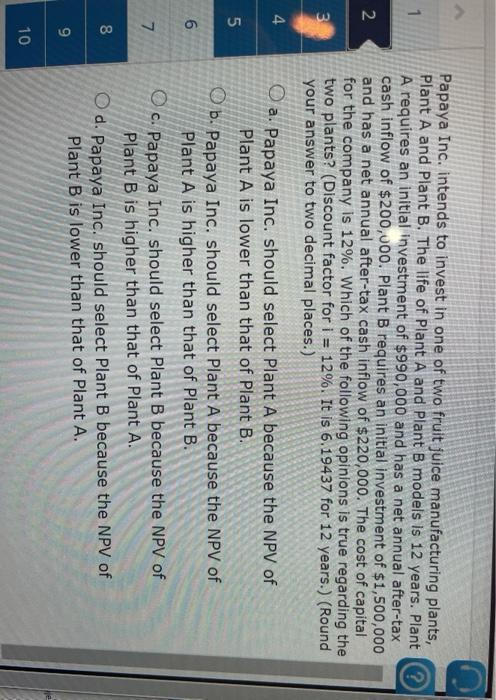

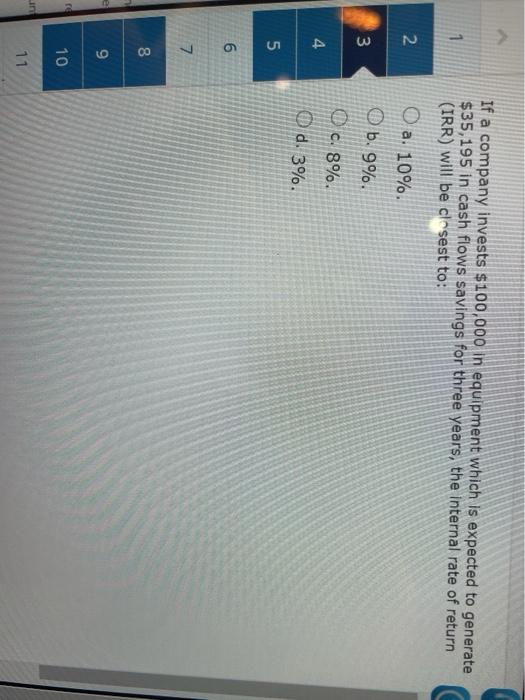

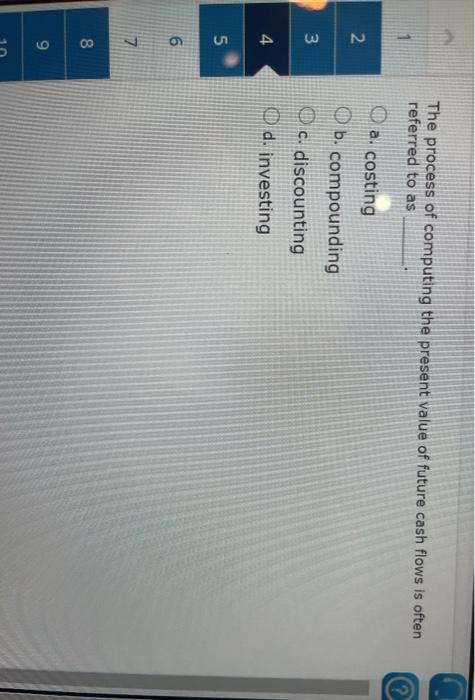

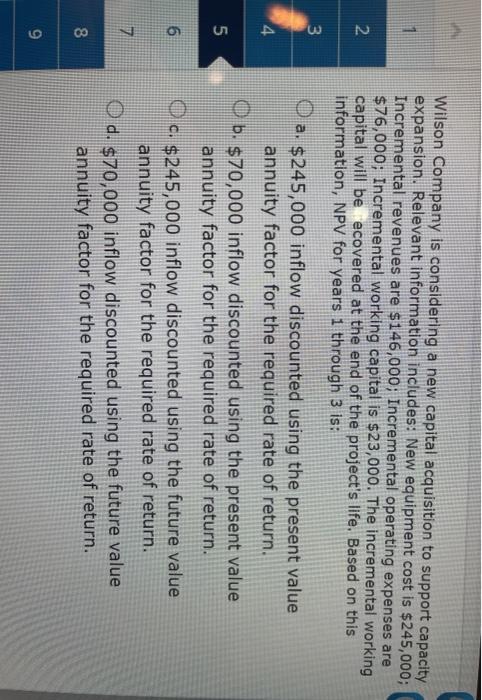

1 2 3 4 Papaya Inc. intends to invest in one of two fruit juice manufacturing plants, Plant A and Plant B. The life of Plant A and Plant B models is 12 years. Plant A requires an initial investment of $990,000 and has a net annual after-tax cash inflow of $200,000. Plant B requires an initial investment of $1,500,000 and has a net annual after-tax cash inflow of $220,000. The cost of capital for the company is 12%. Which of the following opinions is true regarding the two plants? (Discount factor for i = 12%. It is 6.19437 for 12 years.) (Round your answer to two decimal places.) O a. Papaya Inc. should select Plant A because the NPV of Plant A is lower than that of Plant B. O b. Papaya Inc. should select Plant A because the NPV of Plant A is higher than that of Plant B. O c. Papaya Inc. should select Plant B because the NPV of Plant B is higher than that of Plant A. O d. Papaya Inc. should select Plant B because the NPV of Plant B is lower than that of Plant A. in 6 7 8 9 10 If a company invests $100,000 in equipment which is expected to generate $35,195 in cash flows savings for three years, the Internal rate of return (IRR) will be closest to: 1 O a. 10% N O b.9%. 3 O c.8%. 4 O d. 3%. on U 7 00 9 re 10 in 11 The process of computing the present value of future cash flows is often referred to as 1 2 a. costing O b. compounding O c. discounting O d. investing 3 4 un 6 7 00 9 Wilson Company is considering a new capital acquisition to support capacity expansion. Relevant information includes: New equipment cost is $245,000; Incremental revenues are $146,000; Incremental operating expenses are $76,000; Incremental working capital is $23,000. The incremental working capital will be ecovered at the end of the project's life. Based on this information, NPV for years 1 through 3 is: 2 3 4 un a. $ 245,000 inflow discounted using the present value annuity factor for the required rate of return. O b. $70,000 inflow discounted using the present value annuity factor for the required rate of return. c. $245,000 inflow discounted using the future value c. annuity factor for the required rate of return. O d. $70,000 inflow discounted using the future value annuity factor for the required rate of return. 6 7 8 9