1.

2.

3.

4.

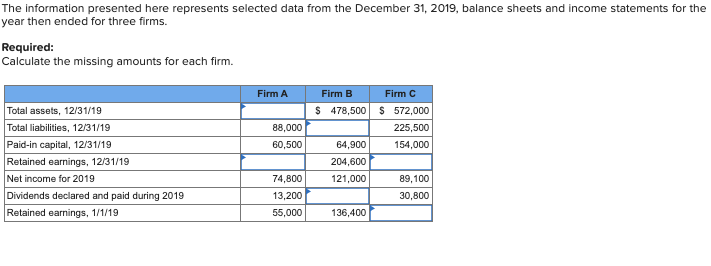

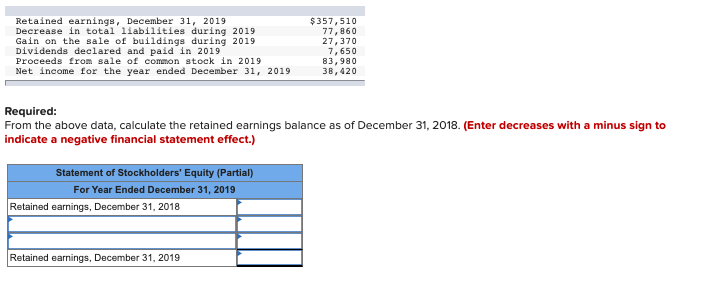

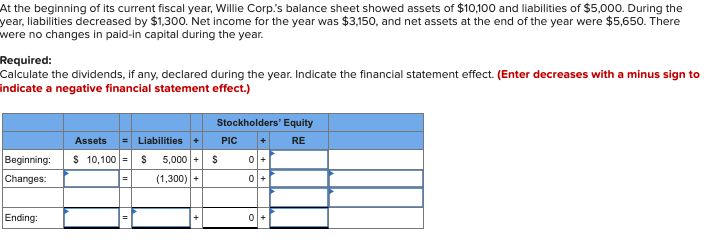

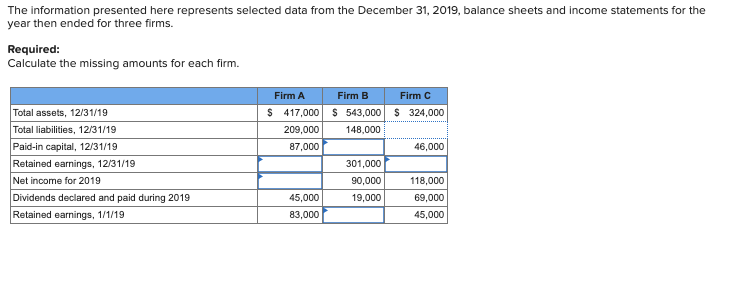

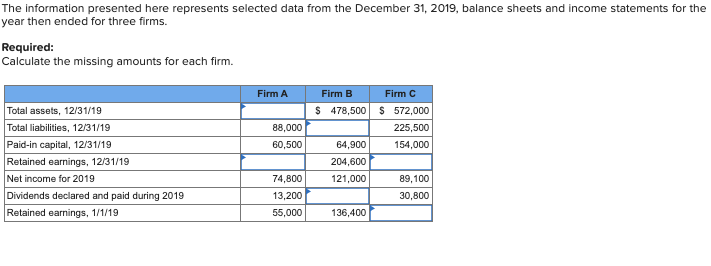

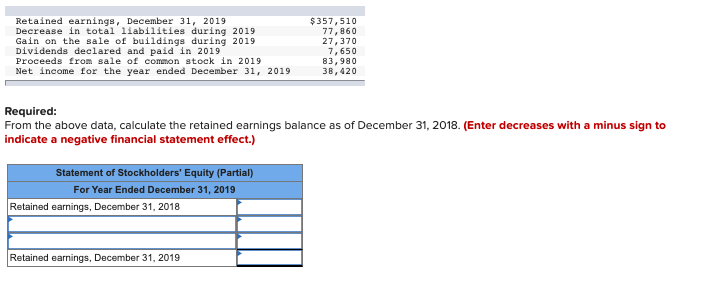

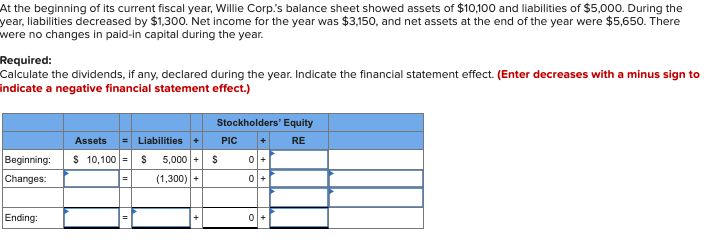

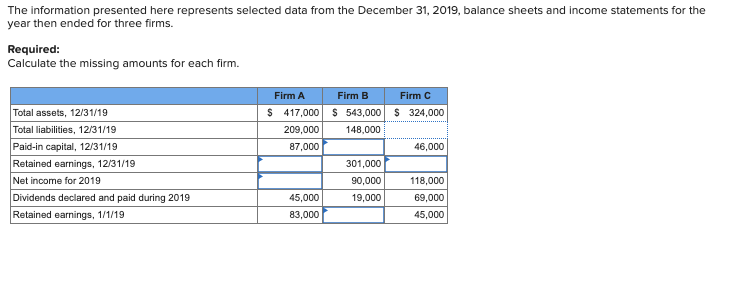

The information presented here represents selected data from the December 31, 2019, balance sheets and income statements for the year then ended for three firms. Required: Calculate the missing amounts for each firm. Firm A 88,000 60,500 Total assets, 12/31/19 Total liabilities, 12/31/19 Paid-in capital, 12/31/19 Retained earnings, 12/31/19 Net income for 2019 Dividends declared and paid during 2019 Retained earnings, 1/1/19 Firm B Firm C $ 478,500 $ 572,000 225,500 64,900 154,000 204,600 121,000 89,100 30,800 136,400 74,800 13,200 55,000 Retained earnings, December 31, 2019 Decrease in total liabilities during 2019 Gain on the sale of buildings during 2019 Dividends declared and paid in 2019 Proceeds from sale of common stock in 2019 Net income for the year ended December 31, 2019 $ 357,510 77,860 27,370 7,650 83,980 38,420 Required: From the above data, calculate the retained earnings balance as of December 31, 2018. (Enter decreases with a minus sign to indicate a negative financial statement effect.) Statement of Stockholders' Equity (Partial) For Year Ended December 31, 2019 Retained earnings, December 31, 2018 Retained earnings, December 31, 2019 At the beginning of its current fiscal year, Willie Corp.'s balance sheet showed assets of $10,100 and liabilities of $5,000. During the year, liabilities decreased by $1,300. Net income for the year was $3,150, and net assets at the end of the year were $5,650. There were no changes in paid-in capital during the year. Required: Calculate the dividends, if any, declared during the year. Indicate the financial statement effect. (Enter decreases with a minus sign to indicate a negative financial statement effect.) Stockholders' Equity PIC RE Assets $ 10,100 - Liabilities $ 5,000 (1,300) + S Beginning: Changes 0+ 0+ Ending: 0 The information presented here represents selected data from the December 31, 2019, balance sheets and income statements for the year then ended for three firms. Required: Calculate the missing amounts for each firm. Total assets, 12/31/19 Total liabilities, 12/31/19 Paid-in capital, 12/31/19 Retained earnings, 12/31/19 Net income for 2019 Dividends declared and paid