Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. 2. 3. 4. Thanks Q 4.21: Next year, Oak Industries expects to spend a total of 204,400 machine hours producing five different products, while

1.

2. 3.

3.

4.

4.

Thanks

Thanks

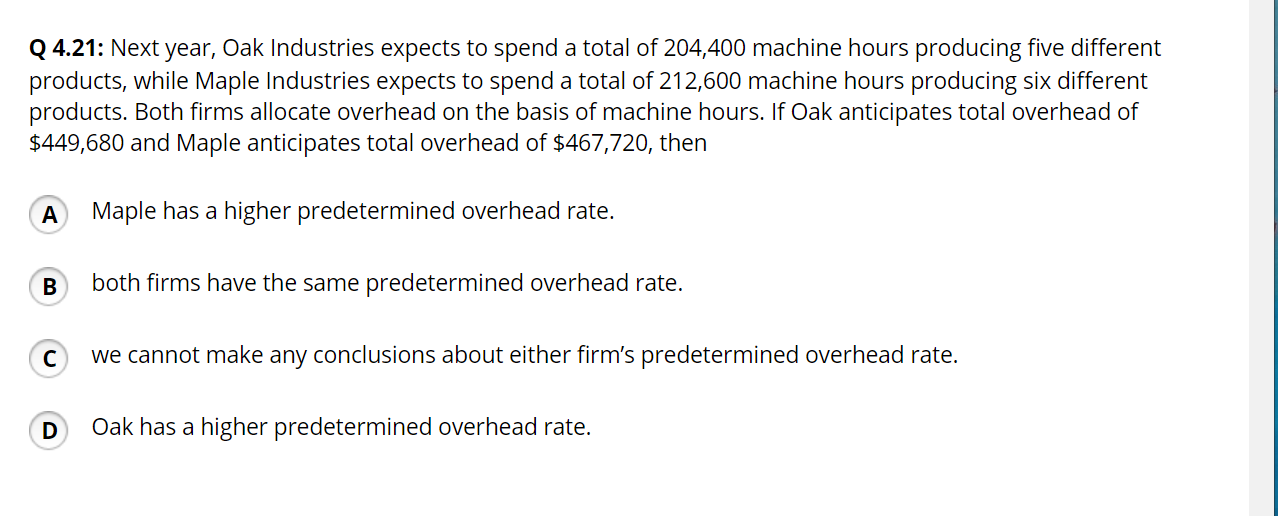

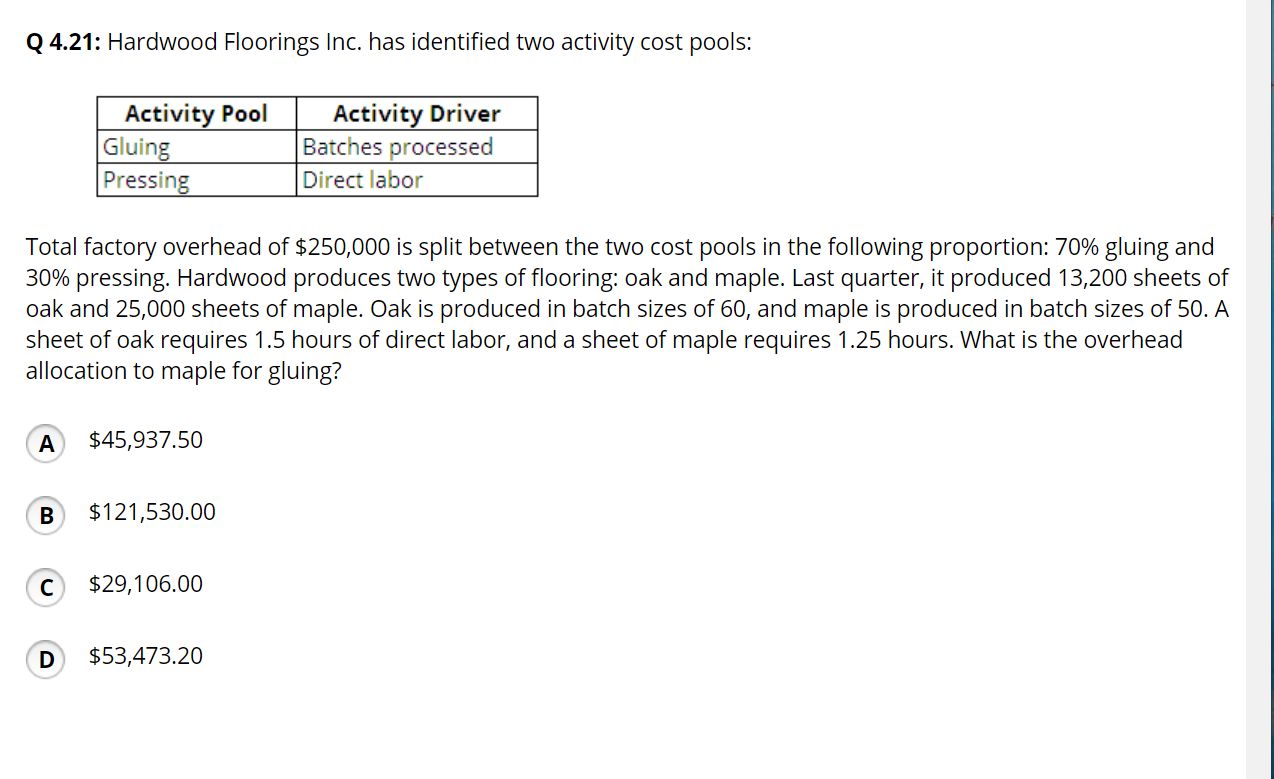

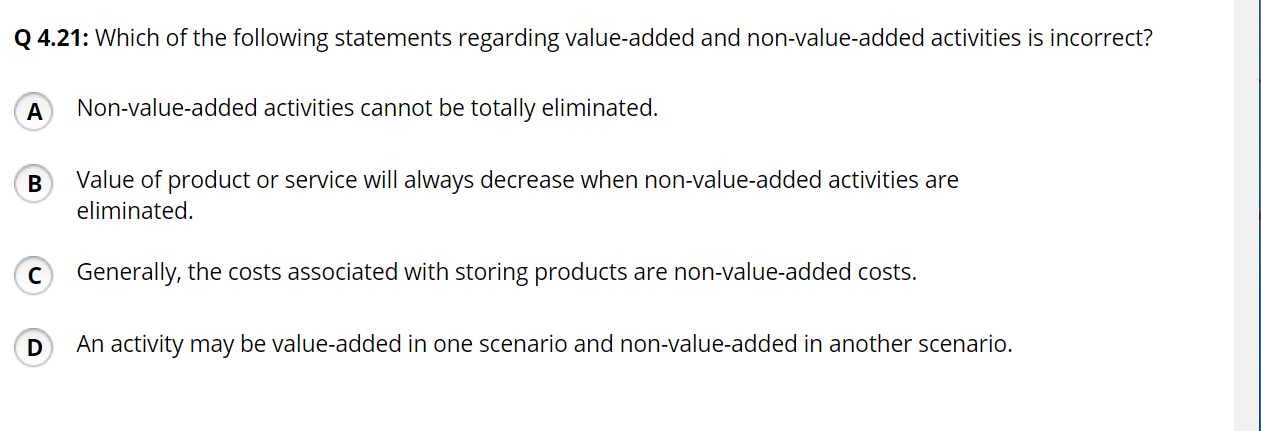

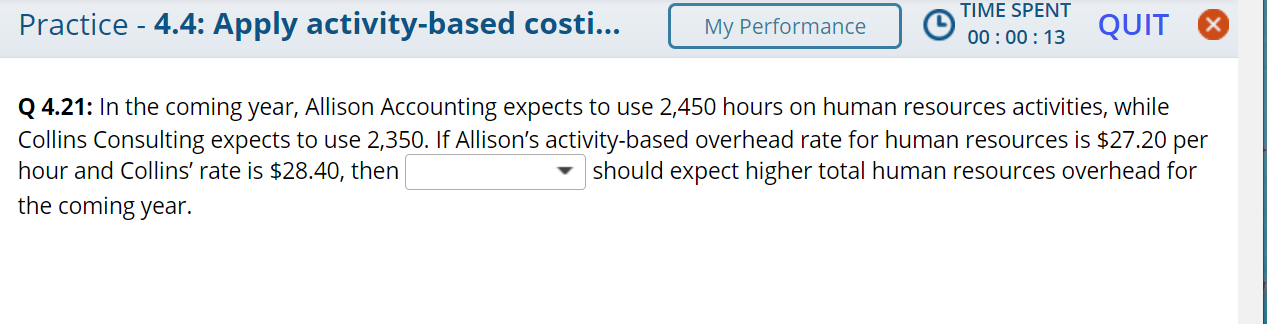

Q 4.21: Next year, Oak Industries expects to spend a total of 204,400 machine hours producing five different products, while Maple Industries expects to spend a total of 212,600 machine hours producing six different products. Both firms allocate overhead on the basis of machine hours. If Oak anticipates total overhead of $449,680 and Maple anticipates total overhead of $467,720, then A Maple has a higher predetermined overhead rate. B both firms have the same predetermined overhead rate. C we cannot make any conclusions about either firm's predetermined overhead rate. Oak has a higher predetermined overhead rate. Q 4.21: Hardwood Floorings Inc. has identified two activity cost pools: Activity Pool Gluing Pressing Activity Driver Batches processed Direct labor Total factory overhead of $250,000 is split between the two cost pools in the following proportion: 70% gluing and 30% pressing. Hardwood produces two types of flooring: oak and maple. Last quarter, it produced 13,200 sheets of oak and 25,000 sheets of maple. Oak is produced in batch sizes of 60, and maple is produced in batch sizes of 50. A sheet of oak requires 1.5 hours of direct labor, and a sheet of maple requires 1.25 hours. What is the overhead allocation to maple for gluing? A $45,937.50 B $121,530.00 C $29,106.00 D $53,473.20 Q 4.21: Which of the following statements regarding value-added and non-value-added activities is incorrect? A Non-value-added activities cannot be totally eliminated. B Value of product or service will always decrease when non-value-added activities are eliminated. Generally, the costs associated with storing products are non-value-added costs. D An activity may be value-added in one scenario and non-value-added in another scenario. Practice - 4.4: Apply activity-based costi... My Performance TIME SPENT 00:00:13 QUIT Q 4.21: In the coming year, Allison Accounting expects to use 2,450 hours on human resources activities, while Collins Consulting expects to use 2,350. If Allison's activity-based overhead rate for human resources is $27.20 per hour and Collins' rate is $28.40, then should expect higher total human resources overhead for the coming year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started