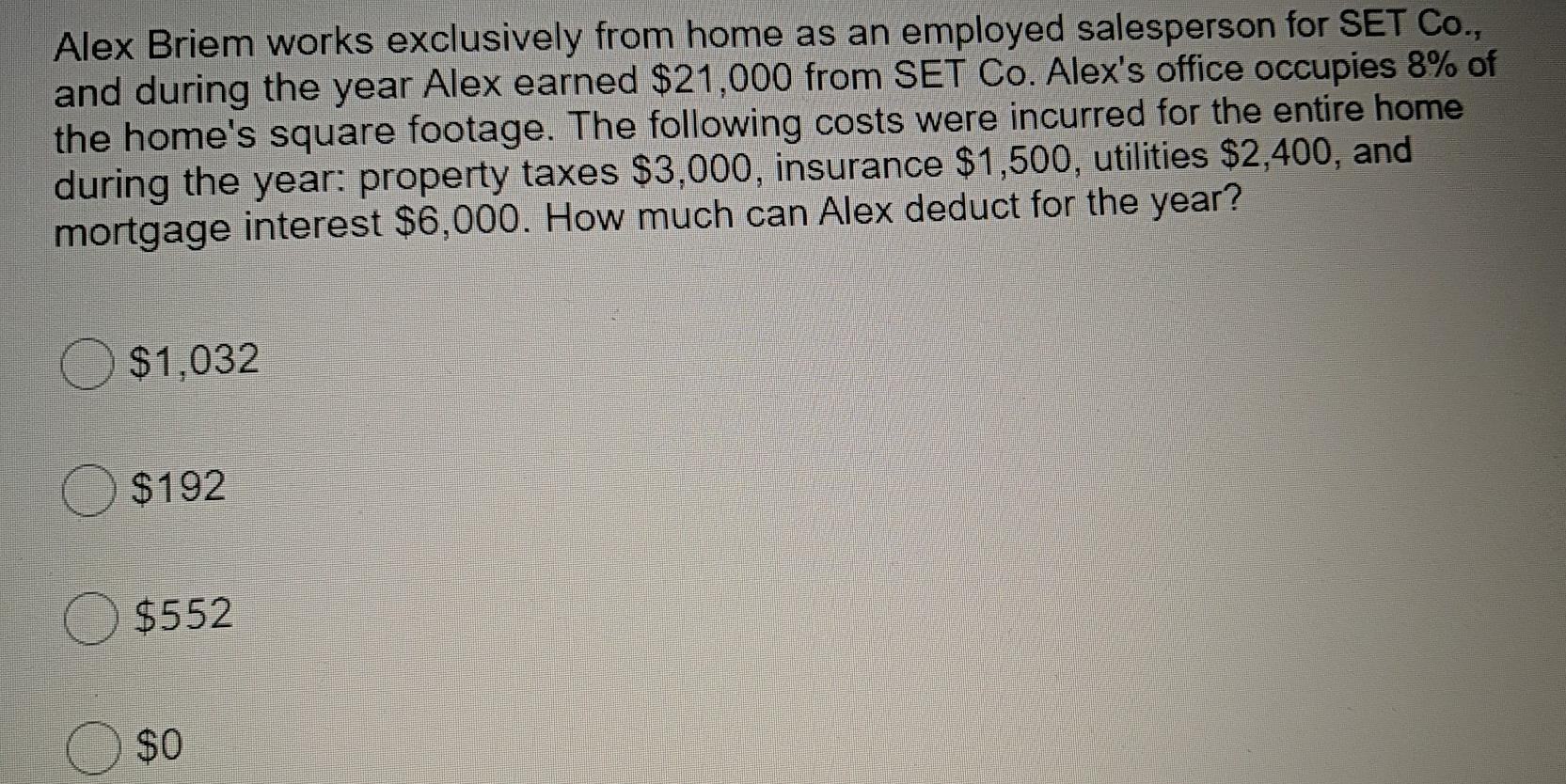

Which of the following statements with respect to allowances is NOT correct? An allowance from an employer to cover an employee's professional association dues will not be included in an employee's income. Reimbursement by an employer of an employee's moving expenses will not be included in an employee's income. Travel allowances provided by an employer are never included in an employee's income. In general, employers prefer allowances to reimbursements. An employee of a public Canadian corporation receives an option to purchase 1,000 of her employer's common shares at $20 per share in July, 2018. At this time, the fair market value of the stock is $19 per share. In March, 2020, when the fair market value is $26 per share, she exercises the option and immediately sells the shares. By what amount do these transactions increase her Taxable income? $1.000 in 2018. $3,500 in 2020. $3,000 in 2020. $6,000 in 2020, Which of the following will be included in taxable income because it is NOT a "reasonable allowance"? $750 allowance for employment related trip expenses (actual costs were $700). An allowance of $6,500, calculated as 10,000 kilometers at $0.65/km. $750 allowance for employment related trip expenses (actual costs were $800). An allowance of $500, calculated as 2,000 kilometers at $0.25/km. Alex Briem works exclusively from home as an employed salesperson for SET Co., and during the year Alex earned $21,000 from SET Co. Alex's office occupies 8% of the home's square footage. The following costs were incurred for the entire home during the year: property taxes $3,000, insurance $1,500, utilities $2,400, and mortgage interest $6,000. How much can Alex deduct for the year? $1,032 $192 $552 $0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started