during 2019 Retained earnings, 1/1/19 Firm A Firm B Firm C $ 417,000 S 543,000 S 324.000 209,000 148.000 87,000 46,000 301,000 90,000 118,000 45,000 19,000 69,000 83,000 45,000 The information presented here represents selected data from the December 31, 2019, balance sheets and income statements for the year then ended for three firms. Required: Calculate the missing amounts for each firm. Firm A 88,000 60,500 Total assets, 12/31/19 Total liabilities, 12/31/19 Paid-in capital, 12/31/19 Retained earnings, 12/31/19 Net income for 2019 Dividends declared and paid during 2019 Retained earnings, 1/1/19 Firm B Firm C $ 478,500 $ 572,000 225,500 64,900 154,000 204,600 121,000 89,100 30,800 136,400 74,800 13,200 55,000 Retained earnings, December 31, 2019 Decrease in total liabilities during 2019 Gain on the sale of buildings during 2019 Dividends declared and paid in 2019 Proceeds from sale of common stock in 2019 Net income for the year ended December 31, 2019 $ 357,510 77,860 27,370 7,650 83,980 38,420 Required: From the above data, calculate the retained earnings balance as of December 31, 2018. (Enter decreases with a minus sign to indicate a negative financial statement effect.) Statement of Stockholders' Equity (Partial) For Year Ended December 31, 2019 Retained earnings, December 31, 2018 Retained earnings, December 31, 2019 At the beginning of its current fiscal year, Willie Corp.'s balance sheet showed assets of $10,100 and liabilities of $5,000. During the year, liabilities decreased by $1,300. Net income for the year was $3,150, and net assets at the end of the year were $5,650. There were no changes in paid-in capital during the year. Required: Calculate the dividends, if any, declared during the year. Indicate the financial statement effect. (Enter decreases with a minus sign to indicate a negative financial statement effect.) Stockholders' Equity PIC RE Assets $ 10,100 - Liabilities $ 5,000 (1,300) + S Beginning: Changes 0+ 0+ Ending: 0 The information presented here represents selected data from the December 31, 2019, balance sheets and income statements for the year then ended for three firms. Required: Calculate the missing amounts for each firm. Total assets, 12/31/19 Total liabilities, 12/31/19 Paid-in capital, 12/31/19 Retained earnings, 12/31/19 Net income for 2019 Dividends declared and paid during 2019 Retained earnings, 1/1/19 Firm A Firm B Firm C $ 417,000 S 543,000 S 324.000 209,000 148.000 87,000 46,000 301,000 90,000 118,000 45,000 19,000 69,000 83,000 45,000